Japan Tax Returns for Employees in 2026: Filing Rules, Refunds, and Deadlines

Tax season in Japan is just around the corner. If you’re employed full-time, you might assume your company has already taken care of everything through year-end adjustment (nenmatsu chousei). In most cases, that’s true — but not always.

While tax returns (kakutei shinkoku) are usually associated with freelancers, self-employed professionals, or landlords, some employees are required to file, and others should file to get tax refunds they’re entitled to.

This guide explains how Japan’s tax return system applies to foreign employees and what situations require filing, what documents you need, and what happens if you miss the deadline.

See also: Upcoming Year-End Tax Adjustment in Japan – What You Need to Prepare

NEW: The National Tax Agency has updated its website with information to prepare for the 2025 tax year, which you will file in early 2026.

You can review the latest official guidance (Japanese only) here:

https://www.nta.go.jp/taxes/shiraberu/shinkoku/tokushu/index.htm

(Updated as of December 13, 2025)

This blog covers:

Scope of Taxable Income for Foreign Employees in Japan

When Employees Are Required to File a Tax Return

When You Should File a Tax Return to Get a Refund — Even If You Don’t Have To

Filing Period, Required Documents, and Payment Methods (for 2026 Filing)

What Happens If You Delay Filing or payment

Special Note: FX Trading and Carrying Losses Forward

Q&A

Wrap Up

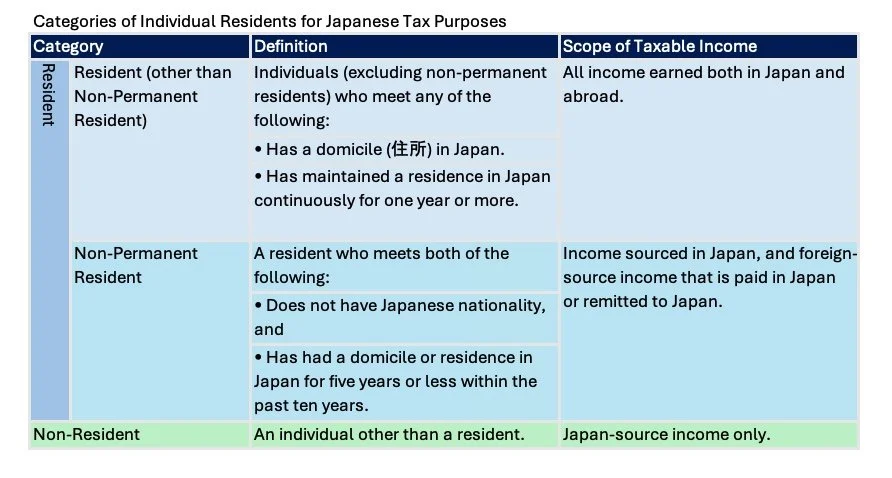

1. Scope of Taxable Income for Foreign Residents in Japan

As a first step in tax planning, confirm your residency category—it determines what counts as taxable income under Japan's rules.

Source: https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/2010.htm

Any income not covered by your company’s year-end adjustment (nenmatsu chosei) must be reported via a personal tax return (kakutei shinkoku). This ensures compliance and unlocks refunds for overlooked deductions.

2.When Employees Are Required to File a Tax Return

Even as a salaried employee, you must file a tax return if any of the following apply. In these cases, filing is mandatory — not optional.

A. Your annual employment income exceeds JPY20 million

If your total employment income exceeds 20 million yen during the year, your employer cannot process your year-end tax adjustment. You will receive a withholding slip (gensen choushuuhyou) and must complete your own tax return.

B. You earned more than JPY200,000 from side jobs or other income

If you earn income from a second job, or other non-salary sources totaling more than JPY200,000 (after expenses), you must file a tax return.

This includes:

Side job/Outside your main job

Temporary or part-time work from another employer

Rental or investment income

If your side income is below JPY200,000, you don’t need to file an income tax return — but you still need to declare it for inhabitant tax (住民税).

💡 Tip for foreigners: If your company prohibits side work (fukugyo), your employer may still see the inhabitant tax increase and become aware of it. You can request a “self-payment” method for resident tax to keep it separate from salary withholding.

C. You received “one-time” income (e.g. insurance payout)

If you received insurance maturity payments, prize money, or gambling winnings, these are treated as temporary (one-time) income (ichiji shotoku). A special deduction applies to temporary income — up to JPY 500,000 in total per year. Note that this deduction is applied to the combined total of all one-time income, not to each transaction individually.

Example (Your one-time income is only from an insurance maturity payment for the year)

If you paid JPY 2.5million in insurance premiums and received JPY 3.5 million as a payout:

3.5M − 2.5M − 0.5M(deduction) = JPY 0.5M

Half of this (JPY 250,000) counts toward your taxable income.

D. Your year-end adjustment contained mistakes

If your employer’s year-end adjustment missed or incorrectly applied deductions (for example, both spouses claimed each other as dependents, or a dependent earned too much), you must correct it through a tax return.

E. You changed jobs mid-year but didn’t submit your previous withholding slip

If you changed jobs during the year and your new employer didn’t include your previous salary information in the year-end adjustment, you must file. All income from the year — including all employers — must be declared. To avoid this, submit the withholding slip (gensen choshuhyo) from your previous employer to your new HR department upon joining.

F. You left your company and weren’t employed at year-end

If you retired or resigned mid-year and weren’t employed on December 31, your company could not perform year-end adjustment. You must file your own tax return.

G. You sold property or other assets

Even if you’re an employee, capital gains from selling real estate, stocks, or crypto require separate reporting.

For details, see Japan’s National Tax Agency (NTA) page:

No.1900: When salaried employees must file tax returns (給与所得者で確定申告が必要な人)

3. When You Should File a Tax Return to Get a Refund — Even If You Don’t Have To

Even if you’re not legally required to file, you may get money back by filing voluntarily. The following are common situations where filing benefits employees:

A. Medical expense deductions (iryohi koujo)

If you or your family spent more than JPY100,000 (or 5% of total income, whichever is lower) on eligible medical expenses, you can claim a deduction. This includes hospital visits, prescription drugs, and some transportation costs to hospitals.

Keep all receipts — they’re required.

B. Donation deductions (kifukin koujo) and Furusato Nozei

Donations to recognized organizations or local governments qualify for a tax deduction.

If you used the Furusato Nozei one-stop system and later need to file for other reasons (e.g. medical deduction), you must re-file all donations through your tax return.

C. The first year of your housing loan

Mortgage deductions (jutaku koujo) apply from the second year via year-end adjustment, but the first year requires filing. The benefit can be significant — often hundreds of thousands of yen — so don’t skip it. Note that this deduction only applies if you have a mortgage loan. If you purchased your home entirely in cash, you are not eligible.

D. You forgot to claim deductions during year-end adjustment

Missed life insurance, earthquake insurance, or dependent deductions? You can still claim them through your return. I’ve seen many cases where employees either lost or not yet received the required certificate from their insurance company — but don’t worry, you can still make the claim. Just contact your insurer and request a certificate (hokensha shomeisho).

E. Your family situation changed after year-end adjustment

If you got married, had a child, or became a single parent after your company processed year-end adjustment, you can apply those new deductions through your return.

F. You received retirement pay without submitting the required form

If you received retirement/resignation pay but didn’t submit the “Declaration of Receipt of Retirement Income,” your tax may have been over-withheld. Filing can get it refunded. Your HR department usually asks you to complete this form before payment — so be sure not to miss it.

G. You suffered disaster or theft losses (zasson koujo)

Losses from natural disasters, fire, or theft can qualify for special deductions. These cannot be handled in year-end adjustment — you must file. You can consult your local tax office for help with calculating the amount of loss and preparing the required documents.

H. You have rental or investment losses

If you own rental property or investments and had losses, you may be able to offset them against other income. However, rules vary by income type and case.

I. You had stock or FX losses

You can’t offset these against salary, but you can offset between accounts and carry losses forward for three years. This requires filing each year. -> See more detail at 6. Special Note: FX Trading and Carrying Losses Forward

💡 Tip for foreign investors: If you trade via foreign brokers (like Interactive Brokers), their reports are not automatically sent to Japanese tax offices. You must convert figures into JPY and declare manually. Keep transaction reports for all trades.

4. Filing Period, Required Documents, and Payment Methods (for 2026 Filing)

A. Filing period

For 2026, the filing period is expected to run from February 16 (Monday) to March 15 (Monday), 2026. You can begin submitting data through e-Tax as early as early January.

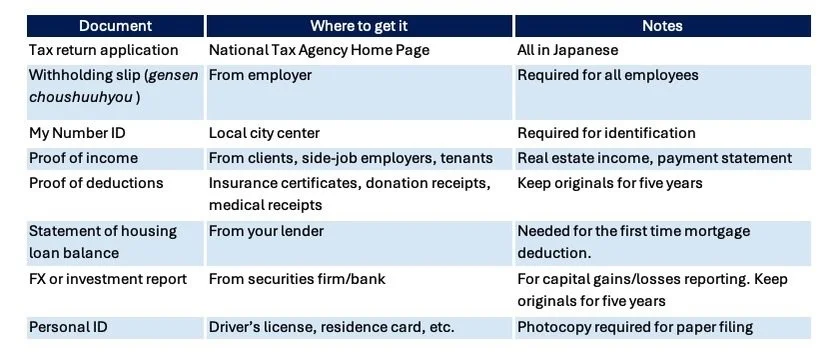

B. Key documents

C. Filing methods

• e-Tax (online filing) – English guidance is available on the National Tax Agency website. Using e-Tax requires a My Number card and password. The initial setup can be a little complicated, but once it’s done, future filings are much easier.

• Paper filing – You can mail your documents or submit them directly to your local tax office.

• Tax software or accountant – Many expats prefer hiring a bilingual tax accountant, especially if they have foreign income or complex deductions. Fees typically range from JPY 30,000 to 60,000, depending on the complexity of your case.

💬 For Foreign Residents

In Japan, residents classified as Non-Permanent Residents who own overseas assets worth more than JPY 50 million must report those assets to the National Tax Agency under the Overseas Asset Reporting System (Kokugai Zaisan Chousho).

—>For classification, see 1. Scope of Taxable Income for Foreign Residents in Japan.

This requirement applies to residents with financial or real estate holdings abroad and is separate from the annual income tax return. The filing deadline is June 30 each year.

One expatriate I know didn’t learn about this rule until his tax accountant in Japan pointed it out — and it could have saved him a lot of confusion. Bilingual tax accountants not only ensure compliance but also provide valuable advice tailored to your residency status and financial situation. Penalty for non-report would be up to JPY500,000 fine.

D. Payment methods

As a result of your tax return, if you owe additional tax, you can pay it by:

Bank transfer from your own bank account

Bank transfer via e-Tax(It can be a bit complicated the first time you use it.)

Convenience store (under JPY300,000 per payment)

Credit card (https://koukin.f-regi.com/fc/kokuzei_direct/)

Mobile payment apps: PayPay, d-Bara, au PAY, Merpay, Amazon Pay, Rakuten Pay

At tax office counters

⚠️ Receipts are not issued for payments made through apps or convenience stores.

Be sure to keep a screenshot or printout of your payment confirmation as proof.

For convenience store payments, the cashier usually stamps the invoice and issue receipt — make sure to keep them safely for your records.

5.What Happens If You Delay Filing or Payment

Missing the filing deadline doesn’t mean you’re stuck — but penalties can add up quickly.

A. If You Miss the Filing Deadline

If you fail to file your income tax return by the due date without special permission, additional penalties may apply.

Late filing penalty (mushinkoku kasanzei)

This penalty is imposed when an income tax return is not filed by the deadline.

However, it may not apply if you voluntarily file and complete payment within one month after the deadline, or if you meet certain other conditions showing you intended to file on time. (In other words, the deadline still matters, but prompt voluntary filing helps minimize penalties.)

The penalty rate depends on when you file:

Before receiving a notice from the tax office: 5% of the unpaid tax amount

After receiving a notice from the tax office: generally 10%

For larger unpaid amounts, the rate can increase further depending on the total tax due.

💡 Tip: Even if you cannot pay immediately, file first. You can request a deferred payment (enno), which may reduce the total penalties charged.

B. If You Filed but Didn’t Pay on Time

Late payment penalty (entaitzei)

Interest-like late payment penalties apply automatically if you don’t pay by the deadline.

The rate depends on how many days the payment is delayed, up to a maximum of 14.6%.

C. Other Possible Penalties

Underreporting penalty (kasho shinkoku kasanzei) – imposed if you file but underreport income or deductions

Serious concealment penalty (ju kasanzei) – applied when the tax office finds deliberate concealment or falsification

These penalties can be in addition to late filing or late payment charges, so accurate and timely filing is essential.

💡 If you’re unsure whether your case qualifies for an exception or voluntary correction, it’s best to consult your local tax office or a tax accountant.

6. Special Note: FX Trading and Carrying Losses Forward

If you trade FX (foreign exchange), you must file when your profit exceeds the threshold.

However, even if you had losses, filing can benefit you.

Why file when you had losses?

Offset profits and losses across brokers

If you profited JPY300,000 with one broker and lost JPY100,000 with another, you can offset them for a net profit of JPY200,000 — reducing tax. Only trades through registered Japanese brokers qualify for this.Carry forward losses up to 3 years

You can apply losses to future profits, but only if you file each year continuously.

Documents needed for FX tax filing

Tax return forms

Calculation sheet for “Miscellaneous Income from Futures Transactions”

Annual transaction report from your broker

Withholding slip (if employed)

My Number

💡 Many Japanese brokers provide online “FX profit and loss reports.”

Translate or label key figures (in English or Japanese) for clarity when attaching to your filing. I once had to pay a fee at a bank to get this report — so make sure to download it while it’s available online, as it may not remain accessible later.

6. Q&A

Q1. I moved to Japan mid-year. Do I need to file for the period before I arrived?

A1. No, you only need to report income earned after you became a Japanese resident.

However, once you qualify as a “permanent resident for tax purposes” (after living in Japan for more than five years within the past ten), your worldwide income becomes taxable in Japan. That’s when the complex Foreign Tax Credit (FTC) rules come into play.

I strongly recommend consulting a cross-border tax advisor who understands both Japanese and international tax systems.

Q2. What if I left Japan before March?

A2. You must file before departure or appoint a tax agent.

Many departing expats forget this and miss refunds for overpaid taxes.

Q3. My dependents live overseas. Can I claim them?

A3. Yes. From the 2023 tax year (Reiwa 5), the eligibility rules for claiming overseas dependents under the dependent deduction have become stricter. Only certain relatives living abroad can qualify as dependents. In particular, the new rule limits eligibility to those who fall under one of the following three categories:

Individuals aged 16–29

Individuals aged 70 or older

Individuals aged 30–69 who meet one of the following conditions:

Left Japan to study abroad (no longer residing in Japan)

Have a disability

Received at least JPY380,000 yen in financial support (for living or education expenses) from the taxpayer during the year

You can claim overseas dependents through year-end tax adjustment (nenmatsu chousei) or through a tax return (kakutei shinkoku).

For example, one Australian employee could not collect all the required documents by the year-end adjustment deadline but later corrected the claim through a tax return.

For detailed requirements and required documents, please refer to the National Tax Agency (NTA) guide:

👉 NTA pamphlet on Dependent Deductions (Japanese PDF)

Q4. Can I file in English?

A4. The National Tax Agency offers English guidance pages, but forms are in Japanese.

If you’re not comfortable with Japanese, consider hiring a bilingual tax accountant.

Some tax offices in Tokyo and Osaka have limited English assistance during February–March.

Q5. Do I need to tell my employer if I correct a mistake from the year-end adjustment in my tax return?

A5. It depends on the type of correction.

If the correction involves a dependent (for example, adding or removing a spouse or child), you should also update your information with HR, since it affects payroll calculations and future year-end adjustments.

If the correction involves missed deductions — such as life insurance, earthquake insurance, or medical expenses — you can simply claim them in your own tax return (kakutei shinkoku). In these cases, you don’t need to inform your employer, because the adjustment is handled directly between you and the tax office.

When in doubt, check with your HR or payroll department, especially if the correction may affect next year’s withholding.

7. Wrap-Up

For many cross-border professionals, taxes can feel like a headache.

None of us want to pay more tax than necessary, but compliance is important — and it’s far better to stay on top of filing requirements than to face problems later. The good news is, filing properly can sometimes result in a refund rather than an extra payment.

Key takeaways:

Check whether your company’s year-end adjustment covered all your income and deductions.

Keep all receipts for medical expenses, donations, and insurance payments.

Use e-Tax if possible — it’s faster and often results in quicker refunds.

If you leave Japan or have foreign income, double-check your residency status and reporting rules.

When in doubt, consult a bilingual tax accountant, especially if you have overseas assets or multi-country income.

✉️ Have a question about filing your taxes in Japan?

Share your experience in the comments below — your story might help another expat navigating the same challenge!

✅ Resources

National Tax Agency (NTA) – English Home Page

e-Tax Portal (National Tax Agency Online Filing System)

NTA Q&A: Common Questions about Tax Returns (in Japanese)

If this helped you, here are a few other things that might help too:

(Related Guides)

Overtime in Japan: What’s Legal, What’s Not, and How to Protect Yourself

Senior Care in Japan: Costs, Choices, and What Foreigners Should Know