How to Prepare for Japan’s New Business Manager Visa Rules (Effective October 16, 2025)

Japan’s “Business Manager” visa (経営・管理) has long been a gateway for foreign entrepreneurs who want to start or run a business here. It’s the visa that allows a person to establish and operate a company, hire staff, open a bank account, rent an office, and reside legally in Japan as the organization’s representative director or executive.

Since October 16, 2025, the rules have changed, affecting many foreign entrepreneur, small-business owner, and even existing visa holder. The new regulation, announced by Japan’s Immigration Services Agency under the Ministry of Justice, tightens eligibility, raises capital requirements, and introduces new conditions for experience, staffing, and documentation.

This blog explains what is changing, why the government decided to act, and what foreign entrepreneurs should do to prepare.

This blog covers:

1. What Is the Business Manager Visa?

2. Why the Change?

3. The New Rules from October 16, 2025

4. Impact on Entrepreneurs and Small Businesses

5. Possible Alternatives and Future Paths

6. Practical Preparation Tips

7. Q&A

8. Wrap Up

1. What Is the Business Manager Visa?

The Business Manager visa (在留資格「経営・管理」) is one of Japan’s “work” visa categories, designed for individuals who either manage a business or invest and oversee its operations. Over 10,000 issued annually pre-2025.

Typical holders are company founders, branch managers, or senior executives of foreign-owned subsidiaries.

To qualify under the old framework, applicants generally needed:

a registered business entity in Japan

a dedicated physical office

capital or investment of at least JPY5 million, or equivalent evidence of stable business operations; and

proof that the business was real, viable, and tax-compliant.

This made the visa accessible to many small and medium enterprises. In practice, numerous small import-export firms, restaurants, or consulting businesses were launched under this route.

2. Why the Change?

According to the Ministry of Justice’s explanatory materials, the revision addresses growing concern that the visa had been used for residence purposes rather than genuine management. Some individuals established shell companies with minimal capital, leased a desk, and maintained nominal business activity to stay in Japan.

Compared to other OECD countries, Japan’s JPY5 million threshold (around USD 30,000) was unusually low. Officials also noted that some firms hired no Japanese staff and had limited economic impact, undermining the visa’s original goal of attracting real foreign investment.

In short, the government wants to shift the focus from “residency via paperwork” to “credible, job-creating enterprise.” The 2025 reform therefore tightens both the scale and the quality of businesses eligible for this status.

3.The New Rules from October 16, 2025

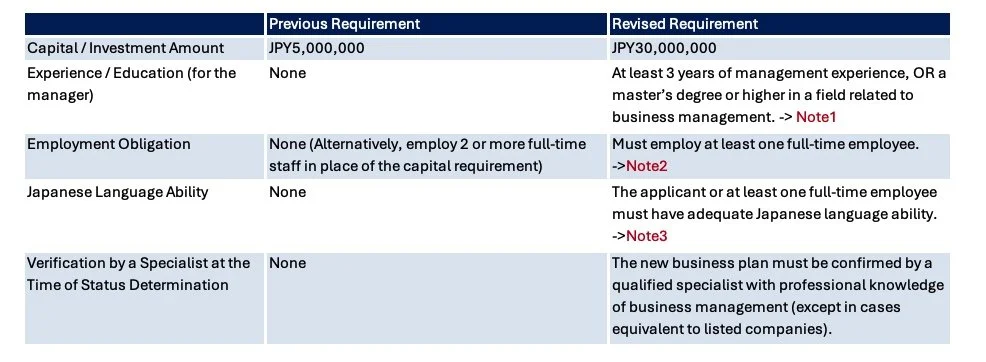

Note: This chart was prepared by the author with reference to the Overview of Revisions to the “Business Manager” Status of Residence published by the Immigration Services Agency of Japan, Ministry of Justice (https://www.moj.go.jp/isa/content/001448231.pdf)

Note 1: Management experience” includes business preparation activities conducted under the residence status of Designated Activities (“Tokutei Katsudo”).

Note 2: Eligible employees are:

Japanese nationals,

Special permanent residents, and

Foreign nationals who live in Japan with long-term residence status — for example, Permanent Residents, spouses or children of Japanese nationals or Permanent Residents, and Long-Term Residents.

Note 3: For Japanese language ability, applicants (or one of their full-time employees) are generally expected to have an upper-intermediate level of Japanese, roughly equivalent to CEFR B2 or JLPT N2. This means being able to communicate smoothly in everyday and workplace situations without major difficulty.

Full-time employees may also include foreign nationals who already live and work in Japan under standard work visa categories.

The table above summarizes the major revisions to the Business Manager visa.

Below is a closer look at each change and what it means in practice for foreign entrepreneurs and business owners.

(1) Higher Capital Requirement: JPY30 Million or More

The most publicized change is the jump in the minimum investment amount from JPY5 million to JPY30 million. That’s a six-fold increase, roughly USD 200,000 at today’s rates.

Applicants must demonstrate that this capital has been actually paid into the company’s account, not merely pledged. Documentation such as bank statements and the corporate registry (登記事項証明書) will be required.

Why such a large leap? Officials argue it brings Japan in line with major economies and discourages paper companies that never reach operating scale. For many genuine founders, it means more preparation — or seeking investors before applying.

(2) At Least One Full-Time Employee in Japan

Under the previous regime, an applicant could qualify based solely on the capital test.

From October 2025, both will be required:

minimum JPY30 million investment, and

employment of at least one full-time (常勤) employee based in Japan.

The employee may be a Japanese national or a foreign resident with a valid working status. The government intends this to ensure that foreign-owned businesses contribute to domestic employment rather than exist only on paper.

For start-ups, this effectively doubles the fixed cost of entry — salary plus social insurance registration — but it also signals a shift toward more credible operations.

(3) Management Experience or Advanced Degree Required

Another new element focuses on the personal qualification of the visa applicant.

From October 2025, the main applicant must satisfy one of these:

at least three years of business or management experience, or

a master’s degree or higher in a relevant business/management field.

In other words, the “CEO” of a Japanese company must show either a professional background or academic competence to perform that role. This change mirrors global norms for investor or entrepreneur visas and filters out proxy applicants without genuine expertise.

(4) Independent Business Plan Verification

Applicants will need to submit a detailed business plan (事業計画書) that has been evaluated by a certified professional such as a licensed Small and Medium Enterprises (SMEs) consultant (中小企業診断士), tax accountant (税理士), or certified public accountant (公認会計士).

Authorities will review not only financial projections but also the plan’s realism, market fit, and staffing structure. The goal is to ensure that applicants have a sustainable, verifiable plan rather than a placeholder document created only for immigration filing.

(5) Stricter Documentation and Post-Approval Monitoring

To support renewal applications, the company must now regularly submit:

proof of tax payments (法人税・消費税)

evidence of employee enrollment in social and labor insurance

updated financial statements and

explanations of any business model changes since the last filing.

Site visits and document verification are expected to become more frequent, especially for small or newly established entities.

(6) Transition and Implementation Schedule

For those already residing in Japan under the “Business Manager” status, renewal applications submitted on or before October 16, 2028 (that is, within three years from the effective date) will be reviewed comprehensively, even if the business does not fully meet the new standards. In such cases, the Immigration Services Agency will consider the applicant’s current business condition and the likelihood of meeting the revised criteria in the near future when deciding whether to grant renewal.

Applicants may also be asked to submit a professional evaluation document prepared by a qualified expert regarding the business’s management status.

After October 16, 2028, however, all renewal applications must comply fully with the new standards.

Note: Even after the three-year transition period, if the enterprise is operating soundly, has duly paid its corporate taxes, and is expected to meet the new standards by the next renewal, the authorities may still make a comprehensive decision taking overall residency circumstances into account.

4. Impact on Entrepreneurs and Small Businesses

The changes will reshape Japan’s entrepreneurial landscape.

■ For New Applicants

Foreign entrepreneurs planning to enter Japan will face a steeper starting line:

raising JPY30 million in capital, securing office space, hiring staff, and preparing professional documentation. Those who can meet the standard may benefit from smoother long-term renewals because their operations will clearly satisfy credibility tests.

■ For Current Visa Holders

Existing Business Manager visa holders must review their operations now.

Even if their initial approval was under the old JPY5 million standard, their next renewal could require proof of real operations, employee enrollment, and sustained capital.

Businesses that remain small or semi-dormant may need restructuring, new investment, or conversion to another visa status.

■ For Smaller Start-Ups

The concern is that these changes may discourage micro-entrepreneurs — especially those launching digital or solo ventures with modest capital. Under the old rules, a freelancer could get a visa by setting up a small company. Under the new system, that option is gone unless they grow the business or hire staff.

Yet the government appears willing to make this trade-off in exchange for higher-quality foreign investment.

5.Possible Alternatives and Future Paths

Entrepreneurs who cannot meet the new JPY30 million requirements still have several options:

Startup Visa programs run by certain local governments, which allow six-month to one-year residence for preparing a business with lower capital; E.g. Fukuoka or Tokyo

Highly Skilled Professional (HSP) visas for those with advanced academic or salary credentials;

Intra-company transferee or Engineer/Specialist in Humanities/International Services statuses for those joining existing firms; and

J-Skip Visa — a new fast-track route launched by the Immigration Services Agency of Japan (ISA) in April 2023, allowing qualified professionals and executives to obtain the “Highly Skilled Professional” residence status without undergoing the usual points-based evaluation.

Eligibility:

o Holding a master’s degree or higher and expected annual income of JPY20 million or more.

o At least ten years of relevant professional experience and expected income of JPY20 million or more.

o For business/management activity - at least five years of experience in business management and expected annual income of JPY40 million or more.

Partnerships with Japanese nationals or companies who can serve as representative directors while the foreign partner holds a different work status.

Each path has its own conditions, but all require genuine activity rather than a “visa-first, business-later” approach.

6.Practical Preparation Tips

For anyone considering or already holding a Business Manager Visa, early preparation and compliance are essential.

A. Confirm Your Timeline

Check your current visa expiry date.

Begin preparing renewal documents at least three months in advance.

B. Review Capital Structure

Ensure that at least JPY 30 million has been actually paid into the company’s bank account and is recorded in the company registry.

Avoid using funds that will be immediately withdrawn; authorities look for sufficient operational liquidity to sustain business activity.

C. Hire and Document Employees

Employ at least one full-time employee and register them for all mandatory social and labor insurances, including:

o Social Security and Pension Office (年金事務所) – for pension registration and health insurance enrollment, typically through

the Japan Health Insurance Association (協会けんぽ).

o Hello Work (ハローワーク) – for employment insurance.

o Labor Standards Inspection Office (労働基準監督署) – for workers’ compensation insurance.

NOTE:

Sole proprietors / individual businesses (個人事業主/個人事業所) are generally required to enroll in employees’ health insurance and pension (厚生年金・健康保険) only if they regularly employ five or more workers in applicable industries. For 1-4 employees, stick to national health insurance individually, but document all for visa proof.

However, labor-related insurances such as un-employment insurance and workers’ compensation are required once even a single employee is hired. Always confirm specific obligations with your local Social Security and Pension Office (年金事務所) or Labor Bureau (労働局).

D. Keep Detailed Payroll and Insurance Records

Maintain salary slips, social insurance payment receipts, and copies of employee insurance certificates as proof of proper employment.

Payroll must reflect accurate social security deductions, Income tax, overtime calculations, and actual insurance payment transfers. Consider hiring a certified labor and social security attorney (社会保険労務士) or payroll specialist. They can ensure compliance with immigration, labor, and tax regulations—especially useful for start-ups unfamiliar with Japan’s procedures.

E. Strengthen Your Business Plan

Update your business plan with realistic sales forecasts, financial data, and evidence of operations.

Whenever possible, obtain evaluation or confirmation from a certified professional, such as an accountant, lawyer, or chamber of commerce advisor.

F. Stay Compliant with Taxes and Reporting

File corporate, withholding, and consumption tax returns on time.

Keep organized records of receipts, invoices, and financial statements.

These may be required when you apply for visa renewal or business verification.

G. Consult Experts Early

Seek advice from administrative scriveners (行政書士) or immigration lawyers familiar with the revised 2025 regulations.

Some prefectures and local governments also offer free consultation or advisory programs for foreign entrepreneurs.

A useful example:

Tokyo Metropolitan Government – Program to Increase Foreign Entrepreneurs

H. Monitor Official Announcements

Bookmark the Immigration Services Agency (Japan) official page:

7. Q&A – Common Questions About the Business Manager Visa

Q1: How long does the screening process usually take?

A1: The review period typically ranges from two to three months, depending on the content of your application, the timing of submission, and the workload at your regional immigration office. It is highly recommended to plan ahead and allow ample time for processing.

Q2: When can I apply for renewal?

A2: You can apply for visa renewal up to three months before the expiration of your current status.

Because collecting documents often takes longer than expected, it’s ideal to start preparing at least three months before your visa expires. Items such as financial statements, tax payment certificates, and social insurance enrollment proof may require time to obtain from relevant authorities.

Q3: I’m running out of time—what if my renewal application is submitted just before my visa expires?

A3: Don’t panic. As long as you submit your renewal before your visa’s expiration date, you are protected by a special grace period (“tokurei kikan”). This allows you to legally remain in Japan for up to two months after the expiration date while your renewal is under review.

Q4. What are common reasons why a Business Manager Visa might be denied?

A4. Based on Immigration Services Agency (ISA) guidelines and post-2025 review standards, here are the typical reasons for denial:

Weak or unrealistic business plan: Plans are vague, lack revenue structure or fail to show feasibility.

Poor financial: Unverified capital (approx. JPY30 million), unclear fund sources, or inconsistent transaction history.

Lack of a real business office: Using residential address without physical facilities, signage, or activity proof.

Q5: What should I do if I need to be outside Japan for an extended period?

A5: If you have long-term business travel or overseas stays, you should prepare documentation showing that your management responsibilities continue while abroad. Examples include:

Travel itinerary, flight records, and business trip orders/reports

Board meeting minutes, delegation letters, or communication logs (emails, chat records) showing instructions from abroad

Evidence of remote management activities such as contract approvals or business transactions

Attach these materials to your renewal application to demonstrate that your business operations in Japan remain active and under your direction.

8.Wrap Up

The October 2025 revision marks the biggest change to Japan’s Business Manager visa in more than a decade.

While the higher capital, employment, and qualification requirements will certainly make entry more demanding, they also clarify what Japan truly seeks — serious investors who will create value and jobs.

For legitimate entrepreneurs, the message is not discouragement but preparation:

build a solid plan, gather sufficient funding, hire responsibly, and operate transparently.

Do that, and Japan remains an attractive, stable, and rule-based place to run a business.

The fine print may have changed, but the opportunity to succeed in Japan has not.

What do you think about Japan’s new Business Manager visa rules?

Share your thoughts or experiences in the comments — especially if you’re planning to start or manage a business in Japan after 2025!

Official Reference Links

Immigration Services Agency of Japan – Amendment to the Ministerial Ordinance on Landing Criteria for the “Business Manager” Status of Residence

Overview of the Revision (Effective October 16, 2025)

Immigration Services Agency of Japan – Business Manager Visa

See also

Employment Contracts in Japan – What You Need to Know

2025 Japan Cost of Living Blueprint - With Free Excel Sheet!