Raising Rich Kids in Japan: Teaching Financial Literacy from Age 6 (2025 Expat Parent Edition)

Japan only introduced structured financial education recently—in elementary schools in 2020, junior high in 2021, and high schools in 2022. Until then, there was almost no systematic approach.

Meanwhile, savings sitting in a 0.2% bank account can’t even keep up with inflation. The Financial Services Agency (FSA) has been pushing people to shift from saving to investing—allowing employers to offer 401(k)-style plans and introducing tools like NISA and iDeCo—but investing still requires real knowledge and experiences.

That’s why teaching kids about money early is one of the most powerful gifts we can give them. It can mean the difference between living paycheck to paycheck, facing financial insecurity, or enjoying a stable, comfortable life with a real safety net.

This blog covers:

Why Japan Still Struggles With Financial Literacy

What Japanese Schools Actually Teach About Money

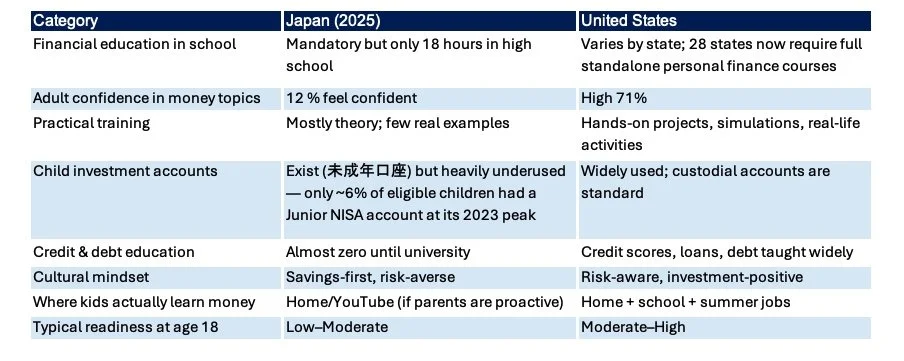

Japan vs. U.S. Financial Literacy — 2025 Comparison Table

The Expat Parent Playbook — Age-by-Age Guide (With Books & Tools)

Setting Up a Minor Investment Account (未成年口座) in Japan

Expectations for the Child NISA (こどもNISA)

Q&A

Warp up

1. Why Japan Still Struggles With Financial Literacy

Japan has a long cultural tradition of valuing:

saving over investing

safety over risk (The survey shows that more than 80% of Japanese women, across all age groups, tend to be strongly loss-averse.)

bank deposits over capital markets

This approach worked well during decades of low inflation and economic stability. But in today’s global, fast-moving economy, it often leaves children (and adults) unprepared to make informed financial decisions.

According to Japan’s 2022 Financial Literacy Survey, only 12% of Japanese adults feel confident in their financial knowledge, compared with 71% in the U.S.

The same survey also shows that Japan’s correct-response rate on basic financial literacy questions is significantly lower than that of other major OECD countries such as the U.K., Germany, and France.

Together, these numbers highlight a simple reality: Japan’s financial education still lags behind other developed nations, and children are not receiving the practical money skills they need for adulthood.

Real story:

In 2004 I clung to Japan’s old ‘safe’ retirement system and feared the new 401(k). Six months later in the U.S. I watched money vanish because I didn’t understand investing. I refuse to let my kids learn that lesson the hard way.

2. What Japanese Schools Actually Teach About Money

Here’s what children actually learn.

🏫 Elementary School (Ages 6–12)

What they learn in Family and Household Studies:

How shopping works and the basic role of consumers

The importance of goods and money, and how to use money in a planned, responsible way

An introduction to the basics of purchase and sales contracts

🏫 Junior High School (Ages 12–15)

What they learn:

How banks and financial systems work

The roles and responsibilities of individuals and companies within the economy

The importance of planning and managing money carefully

How three-party credit contracts (such as credit card arrangements) work

🏫 High School (Ages 15–18)

Japan now includes 18 hours of financial education across three years of high school. The curriculum covers the following areas:

a.Household budgeting and life planning(家計管理とライフプランニング)

Students learn how to manage income, expenses, and savings, and how to plan financially for future goals. They explore what it takes to prepare money for major life events and dreams.

b.How to save and grow money(お金の貯め方・増やし方)

Students study asset building in both basic and advanced modules.

The basic module

interest and interest rates

simple vs. compound interest

how interest rates move

the three criteria of financial products (return, safety, liquidity)

characteristics and risks of major financial products

the relationship between risk and return

The advanced module

long-term investing

dollar-cost averaging (tsumitate)

diversification

c.How to use money wisely(お金の使い方)

Students learn:

the difference between needs and wants

the basics of managing a household budget

the benefits and risks of cashless payments

d.How to prepare and protect yourself financially(お金の備え方)

This section covers both social insurance and private insurance.

Students learn how:

pension, health, and long-term care insurance work

life insurance and non-life insurance protect against risks

They also learn how to combine insurance and savings to prepare for unexpected events.

e.How borrowing and loans work(お金を借りる仕組み)

Students study:

the difference between credit cards and cash advances

how all borrowing is a form of debt

why revolving payments (リボ払い) often lead to high interest costs

Importantly, scholarships are also discussed—how they work, the different types, and the need for planned repayment.

f.How to avoid financial scams and trouble(金融トラブルの防ぎ方)

Students learn about common financial traps and how to respond using civil law, consumer contract law, and the Act on Specified Commercial Transactions.

Examples include:

multi-level marketing schemes

money troubles with friends

peer-to-peer lending through social media

These examples are chosen because they are realistic risks for high school students.

Still Missing from the Curriculum

Despite progress, Japan’s high school financial education still does not teach:

how to open a brokerage account

how index funds work

how to compare investment fees

tax-efficient investing strategies

real long-term compounding scenarios

Japan’s system keeps students safe, but not wealth-ready.

See also: Japanese Education System 101: A Practical Guide for Families and Students

3. Japan vs. U.S. Financial Literacy — 2025 Comparison Table

The U.S. is far from perfect — there is no national standard — but overall, children are exposed to more real-world financial concepts earlier.

Source:

Statistics Bureau Population Estimate

This comparison highlights why many expat parents choose to supplement Japan’s school system with their own financial literacy plan.

4. The Expat Parent Playbook — Age-by-Age Guide (With Books & Tools)

Japan’s curriculum is improving, but there is still a wide gap between what students learn in school and the financial skills they need for real life. This is where parents — especially globally minded expat parents — play an essential role.

To bridge that gap, here is a practical, age-by-age playbook you can use at home to help your child build confidence, literacy, and long-term wealth.

📚Age 6–9: Build Money Awareness (3-Jar System)

Tools to Use

3 jars labeled “Spend,” “Save,” and “Give/Invest/Donate”

Clear jars or acrylic boxes

How it works

Give age-appropriate allowance

Have a 5-minute “Family Money Meeting” weekly

Let them choose how to split their money

Recommended Books (Ages 6–9)

The Opposite of Spoiled (E)

J-FLEC site (J)

FSA (J) – Poopoo Drill/Daily Life Version, Poopoo Drill/Economics Version (Source: Financial Services Agency/FSA + 文響社)

Why this stage matters

Kids don’t need complex math — they need repetition and ownership.

📚Age 10–12: First Investing Experience (Zero-Risk)

Tool to use:

Saving Spree (E) - a kid-friendly app (ages 7+) that teaches the basics of spending, saving, donating, and investing through simple, fun games that show how everyday choices affect their money. Only for iPhone/iPad. USD5.99. See app store.

Knooty Kids (E) – teach your kids the power of investing with Knooty – a safe, educational stock trading app designed for children. Free.

STOCKPOINT for MUFG / STOCKPOINT for CONNECT (Japanese only) free- Kids use Ponta/d-points to “buy” stock points that move exactly like real stock prices. What they learn is how prices rise and fall and what it feels like when an investment drops. As the app is in Japanese, you register with your e-mail address and password, then can share it with your child(ren).

And more such as Life, Monopoly, or Payday.

Recommended Books (Ages 10–12)

I Will Teach You to Be Rich (Young Readers) (E)

The Motley Fool Investment Guide for Teens (E)

Rich Dad Poor Dad for Teens (E)

マンガでスイスイわかる株の学校 (J)

📚Age 13–15: Open a Real Minor Account (未成年口座)

Now it’s time for real money, real accounts. A custodial brokerage account for children that allows parents to manage investments on their behalf.

Too to use:

The Fidelity Youth™ Account gives teens access to a range of tools designed to build financial literacy. Through the Fidelity mobile app, teens can learn how to save, budget, and start investing, supported by a built-in “financial curriculum” that guides them step by step. The account has no minimums, no fees, and no trading commissions, but a parent must already have a Fidelity account to open one.

See more -> 5. Setting Up a Minor Investment Account (未成年口座) in Japan

Recommended Books (Ages 13–15)

The Simple Path to Wealth

A Teen’s Guide to Investing

Rich Dad Poor Dad for Teens (E)

📚Age 16–18: Hand Over the Keys (With Guardrails)

This is the transition to adult-level responsibility.

Your system might look like:

Teen proposes investment ideas

Parent approves trades

Teen prepares an annual “Investment Report”

Skills they learn

Accountability

Risk management

Tracking performance

Evaluating investment decisions

Real financial independence

Teens who manage money before age 18 enter adulthood with unmatched confidence.

Recommended Books (Ages 16–18)

The Simple Path to Wealth (E)

A Teen’s Guide to Investing (E)

お金の常識を知らないまま社会人になってしまった人へ (J)

5. Setting Up a Minor Investment Account (未成年口座) in Japan

What Is a Minor Investment Account?

Minor Investment Account is a brokerage account for children aged 0–17, fully controlled by a parent or legal guardian. You decide what to buy, how much to invest, and how the portfolio grows. When your child reaches adulthood (18 or 20 depending on the brokerage), the account converts into a standard account in their name.

Most brokerages require the following:

Parent + child’s passport and residence card

My Number for the child

Certificate of Residence/住民票 (showing parent–child relationship)

Parent’s existing brokerage account (SBI or Rakuten recommended for foreigners)

Step 1: Open the Account

Create or log into your (parent) SBI or Rakuten account → follow the steps to open a 未成年口座 → upload documents.

Step 2: Set Up Automatic Monthly Investing

Choose one global index fund → set a monthly contribution → let compounding do the work.

Step 3: Start Monitoring Together

Important Points to Know About Minor Accounts (未成年口座)

a.No principal guarantee

A minor account is an investment account, not a savings account.

This means the balance can go down, and there is no guarantee against loss. It’s best to invest only amounts you’re comfortable with and combine it with safer tools such as savings accounts or insurance when appropriate.

b.Investment gains are taxable

Unlike the Junior NISA (which was discontinued in 2023), a minor account is a taxable account. Profits from selling mutual funds or stocks are subject to 20.315% tax. However, if you open a tax-reporting account with withholding (源泉徴収ありの特定口座), the brokerage will automatically handle the tax for you, so you don’t need to file a tax return yourself.

c. Account control changes when the child becomes an adult

Once your child reaches adulthood, they take full control of the account.

At that point:

the child manages all investments

parents can no longer buy or sell on their behalf

parents cannot withdraw funds

It’s important to prepare your child gradually so they can responsibly manage the account once it becomes fully theirs.

CRITICAL FOR U.S. TAXPAYERS

Minor accounts in Japan are subject to PFIC rules under U.S. tax law. This means you must be extremely careful when selecting investments. In most cases, U.S. taxpayers are limited to individual Japanese stocks or Japanese government bonds—not mutual funds or index funds, which are treated as PFICs and heavily penalized by the IRS.

6. Expectations for the Child NISA (こどもNISA)

The following information is based on what is known as of November 25, 2025, and may change as new details are released.

After the discontinuation of the Junior NISA at the end of 2023, the government is now considering a new system called “Child NISA (こどもNISA)”, expected to launch sometime in 2026 or later. While many details are still under discussion, it is an important development for families.

Purpose

The proposed Child NISA is designed for parents who want to build education funds—or other future expenses for their children—in a tax-efficient way. At the same time, it creates an opportunity for parents and children to learn about investing together, supporting financial literacy from a young age.

Proposed Features (subject to change and detailed pending)

Eligibility: Children under 18 years old

Annual tax-free investment allowance: Up to JPY1.2 million per year

Lifetime tax-free limit: Expected to be JPY18 million

Withdrawal rules: Likely to be reviewed to allow more flexible withdrawals when needed (a major improvement over the old Junior NISA)

While details such as eligible products, tax treatment, and parental control mechanisms have not yet been finalized, the Child NISA is attracting significant attention as a potentially more flexible and parent-friendly alternative to the old Junior NISA.

7.Q&A

Q1: Will my child pay gift tax if I fund their investment account?

A1: No—as long as annual deposits stay under JPY1.1 million (basic exemption).

Q2: What happens if we move out of Japan?

A2: The minor account can stay open. At age 20, it automatically becomes a standard adult account.

Q3. Will foreign parents be eligible to open a Child NISA for their child?

A3. Most likely yes — as long as the child is a Japanese resident with a valid My Number.

Current NISA rules do not depend on nationality. They depend on:

residency status in Japan, and

the child having a My Number (個人番号).

If the Child NISA follows the same structure as the new NISA for adults — which is expected — then:

Foreign parents

Foreign children

Dual citizens

should all be eligible as long as they are legal residents of Japan and meet the documentation requirements.

However, since official guidelines have not yet been released, final eligibility is still subject to confirmation.

Q4. Will Child NISA investments be restricted for U.S. taxpayers (PFIC issues)?

A4. Yes. U.S. citizens and U.S. tax residents must be very careful.

Most Japanese mutual funds and index funds are classified as PFICs, which are heavily penalized by the IRS. U.S. taxpayers may be restricted to:

individual Japanese stocks, or

Japanese government bonds

unless the Child NISA allows U.S.-compliant products (currently unknown and unlikely).

If your child is a “U.S. person,” seek U.S. tax guidance before investing.

Q5. Will withdrawals be more flexible than the Junior NISA?

A5. This is expected, but not confirmed.

One major complaint about Junior NISA was that money couldn't be withdrawn until age 18.

Child NISA is expected to improve this, allowing:

withdrawals for education

withdrawals for emergencies

more flexibility overall

We must wait for the FSA’s final announcement.

Q6. As for the Child NISA, when will official details be released?

A6. Likely sometime in mid-2026. The government is still reviewing the framework and public feedback.

7.Wrap Up

We don’t need to be rich to raise rich kids.

We don’t need:

✘ expensive tutors

✘ private schools

✘ complex financial products

We need:

✓ early habits

✓ consistency

✓ age-appropriate tools

✓ long-term thinking

Money education isn’t about creating future millionaires — it’s about giving your child confidence, independence, and choices.

Start small.

Start early.

And start today.

If you’d like, share your child’s first “money win” in the comments — I’d love to hear it!

References:

http://www.shiruporuto.jp/public/document/container/program/program05/program504.html

https://www.fsa.go.jp/news/r3/sonota/20220317/package.pdf

See also:

Living Between Currencies: What We’ve Learned About Social Security, Credit Cards, and FX in Japan