Retiring in Japan as an Expat: Pensions, Retirement Allowances, and iDeCo/NISA Explained (2025 Update)

Japan’s retirement system can be confusing at first glance. Unlike countries that have a single national pension or a straightforward 401(k)-style plan, Japan’s framework combines public pensions, company-based retirement allowances, and private savings programs such as iDeCo and NISA.

In addition, most companies in Japan set a mandatory retirement age, which is not considered age discrimination under Japanese labor law.

If you live and work in Japan—especially as a long-term resident or expat—understanding how these different layers work together can help you plan more effectively.

Let’s unpack what each part means and how to make the most of them.

This blog covers:

1. How Japan’s Retirement System Works

2. Japan’s Public Pension System: National Pension and Welfare Pension

3. Company Lump-sum retirement or resignation allowance

4. Private Retirement Savings: iDeCo and NISA

5. Building Your Retirement Strategy in Japan

6. Q&A

7. Wrap up

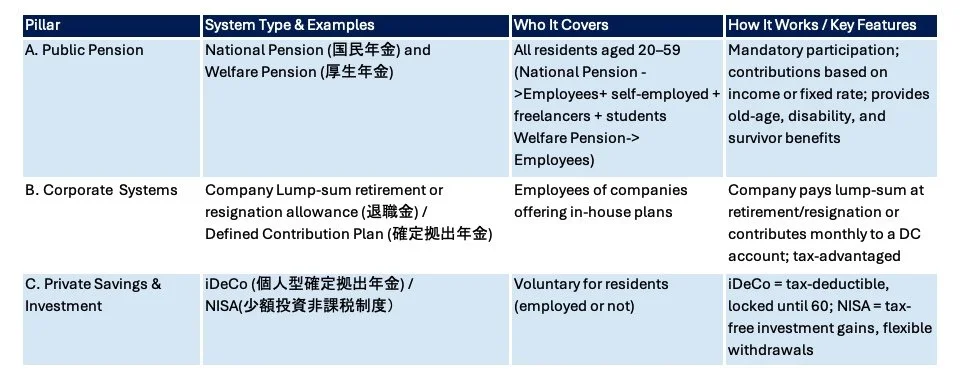

1. How Japan’s Retirement System Works

Japan’s retirement security framework is built on three pillars:

A. Public pension (national system) – Everyone aged 20–59 must join, regardless of nationality.

National Pension (国民年金): for self-employed people, freelancers, and students.

Welfare Pension (厚生年金): for company employees under payroll.

B. Company Lump-sum retirement or resignation allowance – Employers may offer a lump-sum retirement or resignation allowance (退職金) or a 401(k)-style plan (確定拠出年金, “defined contribution”) as part of their employee benefits package.

C. Private savings and investment accounts – Voluntary systems like iDeCo and NISA allow you to build additional savings with tax advantages.

Note: You may also see references to the “National Pension Fund (国民年金基金)” or “Employees’ Pension Fund (厚生年金基金)” on official forms. These are optional or legacy systems and not part of the standard pension coverage for most residents.

⚠️ Common Pitfalls and Realities

While Japan’s system looks stable on paper, there are a few gaps you should plan for:

A. Mandatory retirement age

Most Japanese companies set a retirement age of 60 or 65, which is legal and not considered discrimination under labor law. However, public pension benefits usually start at 65 (except for certain special early pensions / 特別年金).

That means there can be a gap of several years between when you stop receiving a salary and when pension payments begin. According to the Ministry of Internal Affairs and Communications (総務省統計, 2022), 50.8% of people aged 65–69 were still working.

Many continue in different forms—

staying with the same company as contract employees (often one-year renewable contracts with reduced pay),

re-employed by subsidiaries, or

taking new jobs altogether.

To bridge this gap, people either work longer or save enough in advance through company plans, iDeCo, or NISA.

B. Average pension amount

Even after benefits begin, the average public pension in Japan remains modest.

According to the Ministry of Health, Labor and Welfare’s May 2025 report:

National Pension (国民年金) —averages about JPY60,586 per month per person.

Welfare Pension (厚生年金) — averages about JPY154,043 per month per person.

These pension amounts are often not enough to cover living expenses, especially in big cities. A retired couple aged 65 or older typically needs about JPY287,000 per month for basic living, and around JPY380,000 for a more comfortable lifestyle.

(Source link)

Couples in which both partners receive pensions may live relatively comfortably.

C. The so-called “JPY20 million gap”

In 2019, the Japanese government estimated that a typical retired couple would need an extra JPY20 million (about US $130,000) beyond pension income to maintain their lifestyle for 30 years. Yet in reality, the amount varies widely. Your personal shortfall depends on location, housing situation, and lifestyle.

In short, while Japan’s retirement system provides a solid foundation, it’s important to recognize these three pitfalls, and plan accordingly through savings or continued work.

See also: Senior Care in Japan: Costs, Choices, and What Foreigners Should Know

2. Japan’s Public Pension System: National Pension and Welfare Pension

🟦 National Pension (国民年金, Kokumin Nenkin)

This is the foundation of Japan’s pension system.

Everyone—Japanese or foreign—is legally required to join.

Who it covers: Self-employed people, freelancers, students, part-timers, and anyone not covered by a corporate plan.

How it works: You pay a fixed monthly premium (JPY17,510/month in 2025, adjusted annually).

What you get: If you have paid (or been exempted during certain periods, such as maternity leave) National Pension premiums for a total of at least 10 years, you are generally eligible to receive the Old-Age Basic Pension (老齢基礎年金) starting at age 65. To receive the full pension amount, you must have contributed for the entire 40-year period — from age 20 to 60.

Other benefits: Includes disability and survivor pensions, even for foreign residents.

For foreign residents: If your home country has a totalization agreement with Japan (e.g., U.S., Canada, U.K., Germany): You can combine contribution periods from both countries to qualify for benefits in one system.

My story:

When I was 20 and still a student with no income, I applied for the Student Payment Special Exemption (学生納付特例制度), which lets students defer National Pension payments while in school. You can later pay the deferred premiums within 10 years to keep your full record. Applications are made at your city hall or pension office.

🟩 Welfare Pension (厚生年金, Kosei Nenkin)

For employees working under a Japanese company, you are automatically enrolled in Welfare Pension Insurance, which sits on top of the National Pension.

Who it covers: All full-time employees and some part-time workers who meet income and hours criteria.

Contributions: About 18.3% (As of Oct, 2025) of your monthly income, split 50/50 between you and your employer. So employee’s contribution is 9.15%. This contribution theoretically includes the National Pension premium as part of the total.

What you get: Benefits are income-based—the higher your salary and the longer your contribution period, the larger your future pension.

Other benefits: This system also includes disability and survivor benefits, and your health insurance (健康保険) premiums are typically bundled with it.

For foreign residents: If you work for a Japanese subsidiary or local employer, you’re likely enrolled automatically. If you’re a foreign assignee paid from overseas, check whether your company applies for an exemption under a social security treaty—some do to avoid double contributions.

🟦 🟩 Critical Note: If You Leave Japan Permanently — Applies to Both National and Welfare Pension

You may be eligible to claim a Lump-Sum Withdrawal Payment (脱退一時金) if you permanently leave Japan and no longer have a registered address here.

To apply, you must submit your claim within two years from the date you lost your Japanese residence status. Please note that once you receive this payment, all your previous pension contribution records in Japan are erased.

For details, carefully review the official guidelines provided by the Japan Pension Service:

🔗 Lump-Sum Withdrawal Payment Information (Japan Pension Service)

3. Company Lump-sum retirement or resignation allowance (退職金制度)

In addition to the public pension, many companies in Japan maintain a retirement or resignation allowance system. Historically, this was a lump-sum payment given to employees when they retired or resigned. Eligibility requirements vary by company, but employees typically need to have worked at least three years to qualify.

Today, there are two main types:

🟧 Traditional Lump-Sum Allowance (退職一時金型)

This is the classic Japanese model.

How it works: Upon retirement or resignation, you receive a one-time payout calculated from years of service and final salary. In most companies, this payment is made in the first payroll following your termination month.

Portability: You cannot transfer it if you change companies.

Tax treatment: Very favorable. The first several million yen are tax-free, depending on service length, under Japan’s retirement or resignation income deduction system (退職所得控除). In general, social insurance contributions are not required for a lump-sum payment. However, if you receive the benefit in pension-style installments, social insurance premiums may apply.

As job mobility rises and accounting rules change, many companies are moving away from this type.

For foreign residents: Check with your HR department — they should be able to provide an estimated retirement or resignation allowance amount based on your years of service. Each company uses its own calculation formula and model, so the amount can vary widely.

🟨 401(k)-Style Defined Contribution Plan (企業型確定拠出年金, DC)

In recent years, Japanese employers have adopted U.S.-inspired defined contribution (DC) systems.

How it works: The company (and sometimes the employee) contributes a set amount each month into an individual investment account. You choose from a menu of investment funds (domestic/global equities, bonds, etc.).

Portability: When changing jobs, you can roll over your balance to a new employer plan or to a personal iDeCo account.

Tax benefits:

o Contributions are tax-deductible (excluded from taxable income).

o Investment gains are tax-free while the funds are invested.

o Tax deductions apply at withdrawal

Payout options: Tax treatment differs depending on how you withdraw the funds — as a lump-sum payment, pension-style installments, or a combination of both. Be sure to confirm the rules before choosing.

For foreign residents: If your company offers both a lump-sum and a DC plan, you may be able to opt in or out. DC plans suit those planning to change jobs or manage investments more actively.

🟫 SME Retirement Allowance Mutual Aid System (中小企業退職金共済制度)

For employees of small and medium-sized companies, Japan operates the Small & Medium Enterprises (SME) Retirement Allowance Mutual Aid System, managed by the Organization for SME and Regional Innovation (独立行政法人中小企業基盤整備機構).

Purpose: To help smaller companies provide stable retirement benefits to their employees.

How it works:

Employers join the system voluntarily and pay a fixed monthly premium (JPY5,000–JPY30,000 per employee).

When an employee resigns or retires, the mutual aid organization pays out a lump-sum allowance based on contribution years and amount.

The benefit is portable — employees can continue their accumulated record if they move to another participating company.

Tax advantage: Contributions are fully deductible for the employer, and payments to employees are treated as retirement income.

For foreign residents: working in smaller firms, it’s worth checking whether your employer participates in this system, as it can significantly affect your future retirement payout.

NOTE: Some companies do not offer a retirement or resignation allowance system, so it’s best to check with HR before signing your offer.

4. Private Retirement Savings: iDeCo and NISA

Beyond public and company plans, Japan offers two major personal investment programs that help residents build tax-advantaged savings.

🟦 iDeCo (Individual-Type Defined Contribution Pension, 個人型確定拠出年金

iDeCo is Japan’s individual version of a 401(k). It’s ideal for self-employed people, freelancers, or employees without a strong company plan. Be sure to check the details and confirm the most up-to-date information before enrolling.

Tax advantages:

Your contributions are fully tax-deductible from income.

Investment gains are tax-free while in the account.

Payouts at retirement get retirement-income deduction benefits.

Contribution limits (as of 2025):

Self-employed: up to JPY68,000/month

Employees with company plan: up to JPY23,000/month (varies by employer)

Lock-in period: Funds are not withdrawable until age 60 (except for death or disability).

Eligibility for foreigners:

You must be a Japanese resident.

Short-term residents may not benefit if planning to leave within a few years.

For foreign residents: If you change jobs or leave Japan: You can transfer your iDeCo to a corporate DC plan or keep it dormant until you qualify for withdrawal.

🟫 NISA (New NISA, 2024 Reform)

The NISA (Nippon Individual Savings Account) system is Japan’s version of a tax-free investment account—similar to a U.K. ISA or U.S. Roth IRA. Be sure to check the details and confirm the most up-to-date information before enrolling.

No tax deduction for contributions, but investment gains and dividends are tax-free for life- meaning you can avoid the 20.315% tax normally applied to investment income in Japan.

You can withdraw anytime, with no penalties.

2024 “New NISA” system:

Lifetime tax-free investment limit: JPY18 million.

Annual contribution limit: JPY3.6 million.

Unlimited duration (used to be time-limited).

Best for:

Expats or residents who want flexibility—unlike iDeCo, funds are not locked in.

Medium- to long-term investment for goals like education, home purchase, or supplementing retirement.

For foreign residents: Many expats open both iDeCo and NISA accounts to combine long-term savings and liquid investment freedom.

⚠️ For all U.S. Tax payers

Both NISA and iDeCo are subject to FATCA (Foreign Account Tax Compliance Act). U.S. taxpayers must report these accounts on IRS forms, and any gains or withdrawals may still be taxable in the U.S. under global income reporting rules.

U.S. citizens should also be aware of PFIC (Passive Foreign Investment Company) rules, which can apply to NISA/iDeCo investments.

PFIC status may trigger complex tax treatment, with gains potentially taxed at up to 37% plus interest.

👉 Check official IRS guidance or consult a cross-border tax professional.

5. Building Your Retirement Strategy in Japan

How do you put all these layers together?

Strategy Tips

Stay compliant: Make sure you’re paying into the correct public pension category.

Check your Nenkin record: Use the Nenkin Net online portal to track your contributions.

Maximize deductions: iDeCo and employer DC contributions can reduce your taxable income.

Plan for mobility: If you may leave Japan, consider NISA for flexibility and review treaty coverage for pensions.

Ask your HR, bank, or financial advisor if you’re unsure about your eligibility or plan options

Real story:

Recently, one of our friend (an U.S. citizen) went to a Japanese securities company (about 40% US company-owned) to open a NISA account for Japanese stocks. However, he was told he couldn’t open an account because he didn’t speak Japanese. He actually speaks Japanese—just not fluently—but apparently, that wasn’t enough. Technically, it would have been fine, but he was told the policy exists to avoid potential misunderstandings about contract terms or telephone trade orders made in Japanese.

In the end, he decided to open it at Monex.

See also: Living Between Currencies: What We’ve Learned About Social Security, Credit Cards, and FX in Japan

6. Q&A: Common Questions About Retirement and Investment in Japan

Q1. Do I have to pay pension premiums if I’m a student or unemployed?

A1. Yes, the National Pension is mandatory for all residents aged 20–59.

However, students and low-income individuals can apply for exemption or deferment (免除・猶予制度) through their local city office. The future pension amount will be reduced unless payments are made retroactively.

Q2. What if I change from self-employed to company employee (or vice versa)?

A2. Your pension category changes:

From National Pension (国民年金) to Welfare Pension (厚生年金) when you become a salaried employee. Your HR will take care of it.

From Welfare Pension back to National Pension if you leave your job or start freelancing. Visit local pension office and start Nation Pension premium payment.

Your total contribution record continues seamlessly, so you won’t lose any credit. Make sure your My Number is properly linked to your pension account, so all your contributions stay connected to you — even if your family name, pension type, or address changes. Before my number system, they lost my 3 years of contribution, which was recently added.

Before the My Number system was introduced, I actually lost three years of contribution history, which was only corrected recently.

Q3. How can I track all my contributions?

A3: You can register for Nenkin Net using your My Number card or pension book. It shows your contribution history for both National and Welfare pensions. For iDeCo and DC plans, check your provider’s online dashboard.

If you forget your user ID or password, re-register through “ご利用登録 (User ID Application)” on the Nenkin Net website. Please note that the same user ID cannot be reissued, and a new one will be created upon re-registration.

Q4. How do social security agreements help foreigners?

A4. Japan has social security treaties with over 20 countries, including the U.S., U.K., Canada, Germany, Australia, and South Korea.

These agreements:

Prevent double contributions for short-term assignees, and

Allow totalization of contribution periods for long-term residents, ensuring your years in Japan count toward eligibility in either system.

Q5. Can I get pension advice in a foreign language?

Q5: Yes. The Japan Pension Service offers free interpretation support for pension consultations in multiple languages. You can check the list of available languages and contact information here:

🔗 Multilingual Pension Consultation Support (PDF)

Q6: Can I have both iDeCo and NISA?

A6: Absolutely. Many residents use iDeCo for long-term retirement (tax deduction) and NISA for flexible investing (tax-free growth). Combining them balances long-term security with access to funds when needed.

7.Wrap up

Japan’s pension system can feel complicated—even for locals—because of its many layers and rules. Appointments at pension offices often take months, and cross-border residents face additional tax and reporting obligations between your home country and Japan.

Still, Japan’s retirement system is manageable once you understand how each layer fits together. Talk with your HR department, your local pension office, or a financial advisor familiar with expat taxation—or just drop me a line.

The earlier you align your pension, retirement allowance, and savings strategy, the smoother your financial journey in Japan will be.

👉 Want to dive deeper? Explore more guides on Navigator Japan.

How to Navigate Inheritance, Wills, and Tax in Japan for Foreigners