How to Navigate Inheritance, Wills, and Tax in Japan for Foreigners

Can foreigners inherit assets in Japan?

Yes — nationality and residency do not prevent you from inheriting assets in Japan. But the process can be complex.

Inheritance in Japan is governed by a layered system of civil law, tax regulations, and family registry procedures (koseki). These complexities can pose significant challenges—especially for foreigners from countries that do not impose inheritance tax, such as Canada, China, or India.

What documents are required?

How do you navigate the koseki system?

Which taxes apply, and are any deductions available?

While every case is different, successful inheritance begins with clarity, preparation, and timely action.

What This Blog Covers:

Japan’s Inheritance System

Assets and Debts

If There’s No Will: What Happens?

Inheritance tax in Japan

Renouncing an Inheritance

What to Bring When Consulting a Lawyer or Court

How to Avoid Inheritance Disputes

Validity of Foreign Wills and Court Rulings in Japan

Sending Inheritance Abroad

Wrap up

1. Japan’s Inheritance System: Civil Code and Family-Based Succession

Japanese inheritance law is governed by the Civil Code and follows the principle of universal succession. This means when someone passes away, their heirs automatically inherit both assets and liabilities from the moment of death.

If there is no will, the estate is placed in co-ownership among all legal heirs. The Civil Code defines:

Who inherits (legal order of heirs)

How much each person is entitled to (statutory shares)

How disputes are handled

✅ Four Basic Paths to Dividing an Estate

Will-based inheritance (if a valid will exists)

Heirs' agreement (negotiated privately)

Mediation through the family court (if heirs can’t agree)

Judicial decision by the court (if mediation fails)

✅ Legal Order of Heirs and Statutory Shares

Spouse: Always an heir

First order: Children (including legally adopted - in certain cases, recognized illegitimate children)

Second order: Parents and grandparents

Third order: Siblings (Brothers and sisters)

Heirs of a higher order take priority. For example, if children exist, parents or siblings are excluded. The spouse always shares the inheritance with the closest living blood relative(s).

✅The System of Legally Reserved Shares (Iryūbun/遺留分)

Japan’s inheritance law includes a protective mechanism known as iryūbun (legally reserved portion), which guarantees that certain close relatives—such as the spouse, children, and in some cases parents—are entitled to receive a minimum share of the estate, even if the deceased has attempted to distribute assets differently through a will.

🔹 Who Is Entitled to an Iryūbun?

Spouse

Children (including adopted children)

Parents (only if there are no children)

Siblings are not entitled to an iryūbun.

🔹 How Much Is the Reserved Share?

As a general rule, the iryūbun is one-half of the statutory inheritance portion (hōtei sōzokubun) that the heir would have received under Japanese intestacy law.

📘 Example:

If the heirs are a spouse and one child, the statutory inheritance is split equally (1/2 each). Therefore, the iryūbun for each is:

Spouse: 1/4 of the estate

(= 1/2 iryūbun × 1/2 statutory share)Child: 1/4 of the estate

(= 1/2 iryūbun × 1/2 statutory share)

🔹 What Can You Do If Your Iryūbun Is Violated?

If a will or gift unfairly deprives an heir of their iryūbun, that heir can file a legal request known as a 遺留分侵害額請求 (iryūbun shingai-gaku seikyū), or a "Claim for Recovery of Infringed Reserved Share."

This is not a demand to undo a will, but a monetary compensation claim against the heir or beneficiary who received more than their fair share.

🔹 Deadline: Be Careful With the Statute of Limitations

The deadline to file an iryūbun claim is strict:

1 year from the time you became aware of the infringement and the recipient of the assets

10 years from the death of the decedent (regardless of whether you were aware)

🔹 Why It Matters

Foreign heirs or family members living abroad may not be aware of their iryūbun rights or the deadlines involved. In some cases, they are told by a relative or lawyer that the will is final—even when it violates Japanese inheritance law.

✅ The Koseki System (Family Register/戸籍)

The koseki is a Japanese family register that records births, marriages, divorces, adoptions, and deaths. It is essential to proving who the legal heirs are.

It is managed on a household basis (not per person).

It is needed to verify relationships for inheritance purposes.

You can request a copy from the city or ward office where the deceased was registered.

✅ Roles of Heirs and Executors in Inheritance

In Japan, estate administration is handled either by the heirs themselves or by an executor designated in the will.

Unlike many other countries, Japan does not have a probate system (a formal court process to validate and manage a will).

Heirs automatically inherit both the assets and liabilities of the deceased and can proceed with distributing property and settling debts without any public certification or court involvement.

However, if there is no will or disagreements arise among the heirs, legal intervention (as explained later) may become necessary.

📚A Japanese Story:

In traditional Japanese custom, especially under the concept of katoku-sōzoku (patrilineal inheritance/家督相続), it was common for the eldest son or firstborn to inherit the entire estate and take on the responsibility of caring for the parents.

This practice was particularly strong in rural areas, where there was a deeply rooted belief that the person who inherits the family name and home (honke/本家) should also be the one to protect and maintain it.

In many families, it was tacitly accepted that daughters who had married out and have different family name would have no right to inherit.

Even today, this custom remains deeply ingrained among the older generation in rural parts of Japan.

2. Assets and Debts

Japan treats both tangible and intangible property — and even debts — as inheritable.

✅ Tangible Assets

Real estate: Homes, land, rental properties

Vehicles, jewelry, household items: Must be inventoried and valued

✅ Financial Assets

Bank accounts: Frozen at death; require documents to unfreeze

Stocks and bonds: Must be retitled via brokerage

Insurance payouts: Paid to designated beneficiaries but may affect inheritance tax

✅ Intellectual Property and Business Ownership

Shares in companies may be subject to internal restrictions

Patents, copyrights, trademarks are inheritable but must be officially re-registered

✅ Debts and Negative Assets

Yes, you can inherit debt — including:

Mortgages

Loans

Credit card balances

Unpaid taxes or rent

Important: You can legally refuse the inheritance (see Section 5) — but only if done within three months of learning about it.

3. If There’s No Will: What Happens?

Without a will, the estate is divided based on legal rules, not personal wishes. All heirs must come to an agreement on who gets what. This is known as the inheritance division agreement (遺産分割協議).

✅ What if the heirs can’t agree?

Any heir may file for mediation (調停 / chōtei) with the family court. If that fails, the case proceeds to adjudication (審判 / shinpan), where a judge decides how to divide the estate.

(See section 6 for further information)

✅ When is court involvement mandatory?

If any heir is a minor or mentally incapacitated

If an heir is missing or unlocatable

If the validity of a will is contested

These cases often require legal guardians, expert witnesses, or court-appointed administrators.

4. Inheritance Tax in Japan

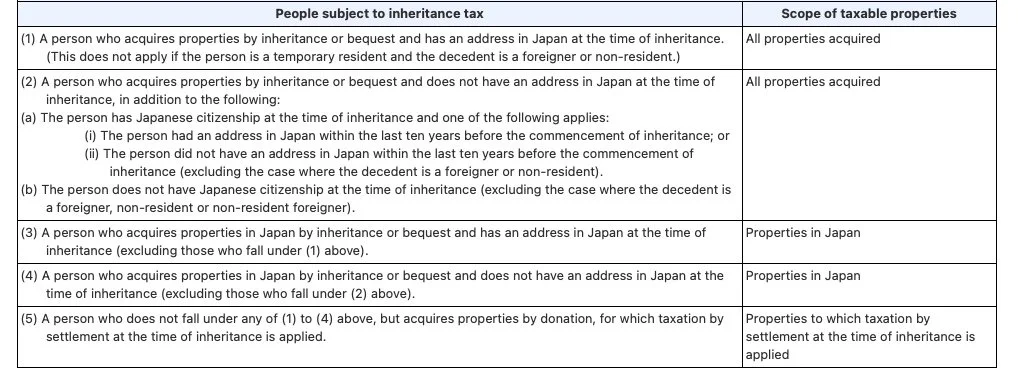

When someone passes away, Japanese inheritance tax (相続税) may apply depending on the residency and nationality of both the decedent and the heirs, as well as the location and type of assets involved.

Unlike some countries where the tax is imposed on the estate as a whole, Japan taxes the individual beneficiaries on the assets they receive.

✅ Who Is Subject to Inheritance Tax?

At the time of inheritance (=the date the decedent dies), Japanese law evaluates two main factors:

Where the decedent lived and their citizenship

Where the heir resides and their citizenship

Based on those, the scope of taxable assets is determined as shown below:

✅Key Definitions for Japanese Inheritance Tax

Temporary Resident: A person who holds a valid Japanese residence status at the time of inheritance and has lived in Japan for 10 years or less during the 15 years prior to the decedent’s death.

Decedent Who Is a Foreigner: A person who had both a Japanese residence status and a registered address in Japan at the time of their death.

Decedent Who Is a Non-Resident: A deceased person with no address in Japan at the time of death, and either (1) had lived in Japan within the previous 10 years but had given up Japanese citizenship, or (2) had not lived in Japan at all in the 10 years before passing.

Non-Resident Foreigner (2017–2022 rule): Someone who did not maintain both a Japanese address and citizenship continuously from April 1, 2017 to the date of inheritance or bequest.

✅ What About Inheritance Tax for Foreign Heirs?

Japanese inheritance law follows the “National law principle” (本国法主義), meaning that the legal process is based on the nationality of the deceased.

That said, the scope of taxation—whether it covers just Japan-based assets or global assets—depends on the residency and citizenship status of both the decedent (the person who passed away) and the heir at the time of inheritance (date of the person passed away)

✅ In general, Japanese inheritance tax applies to worldwide assets if:

Either the decedent or the heir is a Japanese resident at the time of inheritance, or

The decedent or heir is a Japanese citizen who has not lived abroad for over 10 years.

✅ Tax is limited to Japan-based assets mainly if:

Both the decedent and the heir are non-residents,

and the heir is a foreign national (non-Japanese), orBoth the decedent and the heir are non-residents,

and either has lived abroad for over 10 years prior to the inheritance

✅ Inheritance Tax in Japan: Common Questions from Foreign Residents

Q1. Can I inherit property in Japan if I live overseas?

A: Yes. For example, Sarah, a Canadian citizen living in Canada, inherited a house in Tokyo from her Japanese mother. Even though Sarah does not live in Japan, she was required to file and pay Japanese inheritance tax—because the property is located in Japan.

Q2. My parent was a foreign national living abroad—do Japanese laws apply?

A: It depends. Kenji, a Japanese citizen living in Tokyo, inherited a vacation home in France from his father, a French national living in Paris. While French inheritance law governed how the property was passed on, Kenji still had to pay Japanese inheritance tax because he is a Japanese resident and Japan taxes residents on worldwide assets.

Q3. Do I have to pay Japanese inheritance tax on assets outside Japan?

A: If you live in Japan, yes. For instance, John, an American permanent resident of Japan, inherited a U.S. bank account from his father who lived in the U.S. Even though the account is located abroad, Japan imposes inheritance tax on global assets if the heir is a resident.

Q4. I only lived in Japan for a short time. Will I owe tax on an inheritance from Japan?

A: Possibly. Li, a Chinese national who lived in Japan for just two years, inherited a Japanese investment account from his uncle—a Japanese resident for over 15 years. Although Li may qualify as a “temporary resident,” he was still subject to inheritance tax because the decedent’s long-term residency in Japan triggered taxation on worldwide assets.

Q5. My Japanese parent died in Japan. I live abroad—do I have to pay tax?

A: Yes. A Japanese father passed away while living in Japan. His son, a U.S. citizen living in New York, inherited both Tokyo real estate and U.S. stocks. Because the decedent was a Japanese resident, Japanese inheritance tax applied to both domestic and overseas assets.

✅ Tax Rates (as of April 1, 2024):

For the most up-to-date inheritance tax brackets, applicable rates, and deductions, please refer to the official chart from Japan’s National Tax Agency (NTA).

👉 NTA Inheritance Tax Guide (Japanese)

✅ Example: How Inheritance Tax Is Calculated in Japan

Let’s say the deceased left behind a total estate of ¥200 million to his wife and two children.

Step 1: Determine the Basic Exemption

The basic exemption is calculated as:

¥30 million + (¥6 million × number of legal heirs)

In this case, the deceased is survived by a wife and two children (3 legal heirs), so:

¥30M + (¥6M × 3) = ¥48 million

Taxable estate = ¥200 million − ¥48 million = ¥152 million

Step 2: Divide the Estate According to Legal Shares

Under Japanese law, when no will is present, the legal share is:

Wife: 1/2

Each child: 1/4

Applying these to the taxable estate:

Wife’s share = ¥76 million

Each child’s share = ¥38 million

Step 3: Apply Tax Rates and Deductions

Using Japan’s official inheritance tax brackets:

Wife: ¥76M × 30% − ¥7M = ¥15.8 million

Child 1: ¥38M × 20% − ¥2M = ¥5.6 million

Child 2: ¥38M × 20% − ¥2M = ¥5.6 million

Total Inheritance Tax Due:

¥15.8M + ¥5.6M + ¥5.6M = ¥27 million

✅ Deadlines

Must file and pay within 10 months of death

Late payments incur penalties and interest

Filing is done at the Tax Office where the deceased lived

🛑 Tips: Other Exemptions

Life insurance: An additional ¥5 million exemption per legal heir may apply.

Annual tax-free gifts: You can give up to ¥1.1 million per person per year tax-free under Japan’s gift tax system.

🛑 To avoid costly mistakes and ensure full compliance, it is strongly recommended to consult with a qualified legal or tax advisor experienced in cross-border estate matters.

For reference, I have personally consulted the following U.S.-based professionals who are familiar with Japanese inheritance tax. (This is not a sponsored mention—I met with them while I was in Chicago, and some of the team members are Japanese.)

✅ Required Documents

Foreigners can inherit assets in Japan and inherit your assets to both Japanese and foreigners. However, the process can be more complex—especially when international taxation or documentation is involved.

Death certificate

Koseki (family register)

Proof of asset ownership (real estate, bank passbooks, etc.)

ID documents for all heirs (passport, residence certificate)

Inheritance division agreement (if no will)

🔸 Foreign documents must be translated into Japanese and authenticated (via apostille or Japanese consulate certification).

5. Renouncing an Inheritance: What If You Don’t Want It?

Under Japanese law, you can refuse to inherit (相続放棄 / sōzoku hōki) — especially useful if the estate is debt-heavy.

✅ How to renounce

File a formal renunciation petition with the family court

Must be filed within three months of learning about the inheritance

Once accepted, you are treated as if you were never an heir

Note: If you use or dispose of any assets (e.g. live in the house), the court may deny your renunciation.

6. What to Bring When Consulting a Lawyer or Court

If you're seeking legal advice or preparing for a court procedure, bring:

A family tree or diagram showing relationships

Death certificate and koseki

Any wills (do NOT open sealed wills yourself — take them to court unopened)

Property deeds and valuation certificates

Bank passbooks and transaction records

Records of stocks, insurance, or company shares

A list of debts and unpaid bills

A memo outlining past conversations among heirs, in date order

✅ How Mediation and Court Procedures Work

Step 1: Mediation (調停)

A neutral mediator from the family court helps the heirs come to an agreement. If all parties agree, the court finalizes the decision.

Step 2: Adjudication (審判)

If mediation fails, the case goes before a judge. The judge then issues a binding order about how the estate is to be divided.

7. How to Avoid Inheritance Disputes

Preventing conflict starts with clarity, preparation, and professional support. Here are essential steps:

Make a Will in Two Languages

Prepare your will in both Japanese and the heir’s native language to avoid misinterpretation.Use a Civil Trust (民事信託)

A flexible tool to manage assets during life and after death. It allows a trusted person to handle your assets based on a trust agreement. Work with a lawyer or judicial scrivener, as this is still a developing practice in Japan.Consider Adult Guardianship (後見制度)

For concerns about capacity (e.g., dementia), Japan offers:Statutory Guardianship: Court-appointed.

Voluntary Guardianship: You appoint someone in advance.

Appoint a Reliable Executor

Preferably a legal professional to handle asset distribution fairly and efficiently.List All Assets and Recipients

Keep a clear, updated inventory of assets and intended heirs.Talk to Your Family

Sharing your intentions early can reduce confusion and disputes later.Add a No Contest Clause

Consider including a clause that disinherits anyone who challenges the will—though rare, it may help deter disputes.

8.Validity of Foreign Wills and Court Rulings in Japan

✅ Foreign Wills

Foreign wills can be valid under Japanese law if they meet either of the following conditions defined in Japan’s Law on the Conflict of Laws Concerning the Form of Wills:

The will was executed in accordance with the law of the place where it was made,

or with the law of the testator’s nationality or residence at the time of will execution or death.

Additionally:

The will must not violate Japanese public policy (e.g., cannot unjustly disinherit protected heirs),

and it must be translated into Japanese and properly authenticated (apostille or consular certification).

✅ Foreign Court Rulings

Under Article 118 of Japan’s Code of Civil Procedure, a final and binding foreign judgment is recognized in Japanonly if all the following are met:

The foreign court had legitimate jurisdiction under relevant laws or treaties.

The defendant was properly served, or appeared voluntarily.

The judgment and underlying proceedings do not violate Japanese public order or morality.

Reciprocity exists between Japan and the foreign jurisdiction (i.e. Japan recognizes reciprocity with the United States).

Without satisfying these conditions, foreign court decisions — including those appointing executors — may not be enforceable within Japan.

9. Sending Inheritance Abroad: Currency and Reporting

✅ Sending money overseas

Must be wired from a Japanese bank

Requires your SWIFT code, proof of identity, and inheritance documents

Transfers over ¥30 million must be reported to the Bank of Japan

✅ Currency exchange

Japanese banks may charge high margins

Services like Wise, Revolut, or TorFX often provide better rates

✅ Tax reporting overseas

U.S. citizens must file Form 3520 if inheritance exceeds USD 100,000

U.K. residents may need to report it as foreign income (even if no tax is due)

Check with a local tax advisor to avoid compliance issues.

10. Wrap up

No one wants inheritance to cause conflict within the family. From my experience in HR—especially in delicate situations like recommending resignation—I’ve learned that once emotions take over, resolving things becomes much harder. Inheritance is no different. It's deeply personal and often emotionally charged.

On top of that, international inheritance adds another layer of complexity from both legal and administrative perspectives. But with the right understanding and preparation, it doesn’t have to become overwhelming.

That said, it’s not easy to bring up the topic of wills with healthy parents. Still, if the right opportunity arises, it’s probably better to have the conversation sooner rather than later. After all, it’s their assets, and I believe they should feel free to use them and decide their future whatever they wish.

Have you been through international inheritance yourself?

Share your story—it might help someone else going through the same thing !

Source:

https://www.zennichi.or.jp/law_faq/外国人と日本の相続税/