In-Home Care in Japan: From Critical Illness to Senior Support

When someone in your family becomes seriously ill or reaches a stage where daily care is needed, the question always arises: Can they stay at home?

In the U.S., this often means hiring private caregivers, juggling insurance approvals, and facing high hourly rates. When our relatives went through cancer at home in the U.S., costs climbed quickly — $40 per hour in 2016 for a caregiver through private care service provider.

After moving to Japan, I was surprised to find that home-based medical and senior care can be both affordable and well-organized, thanks to government programs and a dense network of visiting doctors and nurses. Let’s see how it works, and how foreigners can prepare for it.

This blog covers:

1. In-Home Care for Advanced Cancer and Critical Illness in Japan

a. How It Works

b. Health Insurance (National Health Insurance and Employee Health Insurance)

c. Cost

d. Long-Term Care Insurance (LTCI)

e. Things to Consider

🧩Real Story

2. Long-Term Senior Care at Home: Japan’s Universal System

a. How it works under Long-Term Care Insurance (LTCI)

b. Cost

c. LTCI Cost Simulation Tool

🧩Real Story

3. Financial Relief Programs Many Don’t Know (and Foreign Residents Can Use)

a. High-Cost Long-Term Care Benefit (高額介護サービス費)

b. Combined Medical & Long-Term Care Benefit (高額医療・高額介護合算制度)

c. Special Long-Term Care Facility Benefit (特定入所者介護サービス費 / Supplementary Benefit)

d. High-Cost Medical Expense Benefit (高額療養費制度)

4. Family Care Leave: If You’re Still Working

5. For Foreign Residents: What You Should Know

6. Q&A

7. Wrap-up

1. In-Home Care for Advanced Cancer and Critical Illness in Japan

Patients in the advanced stages of cancer or other serious illnesses are often given the choice to return home with support from a visiting medical team.

a. How It Works

If you decide to stay at home, talk with your doctor about setting up in-home medical care (在宅医療) under Japan’s health-insurance and long-term care systems. This service is also available for people who:

live with multiple chronic conditions that make regular hospital visits difficult, or

have serious neurological, cardiac, or respiratory diseases that require continuous monitoring at home.

b. Health Insurance (National and Employee Health Insurance)

To receive home-visit medical care, the patient must require ongoing medical management and have difficulty visiting a hospital. Under Japan’s health-insurance system, coverage includes:

regular and emergency home-visit consultations by doctors and nurses,

prescriptions, examinations, and procedures, and

medical management such as home oxygen therapy or intravenous nutrition.

The main providers are Home Medical Support Clinics or Hospitals (在宅療養支援診療所・病院). Typical in-home medical care includes:

a home-visit doctor (訪問診療・往診医), and

a home-visit nurse (訪問看護師).

c. Cost

The cost of in-home medical care depends on your insurance type, income level, and out-of-pocket percentage.

Example: For a person paying 30 % of costs, two doctor visits per month with prescriptions and minor procedures usually total about JPY 18,000–24,000. *Actual charges vary by treatment details, tests performed, and whether after-hours or travel surcharges apply.

d. Long-Term Care Insurance (LTCI)

Patients aged 40 or older may also qualify for LTCI services at home. Depending on the certified care level, available support may include:

Home-visit care – helpers assist with bathing, meals, cleaning, and daily activities.

Welfare-equipment rental – beds, wheelchairs, walkers, and other assistive devices.

…and other community-based services coordinated by a care manager.

Apply through your local Community Support Center (地域包括支援センター), which provides one-stop consultation for care, welfare, and health matters. If you are under 40 years old, check with your local center to find out what services may still be available.

For more details on coverage and costs, see Section 2: Long-Term Senior Care at Home – Japan’s Universal System.

e. Things to Consider

Emergency response: Doctors and nurses may not always be available immediately; response times depend on region and time of day.

Medical equipment: Some devices or medications cannot be used at home due to safety or regulatory restrictions.

🧩Real Story

One of my colleagues’ wives in Japan chose to stay at home during her final months. Her husband was terrified — he had no medical training. Her doctor and care manager arranged everything: an adjustable hospital bed, an oxygen machine, and regular visits from a nurse, with a doctor or nurse available on call. The total monthly out-of-pocket cost was about JPY 90,000, just a fraction of what similar care would cost in the United States.

*Costs vary depending on the level of medical need and the patient’s out-of-pocket percentage.

By comparison, our U.S. relative’s home care was mostly private pay and relied heavily on family members. Without long-term care insurance, out-of-pocket expenses reached several thousand dollars a month — about USD 40 per hour in 2016 for a caregiver whose duties were limited to basic assistance. Soon after, she had to move back to a hospice facility.

See Also: Senior Care in Japan: Costs, Choices, and What Foreigners Should Know

2. Long-Term Senior Care at Home: Japan’s Universal System

Japan introduced LTCI in 2000. It’s mandatory for everyone age 40 and above — meaning you automatically contribute and qualify once you reach 65.

a.How it works under Long-Term Care Insurance (LTCI)

Assessment: You apply at your city office for an evaluation (要介護認定). A care manager visits, interviews, and assesses physical and mental ability. Care Level: There are 7 levels in total:

Support level 1-2 (要支援1–2)

Care level 1-5 (要介護1–5)

Each level determines the monthly service limit covered by insurance. See the actual level chart and more detail -> Senior Care in Japan: Costs, Choices, and What Foreigners Should Know

Then, a care manager drafts a plan with your and you family.

(Example for senior care level 1)

Daily helper visits (cleaning, shopping, and garbage disposal)

Nurse visits (once a month, yet available for emergency call 24/7)

Doctor check-ins,

Equipment rental (bed, walker, potty, handrails)

b.Cost:

You pay 10–30% of total service costs, depending on income.

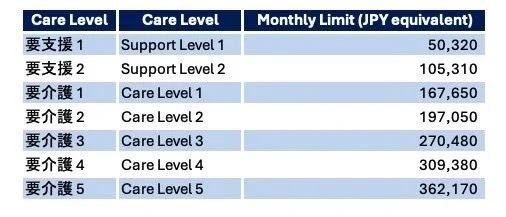

Monthly Benefit Limit for In-Home Care Services (As of November 13, 2025)

Within the benefit limit, 70–90% of the cost is covered by insurance, and you pay 10–30% out of pocket.

Any amount exceeding the limit must be paid in full by the user.

The excess portion (the 100% self-pay amount) is not eligible for reimbursement under the High-Cost Long-Term Care Benefit explained in Section 3.

c. LTCI Cost Simulation Tool

This tool is available only in Japanese, but it’s very convenient for checking both estimated costs and the types of services you can receive.

https://www.kaigokensaku.mhlw.go.jp/?action_kouhyou_simulation_index=true

🧩Real story:

My ex-boss’s father refused to move into a facility and chose to stay in his home in the countryside. Once his care level was approved, the local team delivered a hospital bed, an electric reclining chair, a walker, and a toilet chair the same day. A helper visited daily, and a nurse came once a month — with 24-hour emergency phone support available. The total out-of-pocket expense was less than JPY 50,000 per month + Dinner delivery cost about JPY 500 per meal.

By contrast, in the U.S., my friend’s mother also refused to move into a facility and instead lived with her daughter. Nurse visits were too costly, and insurance didn’t cover home help. Without long-term care insurance, the system effectively stops at family responsibility.

3. Financial Relief Programs Many Don’t Know (and Foreign Residents Can Use)

Even in Japan, costs can add up — for equipment, meals, and supplemental care.

Fortunately, two little-known programs can ease the burden.

🟢 a.High-Cost Long-Term Care Benefit (高額介護サービス費)

If your total monthly out-of-pocket expenses for long term care services (excluding certain costs such as welfare equipment purchases, meals, and housing fees) exceed the income-based limit, the excess amount will be reimbursed through Long-Term Care Insurance.

For example:

Recipients of Old-Age Welfare Pension (non-taxable household): JPY 24,600 per month per household, or JPY 15,000 per person.

Households with taxable income under JPY 3.8 million: JPY 44,400 per month per household.

You can apply at your city or ward office after paying your monthly bills, and the reimbursement will be issued later.

🟢 b.Combined Medical & Long-Term Care Benefit (高額医療・高額介護合算制度)

If a household faces both high medical and long-term care expenses in the same year, the total out-of-pocket limit is capped based on income.

For example:

Upper-income households (~JPY11.6M annual income): max JPY2.12M per year

Low-income pensioners: about JPY190,000 per year

These programs are available to all residents enrolled in Japan’s national health insurance or employee insurance, including foreigners with valid residence status. Ask your local city office or insurer about forms and thresholds.

🟢 c.Special Long-Term Care Facility Benefit (特定入所者介護サービス費 / Supplementary Benefit)

For residents of long-term care facilities whose income and assets fall below a certain threshold, the portion of room and meal costs that exceeds the standard limit is covered by Long-Term Care Insurance.

To use this benefit, you must first apply for a “Certificate of Reduction of User Burden Limits (負担限度額認定証)”at your city or ward office.

🟢 d. High-Cost Medical Expense Benefit (高額療養費制度)

Under Japan’s health insurance system, if your monthly medical expenses exceed a certain income/age-based threshold, the amount beyond that limit will be reimbursed. This applies to hospitalization, outpatient care, and home-visit medical treatment covered by National Health Insurance or Employee Health Insurance. If you reach the maximum payment limit three times within a 12-month period, from the fourth time onward you will be classified as a “frequent user” (多数回該当), and your maximum out-of-pocket limit will be reduced.

To use this program, apply at your city office or health insurance provider. Many hospitals also offer a direct payment reduction system, where you pay only your capped amount upfront, and insurance covers the rest automatically.

4. Family Care Leave: If You’re Still Working

Japan’s Family Care Leave (介護休業・介護休暇) system lets employees take:

Family care leave: Up to 93 days of long-term care leave (can be divided into periods), and

Family care day off: Up to 5 days per year of short-term family care leave

*paid or unpaid depending on company rules。

If you’re on payroll and insured under employment insurance, you may receive a partial wage subsidy (介護休業給付金) from Hello Work.

This helps working family members manage temporary stays or hospital transitions. Still, many companies are only starting to normalize flexible caregiving — Consult with you your HR or the labor bureau if you work in Japan.

Balancing Compassion and Real Life

For many cross-border families, the hardest part isn’t paperwork — it’s distance and guilt. One of my friends spent years flying between Chicago and Japan every month to care for her mother who remained at home until the end.

See also:

Paid and Unpaid Leave in Japan, Vol.2 – Make the Best Use of It

Paid and Unpaid Leave in Japan, Vol. 1 – Make the Best Use of It

5. For Foreign Residents: What You Should Know

A few practical points to keep in mind when using Japan’s Long-Term Care Insurance (LTCI):

To qualify, your family member who will receive care must:

Have an official residence registration (住民票). Tourists and people on short-term visas are not eligible.

Have lived in Japan for more than three months.

Be enrolled in either National Health Insurance or Employee Health Insurance. (After age 40, LTCI premiums are automatically included in your health insurance.)

Be at least 40 years old and, if under 65, be officially certified as having a specified disease (特定疾患) such as terminal cancer or certain chronic conditions.

Language: Care managers and nurses rarely speak fluent English, so you may need an interpreter or bilingual family member during the initial care planning meeting.

Practical Planning Tips

Start early: Even mild cognitive decline or mobility issues can qualify for support. The application process usually takes one to two months.

Talk to your doctor first: A physician’s report (主治医意見書) is required for the long-term care assessment.

Use your local Care Support Center (地域包括支援センター): These centers are free and can explain the system in plain language.

Keep medical receipts: They’re needed for high-cost benefit claims and income tax return.

Coordinate across borders: If you live overseas but manage care for parents in Japan, appoint a proxy or work with a care manager who can update you regularly via email or LINE.

English-Speaking Services for Home Care (private)

Poppins Corporation: Senior support; bilingual staff in Tokyo/Osaka. Home palliative add-ons available

6. Q&A

Q1. What happens to my LTCI coverage if I leave Japan temporarily?

A1. If you move abroad or give up your residence registration (住民票), your LTCI coverage automatically ends because it is tied to your residency status and health insurance enrollment in Japan.

When you return and re-register as a resident, you can re-enroll in National Health Insurance or Employee Health Insurance, and your LTCI eligibility will restart. However, you’ll need to apply for care certification again, since previous care-level assessments are not carried over once you leave the system.

Q2. How do health insurance and long-term care insurance (LTCI) differ in home medical and care visits?

A2. In Japan’s in-home care system, health insurance and long-term care insurance (LTCI) cover different types of services.

Under health insurance, doctors and nurses provide medical treatment and ongoing care for patients who find it difficult to visit a hospital. This includes regular or emergency home visits, prescriptions, medical procedures, and management such as home oxygen or IV nutrition.

Under LTCI, doctors and care managers focus on health monitoring and guidance through programs such as home medical management guidance (居宅療養管理指導). Nursing or helper visits usually occur at a limited frequency within the insurance benefit limit.

By contrast, health insurance allows visits as often as needed — even daily or multiple times a day — when directed by a physician. For terminal cancer patients or those at high risk of sudden changes, health insurance generally provides more comprehensive medical support.

In many cases, it’s possible to combine both health insurance and LTCI, depending on the medical condition and the type of service required.

However, visit frequency and available services can vary by region and care provider, so it’s best to confirm details with your doctor or local Community Support Center (地域包括支援センター).

Q3. As for senior care, can I combine in-home care and day-care services under LTCI?

A3. Yes. You can combine different types of services — for example, receive home-helper visits during the week and attend a day-care program (通所介護) several times a month. As long as the total cost stays within your monthly benefit limit, the combination is flexible and tailored to your care plan. However, any amount exceeding the benefit limit must be paid out of pocket.

Q4. How are LTCI payments handled — do I pay first and get reimbursed later?

A4. Usually, no prepayment is required. Service providers bill your portion (10–30%) directly, and the government pays the remaining 70–90% to them. You only receive separate invoices if you use private or non-covered services beyond the insurance scope.

If you exceed the monthly benefit limit under long-term care insurance, you must decide how to allocate the excess costs among the services you use. This allocation is not determined automatically — in principle, it is assessed and coordinated by your care manager, who assigns the excess amount to each service provider as appropriate.

Q5. Can LTCI expenses be claimed as a tax deduction in Japan?

A5. Yes. The portion you pay out of pocket for certified LTCI services may be included in your medical expense deduction (医療費控除) on your annual tax return. Keep all receipts issued by care providers for tax filing.

Q6. Can a foreign caregiver or family member provide care under LTCI and get compensated?

A6. No. LTCI only covers certified Japanese service providers registered under the system. Family members — Japanese or foreign — are not paid for caregiving. However, families can still receive professional support such as respite care, helper visits, and care-manager coordination to reduce the personal burden.

7Wrap-Up: Why Japan’s Home Care Model Matters

Japan’s aging population has driven the country to develop a structured, affordable system of in-home care. The Ministry of Health, Labor and Welfare (MHLW) also encourages in-home care, not only because people feel more comfortable in familiar surroundings, but also to allow medical facilities to focus on active treatment.

For foreigners living in Japan, understanding this system early can prevent significant emotional and financial strain later on. When someone in your family faces illness or aging, knowing these options can turn fear into a plan — one where compassion and practical support can truly coexist at home. Have you ever experienced this situation or worked with a care manager to adjust your service plan?

We’d love to hear your thoughts or questions in the comments below!

References

MHLW – Overview of the Long-Term Care Insurance System (in Japanese)