Japan's Risk-Averse Banking System: Why It's Tough for Foreigners—and How to Navigate It Rationally

When I first began helping my husband navigate banking in Japan, I was genuinely surprised by how difficult it was.

This article is not about fairness, and it is not a complaint.

It's about clearly understanding why Japan's banking system operates with such caution toward foreigners, and how you can make rational, resilient financial decisions in your cross-border life here.

This blog covers:

1. The Real Reasons Japanese Banks Make It Hard for Foreigners

2. What This Means in Everyday Life

2-1. Open a bank account

2-2. Obtain a credit card

2-3. Borrowing

2-4. Money transfer

3. When Japanese Banking Is the Wrong Anchor

4. Q&A

5. Wrap up

1. The Real Reasons Japanese Banks Make It Hard for Foreigners (It's Not Personal)

For many foreign residents, banking in Japan can feel arbitrary or even personal—applications are rejected without clear explanations, and requirements seem to vary by branch.

In reality, this experience reflects how Japan’s financial system is designed, particularly its strong emphasis on risk-based compliance.

A. The Risk-Based Approach to Compliance

Japanese banks operate under extremely conservative compliance rules. Under the risk-based approach, financial institutions are required to:

Identify and assess their own risks related to anti money laundering (AML) and terrorist financing (CFT).

Classify customers and transactions based on perceived risk levels

Apply controls and monitoring measures that are proportionate to those risks

Ensure that overall risk exposure remains within the institution’s acceptable tolerance

In practical terms, this means banks are not simply checking whether documents are complete. They are continuously evaluating how costly, complex, and risky it is to maintain a given customer relationship.

Foreign residents can be high risk—not necessarily because of individual behavior, but because of structural factors such as:

Overseas financial connections

International money transfers

Time-limited residency status

Language barriers that complicate verification and communication

Understanding this framework helps explain why outcomes can feel impersonal or opaque.

B. Visa Status as a Credit Proxy

In Japan, visa type and remaining period of stay are treated as core credit indicators.

Even when someone has stable employment and sufficient income, a time-limited visa creates uncertainty around repayment horizons. From a risk-modeling standpoint, this uncertainty is difficult to quantify—and banks tend to avoid what they cannot easily model.

As a result, many non-permanent residents are screened out before income or assets are even considered.

C. Domestic-Only Credit History System

Japan’s credit system is largely closed and domestic. Overseas credit histories—no matter how strong—are essentially invisible.

This means that someone with decades of excellent credit abroad may be treated the same as someone with no history at all. Credit cards, installment payments, and loans are evaluated almost entirely on domestic records.

This gap alone explains many otherwise puzzling rejections.

D. Language as a Risk Filter

Language is not just a communication issue—it is a liability issue.

Banks are responsible for ensuring customers understand contracts, disclosures, and obligations. When full comprehension cannot be assured, institutions perceive higher legal and reputational risk.

In practice, this means Japanese language ability can directly affect outcomes, regardless of visa type or income level. For the last few years, some banks in Japan have decided to stop the English support. (e.g. Sony bank, Shinsei bank)

E. Lack of Financial Intermediation and Social Capital

Many Japanese consumers rely—often unconsciously—on social capital: introductions, guarantors, employer support, or a spouse with an established financial record.

Foreign residents are more likely to lack these informal buffers. The absence of someone who can “vouch” for you—socially or institutionally—amplifies perceived risk.

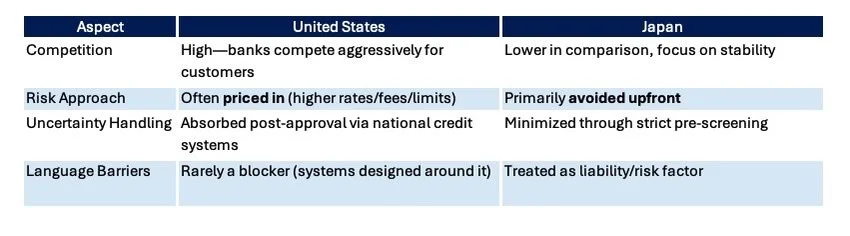

Sidebar: Why Banking Feels So Easy in the U.S. (Compared to Japan)

When I experienced U.S. banking firsthand, everything felt effortless. Here's the core reason why it differs so much from Japan:

2.What This Means in Everyday Life

These barriers show up in four key areas.

2-1. Opening a Bank Account

Two Japanese Banks That Still Make Sense.

Japan Post Bank (Yucho)

Japan Post Bank is often the most accessible option for foreign residents.

You can apply to open an account using your residence card and a smartphone.

Your period of stay must be valid for more than 3 months, and the address on your residence card must be current.

The Operations Support Center will review your application, and confirmation is usually sent by email within about 1 week. Processing may take longer during busy periods.

Japan Post Bank is not suitable for borrowing or sophisticated international finance, but as a baseline account for daily living, it is reliable and practical.

SMBC (Sumitomo Mitsui Banking Corporation)

SMBC is one of the more foreigner-friendly mega banks.

App-based and online account opening is possible, though the process is in Japanese.

U.S. taxpayers are still required to visit a branch in person.

Long-term usability improves once residency becomes more stable.

Citibank exited the Japanese retail banking market in 2015, and its retail operations were taken over by SMBC Trust Bank (Prestia). As a result, many long-time foreign residents transitioned to Prestia or other SMBC-related services, shaping SMBC’s continued role as a practical banking option for non-Japanese residents.

Personal Perspective

Banking with Japan’s mega banks can be challenging for foreign residents. Even when an account is approved, applications and online banking are often Japanese-only, which can be a significant hurdle for non-Japanese speakers.

What to Decide at Account Opening

Rather than asking, “Which bank is best?”, more useful questions are:

Which income flows must pass through Japan?

What level of domestic credit do I realistically need?

Where should emergency liquidity live?

How stable is my visa horizon?

Am I optimizing for convenience—or for resilience?

There is no universally correct answer.

But there is a wrong one: assuming the system will adapt to you.

2-2. Obtaining a Credit Card

For many foreign residents, obtaining a Japanese credit card is another major hurdle—and often the most confusing one.

Approval criteria typically include:

Domestic credit history

Visa type and remaining period of stay

Employment stability

Japanese language ability

Overseas credit history is generally not considered. Even applicants with stable income and strong repayment records abroad may be treated as first-time borrowers in Japan.

When approval does come, it often starts with:

Low credit limits

Conservative usage monitoring

Limited flexibility

This is not a reflection of personal reliability. It is how risk is managed in a system that prioritizes predictability and domestic track records. For this reason, many foreign residents choose to keep a credit card from their home country as a practical backup.

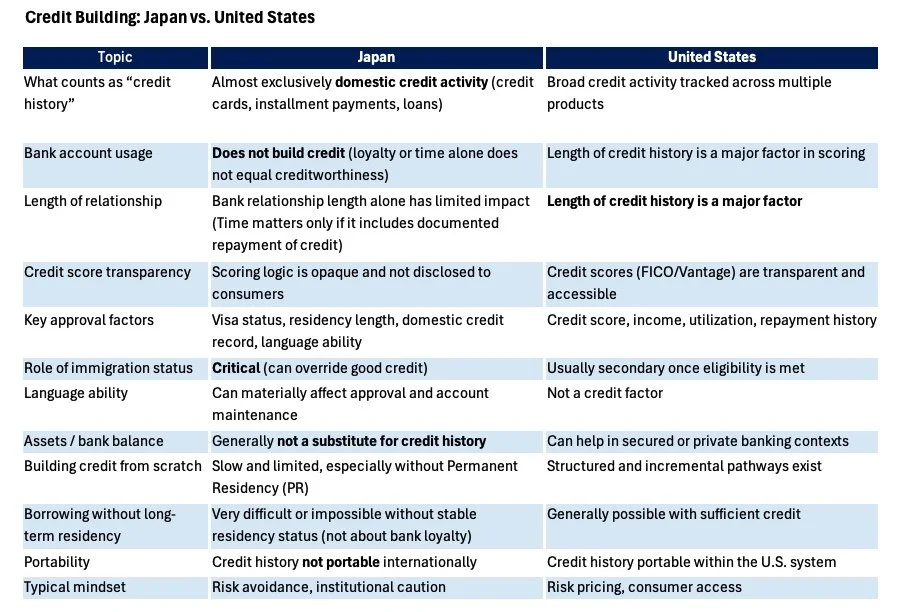

Here's a quick comparison to illustrate how “credit” is defined and built.

2-3. Borrowing: The Invisible Wall Most People Don’t See Coming

The challenges become most visible when borrowing enters the picture.

For many non-permanent residents, access to the following types of loans is often limited or difficult, even with stable income:

Housing loans

Education loans

Car loans

Business loans for startups and early-stage companies

In practice, approval depends heavily on residency stability and predictability. Without long-term status, banks are generally cautious about committing to multi-year lending, regardless of current earnings or professional background.

For example, at SBI Shinsei Bank, applicants without permanent residency are required to have a spouse with Japanese nationality or permanent residency act as a joint guarantor when applying for a home loan. In such cases, the bank assesses not only the applicant’s repayment capacity, but also that of the guarantor as part of the credit review.

In practice, what happens instead is revealing:

People rely on high-interest card loans for short-term cash flow

They borrow informally through personal, community, or ethnic networks

They depend heavily on funds from overseas accounts

This pattern is not accidental. It is the predictable outcome of a system that struggles to accommodate time-limited residency. When repayment horizons are uncertain, lending institutions tend to avoid long-term commitments altogether.

Understanding this reality early helps prevent frustration—and more importantly, helps avoid risky financial decisions made under pressure.

Business Loans for Startups: A Structural Mismatch

When business financing enters the picture, the gap can feel even wider for foreign residents.

In Japan, banks have traditionally been the main gateway to funding, even for relatively small or young businesses. This means financing decisions tend to emphasize stability, clear repayment plans, and, in some cases, personal guarantees. Venture capital is becoming more common in Japan, especially in recent years, but bank financing still plays a larger role than it does in the United States.

In contrast, U.S. startups often turn first to angel investors who focus on future growth, with banks becoming involved later once revenues are stable.

For those unfamiliar with this difference, the system can feel restrictive. In reality, it reflects a structural difference in how business risk is financed, rather than a lack of support for entrepreneurship.

2-4. Money Transfers

International money transfers are another area where foreign residents often encounter friction.

Compared to domestic transfers, overseas remittances typically involve:

More detailed explanations of purpose

Additional documentation requests

Longer processing times

Higher fees

These controls reflect the same risk-based compliance framework discussed earlier. From a practical standpoint, this is why having a clear FX and cash-flow strategy—rather than relying on ad-hoc transfers—becomes important for foreign residents living in Japan.

👉 Related guide: Living Between Currencies: What We’ve Learned About Social Security, Credit Cards, and FX in Japan

3.When Japanese Banking Is the Wrong Anchor

Depending on your situation, banking choices vary. The following is a quick check-tree.

It doesn’t capture whole story, but for your reference.

Should You Rely on Japanese Banking or Home-Country Banking?

START

⬇️

Do you have Japanese permanent residency or Japanese nationality?

YES → Go to A

NO → Go to B

A. Is your long-term life clearly centered in Japan?

(Housing, retirement, family, long-term employment)

YES

👉 Japan-based banking can be your primary systemBuild domestic credit gradually

Consider Japanese mortgages and long-term loans

Keep home-country accounts as backup

NO / NOT SURE

👉 Hybrid strategy recommendedHome-country banking = financial anchor

Japanese banks = daily transactions only

Avoid relying on Japanese credit for resilience

B. Is your visa horizon predictable for 5+ years?

NO

👉 Home-country banking should be your financial anchorKeep liquidity and borrowing overseas

Japanese banks for salary, rent, utilities only

Do not depend on Japanese credit

YES → Go to C

C. Do you already have Japanese credit history?

(Credit card or installment payments, no issues)

NO

👉 Expect limited Japanese credit accessFocus on overseas liquidity

Treat Japanese banking as transactional

YES → Go to D

D. Do you need borrowing for major life expenses in Japan?

(Housing, education, long-term care)

YES

👉 Reality check requiredWithout Permanent Residency (PR), approval odds are low

Terms may be restrictive or expensive

Overseas funding + FX may be more realistic

NO

👉 Transaction-only Japanese banking is sufficient

A Practical Strategy for Foreign Residents: Where to Anchor Your Finances

For many foreign residents, the most rational approach is counterintuitive—especially for those from countries with well-developed credit systems, such as the United States.

Keep core liquidity and credit access in your home-country financial institutions

Use Japanese banks where local functionality is unavoidable

Manage foreign exchange transfers deliberately and strategically

Home-country banks recognize your existing credit history, allow borrowing when needed, and provide continuity regardless of visa status. This stability can matter more than marginal tax efficiency.

Foreign exchange gains may be taxable in Japan. That is a real consideration.

But taxation should be weighed against liquidity risk and financial resilience, not treated in isolation.

4.Q&A

Q1. Does being married to a Japanese national automatically improve my banking situation?

A1. Being married to a Japanese national often helps in practical ways, particularly with administrative processes, long-term residency, and access to guarantor arrangements. However, Japan does not offer joint bank accounts, and credit and loan decisions are still assessed on an individual basis, taking into account residency status, income, and domestic credit history.

Q2. Can my employer help me open a bank account or get credit?

A2. Often, yes—at least for opening a bank account. Because employers usually need a bank account to pay salary, many will assist with account opening or provide confirmation documents, unless you have explicitly agreed to be paid in cash. However, this support generally helps only with basic account setup and does not override credit screening or residency requirements for loans or credit cards.

Q3. Is cash usage in Japan a workaround for banking limitations?

A3. Cash usage can reduce short-term friction, but it is not a solution. Many essential services—housing, mobile phones, online payments—still require bank accounts or credit cards, making full reliance on cash impractical.

Q4. Are online-only or “neo-banks” easier for foreigners in Japan?

A4. Sometimes, but with limitations. Online banks may simplify account opening, but they often offer restricted services, limited customer support, and conservative policies on international transfers and credit. It’s important to assess how you plan to use the account and for how long, rather than choosing based on convenience alone.

Q5. Will my situation improve automatically if I stay in Japan longer?

A5. Time alone does not guarantee improvement. Progress depends on:

Visa stability

Domestic credit usage

Language ability

Financial behavior

Simply “waiting it out” without building domestic records often leads to disappointment.

Q6. Is this situation changing for the better?

A6. Slowly, yes—but unevenly. Digitalization, labor shortages, and internationalization are pushing some improvements. However, risk-based decision-making remains central, so structural constraints are unlikely to disappear soon.

5.Wrap up

Japan’s banking system is not designed to exclude foreigners intentionally, but regulatory structure and institutional caution can make it feel that way. By understanding the why, choosing the right banks for the right purposes, and being realistic about what the system can—and cannot—do, it becomes much easier to navigate.

The goal is not to “win” Japanese banking. The goal is to remain financially functional, liquid, and resilient. When you design your financial life with that mindset, living in Japan becomes far less stressful.

If you found this article helpful, please consider sharing it with friends, colleagues, or anyone navigating life in Japan as a foreign resident.

And if you have experiences or questions of your own, feel free to leave a comment—your perspective may help others facing the same challenges.

Referrals:

Financial Services Agency: How to Use a Bank Account and Send Money in Japan (Guide for Foreign Residents)

FSA AML/CFT Guidelines (Anti-Money Laundering and Combating the Financing of Terrorism)

Financial Inclusion and Education for Foreign Residents in Japan (2025 Winter Edition)

See also:

Living Between Currencies: What We’ve Learned About Social Security, Credit Cards, and FX in Japan

Japan's Workforce Rebalance: The Mid-Career Foreigner's Strategic Edge