Upcoming Year-End Tax Adjustment in Japan – What You Need to Prepare

The Year-End Tax Adjustment process (nenmatsu chosei /年末調整) kicks off soon. It’s your opportunity to declare deductions, update dependent information, and make sure you’re not paying more tax than necessary.

For foreign employees, the process may feel unusual — in countries like the U.S., Canada, or Australia, there’s no employer-run adjustment, and most people file their own tax return.

In Japan, your employer handles everything unless you have extra income, deductions they can’t process, or earn over JPY 20 million.

This guide walks you through:

What the Year-End Tax Adjustment is

Who it applies to

When it happens

What You Need to Prepare

Common mistakes to avoid and FAQ

Wrap up

1. What Is the Year-End Tax Adjustment?

In Japan, employees have income tax withheld from their salary each month through the withholding tax system(源泉徴収, gensenchoshu). Employers deduct the estimated tax from salaries and bonuses and remit it directly to the government.

At the end of the year, your employer reconciles these withholdings with the actual amount you owe based on your total annual income, dependent status, and deductions.

This reconciliation process — called nenmatsu chōsei (年末調整), or Year-End Tax Adjustment — finalizes your income tax for the year.

If too much tax was withheld, you’ll receive a refund through your December (or sometimes January) paycheck. If too little was withheld, the balance will be collected in the same way.

📢 2025 Year-End Tax Adjustment – Key Updates (All Employee Benefits! )

Higher Basic Deduction for most income levels

Bigger Salary Income Deduction (min. ¥650,000)

New Special Deduction for Certain Relatives (See detail below)

Higher Income Limits for dependents and working students

Source: National Tax Agency – 2025 Year-End Adjustment Changes

Note: Although these changes take effect on December 1, 2025, they will be applied in the 2025 Year-End Tax Adjustment and cover your entire 2025 income.

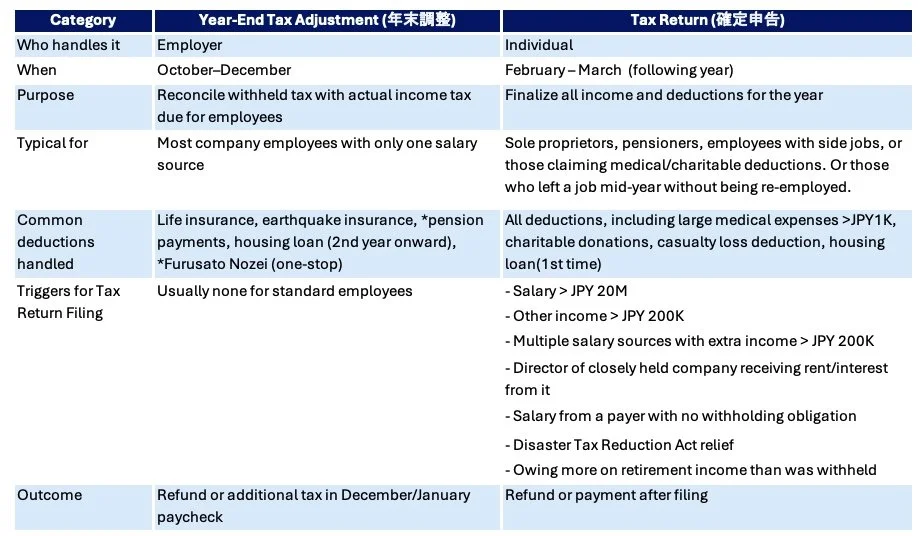

✅ Year-End Tax Adjustment vs. Tax Return

In Japan, there are two main ways your income tax is finalized:

Year-End Tax Adjustment (年末調整) — handled by your employer for most salaried employees to reconcile your withheld tax with the actual amount due.

Tax Return (確定申告) — filed by individuals to declare all income and deductions. This is required in certain cases, such as having multiple income sources or claiming deductions your employer can’t process.

The chart below summarizes the key differences:

Source: National Tax Agency

*Pension payments :Mandatory public pension and voluntary plans like iDeCo, if applicable

*Furusato Nozei (One-Stop Exception): A donation program that lets you contribute to municipalities and receive a tax deduction. If you meet certain conditions, the deduction can be processed through your Year-End Tax Adjustment without filing a separate tax return. (See Section 4: What You Need to Prepare for details.)

2. Who it applies to

Employees (full-time and, in some cases, part-time) whose salary is subject to Japanese withholding tax.

Not applicable if your annual salary exceeds JPY 20 million → you must file a tax return instead.

Not applicable to freelancers, sole proprietors, or independent contractors — they must file their own annual tax return (kakutei shinkoku 確定申告).

For foreign employees: Applies if you are classified as a Resident or Non-permanent Resident under Japanese tax law and have monthly withholding.

If you are a Non-resident, tax is finalized through a flat 20.42% withholding on Japan-source salary, so no Year-End Tax Adjustment is required.

Ask HR or payroll department, if you are not sure.

3. When It Happens

Most companies carry out the Year-End Adjustment process from October through December, so that it can be reflected in your final paycheck of the year.

You’ll usually get a request from your HR or payroll department asking for:

Completed forms

Original certificates for deductions

Updated information on your address and dependents

4. What You Need to Prepare

Here’s a checklist of what most employees in Japan need to submit. The exact requirements may vary depending on your personal situation.

I’ve created an at-a-glance Year-End Tax Adjustment Checklist — check the Freebie Shelf!

✅ Basic Information

My Number (マイナンバー) — your Japanese personal ID number.

Provided to your employer or payroll vendor when you join, but may need reconfirmation.Address and Dependents — make sure these are up to date.

Update if there are changes such as marriage, divorce, childbirth, death, or when a dependent (e.g., child, elderly parent) becomes self-supporting or is transferred to be a dependent under another sibling.

✅ Dependents Living Abroad

If you live in Japan, earn a salary, and want to claim a deduction for a relative living outside Japan—such as a dependent, spouse, special dependent, or disabled relative—you must submit the following to your employer if you wish to use the Year-End Tax Adjustment.

NOTE: Eligible relatives living outside Japan include blood relatives within the sixth degree, a spouse, and relatives by marriage within the third degree. If you are unsure, please check with HR.

Required Documents:

Proof of relationship (e.g. supplementary family register, non‑resident relative’s passport, or foreign certificates showing name, date of birth, and address)

Proof of studying abroad (visa or equivalent), for dependents studying overseas

Proof of remittances for living or educational support, such as:

Remittance forms from a bank

Credit card statements (family card usage)

Electronic payment or transfer records

Alternatively, if you provided ¥380,000 or more total in support during the year, you can submit ¥380,000 remittance documentation instead

If you made more than three remittances to the same person, you only need to submit the documents for the first and last remittance, along with a statement of the total amount.

All documents must be in Japanese or accompanied by a Japanese translation - missing translation and proof not in Japanese are common rejection reasons for overseas dependents.

✅ NEW! Starting December 1, 2025: Special Deduction for Certain Relatives (特定親族特別控除)

A new deduction will be available for dependents who meet all of the following criteria.

Age: 19 to under 23

Household: Shares the Same Livelihood – You do not necessarily need to live together. Even if the dependent lives separately due to work, school, or medical treatment, they are considered to share the same livelihood if the taxpayer covers their living expenses, tuition, medical costs, or similar support.

Income:

o Total income over JPY580,000 and up to JPY1,230,000

o For salary-only income, this corresponds to annual earnings of over JPY1,230,000 and up to JPY1,880,000

Exclusions: Spouse, blue/white business dependents (専従者)

Includes: Foster children under the Child Welfare Law

Deduction amount depends on the dependent’s income — up to ¥630,000 (gradually decreasing as income approaches ¥1,230,000).

Note: If the dependent’s annual income is ¥580,000 or less, they generally qualify for the standard Dependent Deduction — provided they meet the other eligibility rules on relationship and shared livelihood.

To claim this NEW deduction through Year-End Adjustment, you must submit the form:

(->See the Employer Forms below)

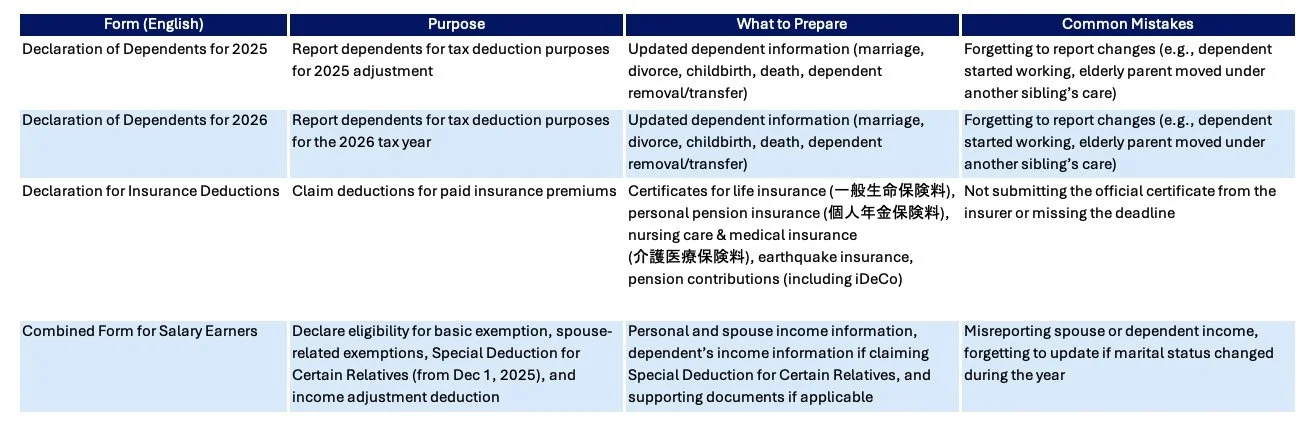

✅ Employer Forms (HR or payroll department will send you the link to you in the internal notice)

Declaration of Dependents (給与所得者の扶養控除等申告書 )

2025 Form (令和7年分)

Declaration of Dependents (Change Notification) (令和8年分給与所得者の扶養控除等(異動)申告書) – For reporting changes in dependent status for the next year.

2026 Form (令和8年分)

Declaration for Insurance Deductions (給与所得者の保険料控除申告書 )

2025 Form

2025 Combined Deductions Form:

(給与所得者の基礎控除申告書 兼 給与所得者の配偶者控除等申告書 兼 給与所得者の特定親族特別控除申告書 兼 所得金額調整控除申告書)

2025 Form

Note: The 2025 Year-End Tax Adjustment forms in Japanese have been published on the National Tax Agency (NTA) website. If you need the multilingual versions, please check the NTA’s multilingual forms page when they are released (typically in the fall).

✅ For Deductions

The following documents may reduce your taxable income — meaning you’ll pay less tax or get a bigger refund.

These certificates are usually sent to you by mail or available online in the fall. Don’t miss them! If you cannot get them in time, notify HR.

Life Insurance Premium Certificate (生命保険料控除証明書)

Covers three categories of insurance eligible for deduction:

a.General Life Insurance Premiums (一般生命保険料)

b.Personal Pension Insurance Premiums (個人年金保険料)

c. Nursing Care & Medical Insurance Premiums (介護医療保険料)

Earthquake Insurance Premium Certificate (地震保険料控除証明書)

Issued by your insurance company if you have earthquake coverage in your home insurance.

National Pension / National Pension Fund Payment Certificate (国民年金保険料・国民年金基金掛金証明書)

Issued by the Japan Pension Service in Oct–Nov.

If you paid premiums yourself for a spouse or family member who lives with you and shares the household, you can also claim the Social Insurance Premium Deduction.

Proof is required for National Pension and National Pension Fund payments.

For other payments (e.g., National Health Insurance premiums for your family), no proof is required.

iDeCo Contribution Certificate (個人型確定拠出年金掛金証明書)

Issued by your iDeCo provider if you contributed during the year.

Spouse Special Deduction Proof (配偶者特別控除関連書類)

Example: your spouse’s Withholding Slip (源泉徴収票) to confirm their income.

Housing Loan Deduction Documents (住宅ローン控除)

First year: apply via a full tax return.

From 2nd year: submit your bank’s year-end balance certificate and the special deduction form from the tax office through Year-End Adjustment.

Furusato Nozei (Hometown Tax Donation) Receipts (ふるさと納税)

If you used the one-stop exception and donated to five or fewer municipalities, submit the receipts (寄附金受領証明書) to your employer.

If you didn’t use the one-stop exception, or donated to more than five municipalities, you must file a separate tax return to claim the deduction.

Important Notes

Many people miss out on deductions simply because they never submit the necessary documents — even though they are eligible.

You must apply to claim these deductions; they are not automatic.

5. Common mistakes to avoid and FAQ

Even though the process is employer-handled, mistakes can cost you money — or cause extra paperwork later.

Common Mistakes

Forgetting to submit or lost insurance certificates

Without the official certificate, the deduction can’t be applied — even if you paid the premiums.

Tip: If you lost it, ask your insurance service provider to re-issue it or check it can be obtained online.

Missing the deadline

If you miss your employer’s submission cut-off, you’ll have to file a full tax return (確定申告) in February–March yourself.

Tip: I’d recommend informing HR/Payroll about the missing information— in some cases, they may be able to assist before the adjustment is finalized. (Not guaranteed, but it has happened.)

Assuming all deductions are automatic

Many require you to submit proof — especially for insurance, housing loans, or Furusato Nozei.Not updating dependent status

If your child started working, your spouse’s income changed, or an overseas dependent no longer qualifies, your deduction could be invalidated. Don’t forget the new Special Deduction for Certain Relatives!

FAQ

Q1: I’m leaving Japan before December — do I still need to do the Year-End Adjustment?

A: Usually no. If you leave mid-year, your employer will settle your tax on your final paycheck. However, if you have deductions you want to claim, you may need to file a tax return before departure.

Q2: I started work in Japan mid-year — do I still get the full year’s deductions?

A: Yes, in most cases, as long as your total annual income is reconciled and you provide all deduction certificates by your employer’s deadline. If you worked overseas earlier in the year, you may need to declare that income depending on your residency status.

Q3: I’m on a short-term contract under one year — do I need to do the Year-End Adjustment?

A: If your stay in Japan is clearly less than one year, you are considered a non-resident for tax purposes.

In that case, your employer withholds a flat 20.42% and no Year-End Adjustment is done. However, if your contract is extended past one year, your status changes and you may become eligible. Please check with your HR/Payroll.

Q4: I changed employers this year — how is the Year-End Adjustment handled?

A: Only your current employer will do the adjustment, but they need your Gensen Choshu-hyo (tax withholding certificate) from your previous employer. Without it, they can’t calculate your correct total income, and you’ll need to file a tax return yourself.

Q5: I sent money for multiple relatives into one bank account, so I don’t have separate remittance statements for each. What should I do?

A: If you cannot submit proper remittance statements for each eligible dependent, the tax office may question the claim during an audit.

There are also cases where people list all relatives as overseas dependents, but if you make incorrect or false claims, your employer — as the withholding agent — could face penalties such as back taxes, late payment interest, or additional tax for underreporting. Please discuss with your HR/Payroll.

6.Wrap up

It’s critical for foreigners to prepare early for the Year-End Adjustment. While it may feel like just another HR chore, it’s your chance to ensure you’re not overpaying tax.

Spending a few minutes gathering the right documents could mean thousands of yen back in your pocket.

If you’re new to Japan, this is one of those “small but important” parts of working life that’s easy to overlook.

Quick Checklist – Year-End Tax Adjustment Prep

✅ Check HR or payroll emails for guidance and deadlines

✅ Gather all insurance and loan deduction certificates

✅ Confirm dependent details and address

✅ Prepare My Number and ID copies (if required)

✅ Fill in the required forms

✅ Submit everything before the deadline

Mark your calendar, keep your certificates somewhere safe, and get it done early — your future self will thank you!

💡 Want to make it even easier? Grab our At-a-Glance Year-End Adjustment Checklist from the Freebie Shelf — it’s a simple, one-page guide to keep you on track and stress-free.