Is Working in Japan Worth It? Comparing Salaries, Taxes, Daily Costs and Culture

For many professionals, Japan represents a mix of fascination and practicality — a country where trains run on time, streets are spotless, and stability still feels possible. But when a job offer lands on your desk, the question becomes sharper:

Is working in Japan actually worth it — financially and personally — compared to staying in the U.S.?

To answer that, let’s look at what life really costs in Tokyo vs. Chicago suburb, including salary norms, taxes, healthcare, currency, and work culture. The results might surprise you.

This blog covers:

1. Salary Reality: Lower Numbers, Different Logic

2. Taxes and Take-Home Pay

3. Healthcare: Japan’s Invisible Raise

4. Cost of Living: Tokyo Efficiency vs. Chicago Space

5. Housing: Upfront Pain, Long-Term Stability

6. Currency and FX: The 2025 Yen Effect

7. Work Culture: Stability vs. Autonomy

8. Hidden Income points

9. Japan’s New Value: Still #4

10. Q&A

11. Wrap up

1. Salary Reality: Lower Numbers, Different Logic

At first glance, Japanese salaries appear modest by Western standards. Japan's own National Tax Agency (NTA) Private Salary Survey—for full-time employees, excluding included part-time employees—reports a national average annual income (salary and bonuses) of JPY5.4 million (about USD36K at JPY150/USD) in 2024.

Average annual income:

for men: JPY5.87 million

for women: JPY3.33 million — about JPY2.5 million less than men.

par-time employees: JPY2.06 million — a gap of more than JPY3 million.

By industry:

Electricity, gas, heat, and water supply: JPY8.32 million

Finance and insurance: JPY7.02 million

Information and communications: JPY6.60 million

Accommodation and dining services: JPY2.79 million

These numbers show not only a gender gap but also significant variation by industry and employment type.

According to the OECD’s 2024 Average Annual Wages report (for full-time employees), Japan’s national average annual wage is about USD 49,446 (roughly JPY 7.4 million at JPY150/USD). In terms of ranking, this places Japan around 26th among OECD countries (well below the OECD average of about USD 61,147).

NOTE: Because the OECD uses a macroeconomic, hours-adjusted calculation and the NTA uses individual-level payroll data, the OECD figure (USD 49,446) appears higher than the NTA’s average for full-time employees (JPY 5.4 million ≈ USD 36,000).

See also:

Behind Japan’s Salary System: Why Pay Works Differently

What Does It Mean to Be Wealthy in Japan vs. the U.S.?

Pay Structure and Stability

Japanese companies still lean toward seniority-based pay (年功序列) and twice-a-year bonuses (賞与), often worth 3–6 months of salary combined. Raises are gradual, but employment tends to be stable and layoffs difficult for employers.

In the U.S., pay is more performance-driven — faster growth, but also faster turnover. That USD90K Chicago job could vanish with a reorg; the JPY8M Tokyo role may last 15 years —with only modest raises along the way.

In Japan, long-term employment is part of the social contract. You trade upside for predictability. The government, however, is increasingly aware of the country’s chronically slow wage growth.

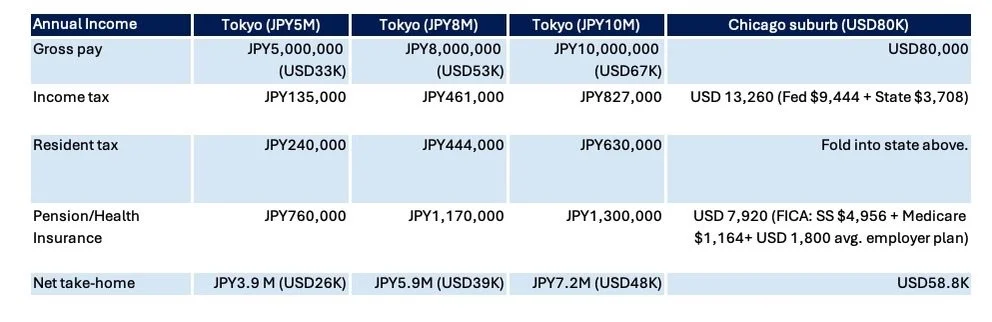

2. Taxes and Take-Home Pay

Japan’s income tax looks high on paper (up to 45%), but most residents fall in the 20–23% national range, plus about 10% local “residence tax.” Add social insurance (health, pension, unemployment), roughly another 15%.

A simplified example:

Note: The figures shown for both Japan and the U.S. are simplified estimates for comparison purposes. In Japan, tax and social insurance calculations include various deductions and credits, so the total percentages shown do not add up directly to the taxable amount. Exemptions for dependents, insurance, housing, and other items are not reflected in the chart.

In the U.S., the amounts shown represent typical statutory rates and average employee contributions. Actual take-home pay can vary depending on personal deductions (such as 401(k) contributions, health savings accounts, or dependents) and the type of employer-sponsored health plan.

See also: Japan Tax Returns for Employees in 2026: Filing Rules, Refunds, and Deadlines

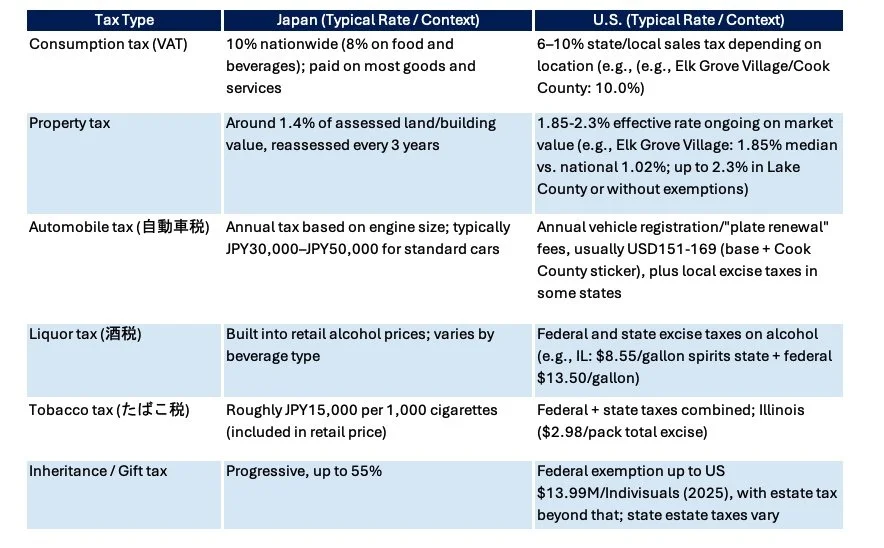

Other Major Taxes: Japan vs. the U.S./Illinois

3. Health Insurance: Japan’s Invisible Raise

Japan’s health insurance covers almost everything — doctor visits, hospitalization, childbirth, even dental and vision — at 30% co-pay. Employer plans cover employees and dependents automatically; National Health Insurance covers individuals.

A Tokyo resident might pay JPY30,000–59,000/month in health premiums. Compare that with USD500–800/month out-of-pocket premiums in Chicago, plus co-insurance.

Notably, Japan has no medical bankruptcy, low prescription prices, and world-class hospitals including the long-term care. Routine checkups are encouraged.

See also:

In-Home Care in Japan: From Critical Illness to Senior Support

Senior Care in Japan: Costs, Choices, and What Foreigners Should Know

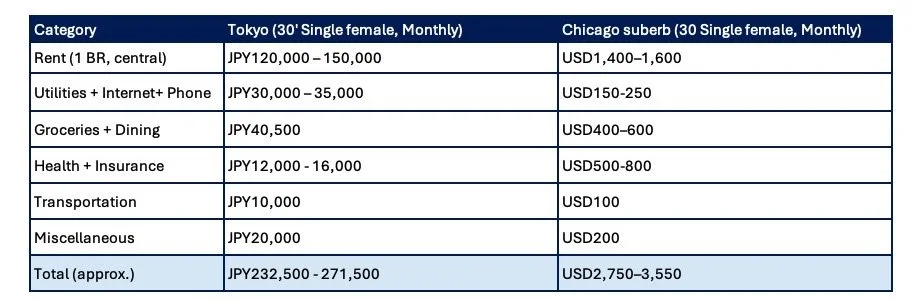

4. Cost of Living: Tokyo Efficiency vs. Chicago Space

Tokyo is often called expensive, but daily life tells a different story.

Single person living in the Tokyo area vs. single person living in the Chicago suburban area

Actual costs vary depending on factors such as rent, groceries, and personal spending on items like clothing or cosmetics, so the chart above is only an example.

NOTE: Bare-bones (USD2,200/mo) or luxury (USD4,000/mo) in Chicago suburbs. 2024 inflation edged higher in the US (2.9% YoY per BLS) than Japan (2.7% per Statistics Bureau). While Japan’s prices have risen modestly in recent years—especially for imported food and utilities—its inflation remains relatively stable. In contrast, U.S. households continue to feel stronger inflation pressure, particularly in housing, groceries, and services.

5. Housing: Upfront Pain, Long-Term Stability

Renting in Japan often requires key money (礼金) and a deposit (敷金) — sometimes totaling three months’ rent upfront — plus guarantor fees. It’s painful at first, but once you move in, ongoing costs are usually stable. Whenever possible, look for properties that don’t require key money or a large deposit.

Apartments in Japan are typically smaller. Most are unfurnished, so tenants usually need to buy their own washing machine, refrigerator, microwave, and air conditioner/heater.

🏡 Once you settle in, Tokyo housing tends to be a steady expense — not a rising liability.

By contrast, renting in Chicago is simpler—usually just a security deposit and the first month’s rent.

See also: [Troubleshooting Renting a Home in Japan: With Freebie Forms]

🧩 Real Story

One thing I’ve noticed is that in the U.S., many people don’t mind—or even prefer—older houses with character. As a result, depreciation isn’t as steep, and real estate may still serve as an investment.

In Japan, the opposite is true: the moment you buy a house or apartment, the value typically drops. Buyers prefer new models with modern layouts and updated equipment. The only consistent exception is location—especially proximity to major train stations or popular school districts.

At the end of the day, property prices in both countries ultimately come down to supply and demand—but the perception of “value” is shaped very differently.

6. Currency and FX: The 2025 Yen Effect

As of November 17,2025, the yen remains historically weak around JPY154.59 per USD. For foreigners paid in dollars or euros, Japan feels like a bargain. But if you earn in yen and send money home, that same weakness hurts.

💱 Exchange rate swings can add or erase of your real income — plan accordingly.

7. Work Culture: Stability vs. Autonomy

Japan’s Rhythm

Japan’s workplaces are built on collective trust and long-term stability. People who succeed here often share certain traits — or learn to develop them over time:

Absorb more and react less. Listening and observing before responding builds credibility.

Be observant and adaptable. Understanding subtle cues and social expectations (“reading the air,” or kuuki wo yomu) goes a long way.

Show a willingness to learn Japanese. Even limited effort demonstrates respect and opens communication.

Be patient with growth. Salary increases and career advancement are slow but steady.

Pursue perfection with humility. The Japanese drive for precision and craftsmanship (takumi) rewards those who care deeply about quality.

Value focus. Many thrive in calm, concentrated environments with minimal interruption.

These characteristics favor professionals who value stability, process, and consistency — people who find satisfaction in steady improvement rather than rapid disruption.

Chicago’s Rhythm

In Chicago — and much of the U.S. — the workplace rhythm emphasizes individual achievement and autonomy. Success often favors those who:

Have a strong personality. Assertive, extroverted, sociable, and confident individuals stand out.

Exercise discretion. Decision-making freedom is valued more than following procedure.

Enjoy flexible work environments. Remote work, role changes, or side projects are normal.

Pursue visibility and reward. Many aim to be “star employees” and link success directly to compensation.

Adapt quickly to change. Shifts in leadership or direction are expected, not feared.

Seek rapid career growth. Frequent job changes are often seen as ambition, not instability.

This rhythm rewards initiative, independence, and personal branding, traits that align with a fast-moving, competitive labor market.

Finding Your Fit

Ultimately, neither rhythm is better — they simply reflect different priorities.

Japan values belonging and endurance; Chicago values initiative and reinvention.

Those who can move fluidly between both mindsets — patient yet proactive, humble yet confident — often find the most sustainable success across cultures.

8. Hidden Income points

Besides salary and health insurance, Japanese employees enjoy a range of structured benefits and indirect advantages that quietly add to real income value. Many of these are built into the system, not negotiated individually.

💼 Employment & Lifestyle Benefits

More public holidays: Japan offers 16 national holidays, and many companies add paid year-end and summer breaks, totaling about 120–125 days off annually—far more than the U.S. average.

Overtime pay (OT): Most employees receive legally mandated overtime pay. Only senior managers are exempt, and even then, they’re compensated for late-night overtime (10 p.m.–5 a.m.).

Medical cost cap: Under the High-Cost Medical Expense Benefit system, once monthly out-of-pocket spending exceeds a certain limit (usually JPY80,000–90,000 depending on income), the rest is reimbursed.

Senior-care cost relief: Japan’s Long-Term Care Insurance supports eldercare for residents over 40, covering a large share of services at home or in facilities.

On-time public transportation: Reliable trains and buses reduce the need for car ownership—no commuting stress, no fuel or parking costs, and time is predictable.

🌏 Environmental & Social Stability

Low personal risk: Theft, violent crime, and medical bankruptcy are rare, which indirectly saves both money and anxiety.

Natural-disaster readiness: While Japan faces earthquakes, typhoons, and tsunamis, building codes and emergency infrastructure are among the most advanced in the world. Employers often include disaster-preparedness training and evacuation support.

9. Japan’s New Value: Still #4

Japan ranks #4 globally in GDP, at approximately USD 4.1 trillion (2024) — but for expats, its edge endures. Even as Asia’s corporate hubs shift toward Singapore, Tokyo continues to attract professionals for the intangibles — quality, reliability, and quiet ambition.

So what, then, is Japan’s continued value for foreign professionals and companies?

💡 What Japan Still Offers

Highly disciplined workforce:

Employees in Japan are known for their strong work ethic, attention to detail, and pride in craftsmanship (monozukuri). For companies seeking quality over speed, this cultural DNA remains a powerful asset.Global reputation for trust and integrity:

Japanese partners tend to value long-term relationships and consistency. For foreign businesses, trust built in Japan often extends beyond borders—it’s a credential that carries weight across Asia.Excellent and affordable medical system:

Japan’s national healthcare system provides universal access with world-class quality and low out-of-pocket costs—a major advantage for both employees and families.Reliable infrastructure:

From transportation and logistics to utilities and technology, Japan’s infrastructure works with extraordinary precision. Trains run on time, internet connections are stable, and energy reliability supports smooth business continuity.

10.Q&A

Q1. Is Japan good for entrepreneurs?

A1. It’s improving but still challenging. Visa options such as the Business Manager Visa or Startup Visa allow foreign entrepreneurs to establish operations, but bureaucracy, language barriers, and high initial costs can be hurdles.

According to Japan’s Ministry of Finance, the effective corporate tax rate is 29.74%, which is higher than in countries like Singapore or the U.S. However, this revenue supports Japan’s robust infrastructure, comprehensive social security system, and strong disaster preparedness—all factors that contribute to a stable and trustworthy business environment once you’re set up.

Q2. How about work–life balance in Japan today?

A2. It’s changing. Government reforms and younger generations are pushing companies to reduce overtime and promote flexibility. Still, many traditional firms remain conservative, while mid-sized and foreign-capital companies tend to have more progressive policies and modern work practices.

See also: Overtime in Japan: What’s Legal, What’s Not, and How to Protect Yourself

Q3. Is it possible to bring family or dependents on a work visa?

A3. Yes. Work visa holders can sponsor dependents (spouse and children) under a Dependent Visa. However, spouses on dependent status generally can’t work full-time without special permission (shikakugai katsudō kyoka).

Q4. How do foreigners handle retirement savings in Japan?

A4. Foreign employees enrolled in Japan’s pension system for at least six months can claim a partial refund (lump-sum withdrawal payment) after leaving Japan. Those staying long-term benefit from reciprocal agreements with many countries (including the U.S.) to avoid double taxation.

In addition, about 44.7% of Japanese companies now offer corporate pension plans similar to a 401(k), providing extra savings options for employees. In addition, iDeCo and NISA programs are also available for individual retirement and investment planning.

Q5. Is Japan still worth moving to for career growth?

A5. Working abroad always offers tremendous learning opportunities—new perspectives, networks, and challenges that expand your global mindset. Japan may not fit everyone, but professionals who enjoy deep analysis, continuous improvement, and cultural nuance often find it a rewarding place to build a career. Those who can adapt with patience, curiosity, and respect for local values tend to thrive here.

11.Wrap up

The motivation to work or study abroad varies for everyone. When I accepted a job in the U.S., the salary was almost half of what I earned in Japan — yet I still took it. Why? Because working in the U.S. was my dream come true. And, as it turned out, compensation follows you once you prove yourself. Back then, my only luxury was treating myself to a bag of boiled shrimp from Walmart every Friday — and honestly, I was so happy.

I have no regrets. The experience of working in a different culture, navigating challenges, and watching myself grow was priceless. It not only broadened my worldview but also strengthened my career when I returned to Japan.

🌏 How about you?

Have you ever worked or dreamed of working abroad — maybe in Japan?

Share your thoughts and experiences in the comments below — I’d love to hear your story.

Referral

Japan Labor & Wages Statistics (e-Stat)

U.S. Federal Tax Rate Tables – IRS Revenue Procedure

Illinois State Income Tax Rates (Tax Authority)

U.S. Social Security Tax Rates (SSA)