What Does It Mean to Be Wealthy in Japan vs. the U.S.?

I’m not here to say one country is better than the other—I love both the U.S. and Japan. But having lived in both, I’ve come to see that “being wealthy” is about more than just how many dollars or yen you have in the bank. It’s about how that money translates into daily life—shaped by cost of living, social systems, cultural values, and most importantly, your own sense of what matters.

You don’t need to be ultra-rich to live a rich life in Japan. Compared to the U.S., wealth here often feels more attainable, more grounded. In the U.S., “wealth” can feel elusive, tied to constant striving. But in Japan, it may be easier to find your own version of wealth.

Let’s explore these differences through data, personal experiences, and a broader cultural lens.

This blog covers:

Defining Wealth: A Numbers Game with Context

Daily Life: Where Your Money Takes You

Social Systems: The Safety Net Factor

Cultural Lens: Modesty vs. Display

Where Might You Feel Wealthier?

Wrap up

1. Defining Wealth: A Numbers Game with Context

Let’s start with how wealth is measured in each country.

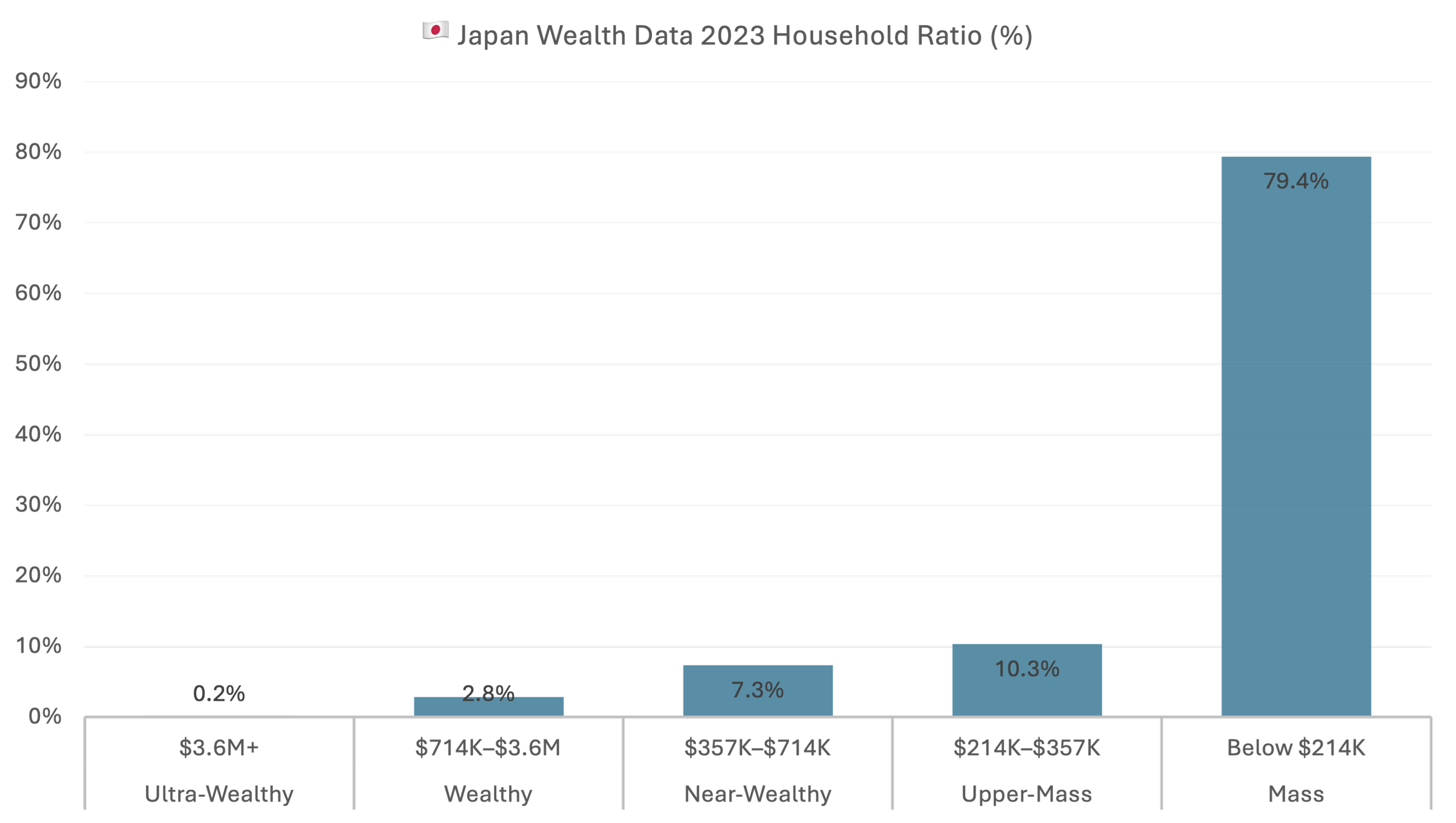

🇯🇵 In Japan, the Nomura Research Institute (NRI) defines wealth tiers based on net financial assets (total financial assets minus liabilities, excluding homes and pensions). According to their 2023 data:

NRI’s exclusion of homes might underestimate wealth for middle-class households with significant real estate—a common asset in Japan.

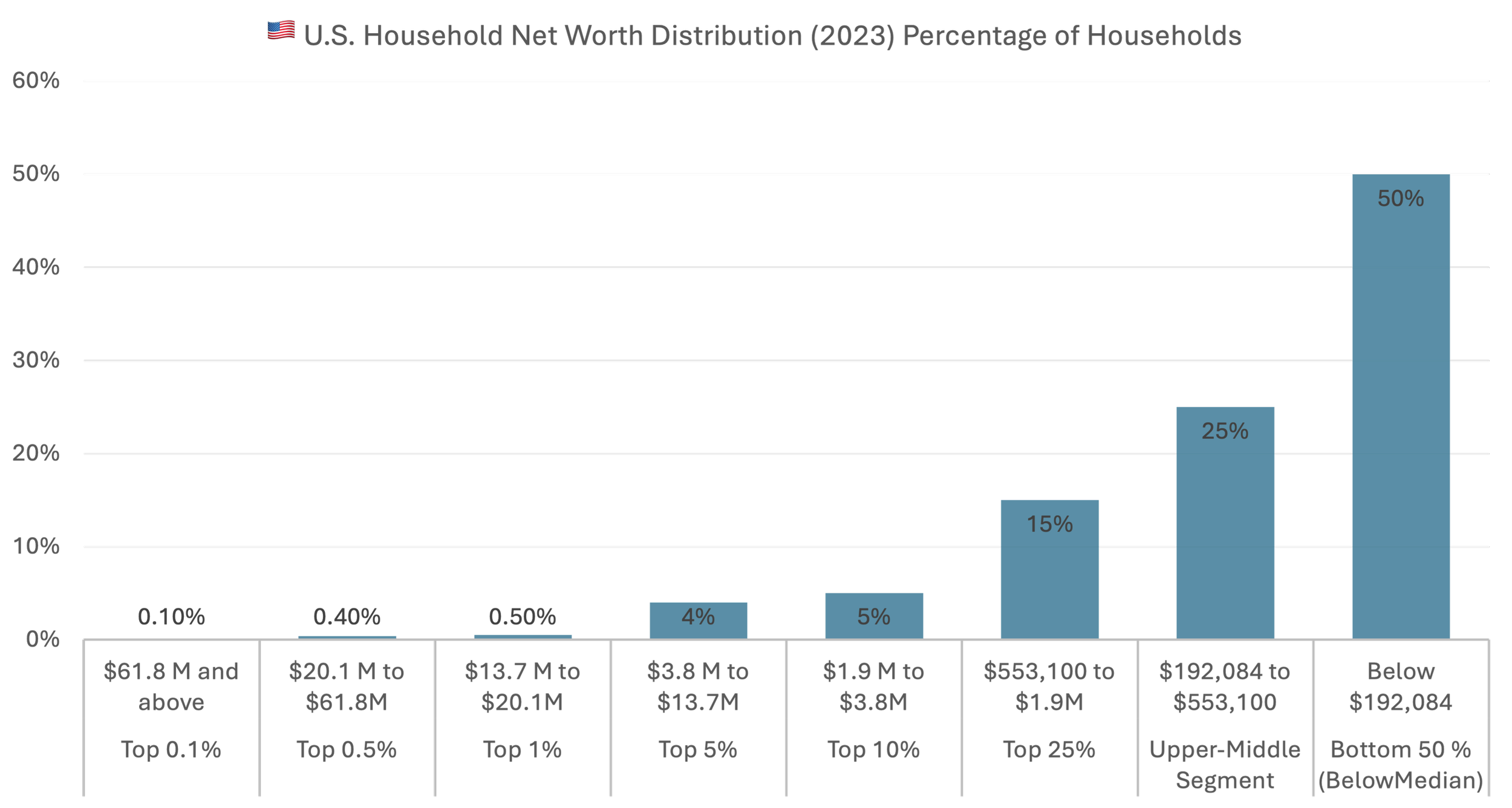

🇺🇸 In the U.S., wealth is typically measured by total net worth asset (including homes and investments).

Source: Federal Reserve's Survey of Consumer Finances and compiled by DQYDJ.

Note: The percentages of “Top” Bracket are cumulative; for example, the Top 5% includes the Top 1%.

Bottom line: In Japan, 89.7% of households fall into the "mass" category (net worth under $333K), compared to 75% in the U.S. This means Japan has a broader financial middle.

In the U.S., roughly 23,684,985 households – about 18.0% of American households – was a millionaire household. Median household net worth in the United States was $192,084.

2. Daily Life: Where Your Money Takes You

Wealth isn’t just a number—it’s what it buys you. Let’s compare how income translates into lifestyle in Japan and the U.S., focusing on practical realities.

🇯🇵 Japan: Practical Comfort

🇯🇵 In Japan/Snapshot: an annual income of ¥20 million (approx. $143,000, excluding bonuses) places you in the top income bracket, often associated with upper management roles like a Director (部長) at a large firm.

For context, Japan’s average income in 2024 was ¥5,24 million (approx. $37,430), per the National Tax Agency, making ¥20 million a significant achievement. Source: Overview of the 2023 National Survey on Living Conditions

After income tax, resident taxes and social insurance (health insurance, pension, unemployment and long-term care for those over 40 y/o), the net income is around ¥13 million (approx. $92,857)—roughly ¥1 million monthly. This covers a suburban apartment mortgage ¥120,000/month (approx. $858), utilities, groceries, childcare for two kids, an Amazon prime subscription and modest savings/investments. Bonuses often fund extras like family trips to Kyoto or Hokkaido.

Important note: However, the average monthly employee pension in Japan (kōsei nenkin – similar to U.S. Social Security) is about ¥150,000 (approx. $1,071), which is not enough to cover basic living expenses in retirement. Due to uncertainty about the future, many Japanese people tend to be cautious with their spending.

Real Story: I know a psychiatrist in Tokyo earning ¥18 million annually – no bonus (approx. $128,570). His income supports a comfortable life, but with a child in private medical school-6 years (¥300,000 monthly- approx.$2142), he works extra shifts to stay ahead. It shows that even a high income must be managed carefully depending on life stage and family needs.

🇺🇸 In U.S.: Higher Income, Higher Pressure

🇺🇸 In the U.S./Snapshot, a $200,000 salary (excluding bonuses) sounds impressive, but in cities like San Francisco (Cost of living is 71% higher than national average – source: RentCafe (2025)), it often feels stretched. For a married couple with two kids, federal taxes, California state taxes and FICA total around $54,000 annually, leaving a net income of $146,000 (approx.$12,167 monthly) – 401K not included. Major expenses quickly add up:

Mortgage: e.g.$5,000/month (for a modest Bay Area home).

Health Insurance: $1,500/month (PPO/family plan – employee contribution).

Childcare: $1,000/month (for 2 kids).

That’s $7,500/month ($90,000/year) before groceries, transportation, student loans, or retirement savings. In suburban areas like Schaumburg, Illinois, a mortgage might drop to $3,000/month, but healthcare, education, and insurance costs still weigh heavily.

There’s one expense we can’t overlook, especially when comparing life in the U.S. to Japan: property tax. In general, property taxes in the U.S. are significantly higher than in Japan.

Real story: Tim had lived in Frisco, Texas, where he bought a $500,000 home and paid about $14,000 in property tax each year—a hefty sum driven by the city’s rapid development. When he moved to Japan, he purchased a brand-new ¥50 million (about $357,000 at ¥140/USD) house in a Kanagawa suburb, and his annual property tax was only ¥200,000 (roughly $1,430), reflecting Japan’s lighter tax burden.

3. Social Systems: The Safety Net Factor

Social systems play a huge role in how wealth feels, especially for medical, long-erm care and retirement. Let’s compare Japan and the U.S. in this critical area.

Health Insurance and long-Term Care Insurance

🇯🇵 In Japan/Snapshot: For an annual income of ¥20 million (approx. $143,000, excluding bonuses), the monthly health insurance + long-term care insurance premium is about ¥80,000/month (approx. $5,714). This typically covers medical, dental, and vision care, with a 30% co-payment for most services.

If you’re not employed, you can enroll in Japan’s National Health Insurance (NHI). For an annual income of ¥20 million (approx. $143,000), the health insurance + long-term care insurance monthly premium is around ¥88,333 (approx. $631).

Then, Japan’s High-Cost Medical Expense Benefit is a government program that limits how much individuals have to pay out of pocket for medical care each month. If your monthly medical expenses exceed a certain threshold, the excess amount is reimbursed.

In addition, Japan’s universal long-term care insurance (Kaigo Hoken), mandatory from age 40 for all residents (including foreigners registered over 3 months), covers in-home nursing, senior daycare, wheelchair rentals, and group homes. Even foreigners who join late—say, at 65 after staying in Japan for over three months—can access long-term care benefits as long as they pay premiums, significantly reducing the financial strain of aging.

Want to know more? Check out my blog below:

Insurance in Japan: Your 4-Part Survival Guide – Health Insurance—Do You Really Need a Private Plan?

Retire Well in Japan: Visas, Living Options, and Senior Care

🇺🇸 In the U.S./Snapshot: As mentioned above, a person earning $200,000 per year typically pays around $1,500 per month for a family health insurance PPO plan. And Illinois premiums tend to be somewhat lower than in California.

Long-term care in the U.S. is mostly a private expense—you’ll need costly insurance ($3,000–$5,000/year) or to deplete savings to qualify for Medicaid. A private nursing home can run $116,000–$128,000 annually in 2025, a financial reality many aren’t fully prepared for. And the nursing home cost aligns with what we experienced in our parents’ case.

Source:

https://www.nbcnews.com/ (specific article from 2023, searchable via archives)

https://www.kff.org/ (search for 2021 long-term care cost reports)

Retirement Savings

🇯🇵 In Japan: The Ministry of Health, Labour and Welfare recommends ¥20 million ($142,857) in savings for retirement, with estimates suggesting ¥230,000 ($1,643) monthly for a basic couple’s lifestyle and ¥380,000 ($2,714) for comfort, based on recent analyses of living costs.

However, many say that ¥500,000/month (approx. $3,571) is needed for a truly stress-free and comfortable retirement.

In addition to pension income, ¥20 million (approx. $142,857) in savings is recommended by the Ministry. That said, some suggest that ¥100 million (approx. $714,285) is the benchmark for a truly secure and worry-free retirement. I agree.

🇺🇸 In the U.S.: The Bureau of Labor Statistics reported in 2021 that households over 65 spent $52,141 annually ($4,345 monthly), though by 2025, this has likely risen to around $62,000 ($5,167 monthly) due to inflation.

Financial experts often recommend savings of about $555,000 to cover such expenses, but studies suggest only around 12% of retirees meet this goal. Roughly 8–10% have saved $1 million or more, while 37% have no retirement savings, pointing to a real savings challenge.

Here’s an interesting site that shows how much you need to retire in each U.S. state:

👉 GoBankingRates – How Much You Need to Survive Retirement in Every State

Sources:

Bureau of Labor Statistics (https://www.bls.gov/cex/),

Vision Retirement (https://www.visionretirement.com),

Fidelity Investments (https://www.fidelity.com/),

Federal Reserve (https://www.federalreserve.gov/publications/2022-survey-of-consumer-finances.htm),

Transamerica Center for Retirement Studies (https://www.transamericacenter.org/),

NBC News (https://www.nbcnews.com/),

Kaiser Family Foundation (https://www.kff.org/)

Welfare Pension vs. Social Security

🇯🇵 In Japan: Japan’s Welfare Pension (Kōsei Nenkin) provides a basic safety net for retirees. For a typical employee who has contributed for over 40 years, the average monthly payout is about ¥150,000 (approx. $1,071). This amount is often supplemented by personal savings or part-time work. The system is mandatory for most employees, offering broad coverage—though the payouts are modest, especially in high-cost areas like Tokyo.

This limited pension income highlights the importance of personal savings. As mentioned earlier, many older adults in Japan continue working well past retirement age to maintain financial stability.

Tip: In Japan, only about 2% of companies offer a 401(k)-style retirement plan. Instead, most employers still provide a lump-sum retirement allowance or encourage participation in iDeCo (Japan’s version of individual defined contribution pensions).

While investment options are evolving, the traditional Japanese mindset tends to avoid financial risk. That’s why financial education from a young age is essential for long-term security and confidence. We have not been able to do so.

🇺🇸 In the U.S.: Social Security offers a safety net, with an average monthly benefit of $1,976 (2025 data, per SSA.gov), or $23,712 annually. However, this covers only about 40% of pre-retirement income for average earners, and high earners, like those making $200,000, receive a smaller proportional benefit—around 20–25%.

For Americans in Japan, the FX rate offers an advantage: $1 million becomes ¥140 million at ¥140/USD, boosting buying power. But a 20% tax on FX gains applies, reducing net benefits.

4. Cultural Lens: Modesty vs. Display

How wealth is perceived and displayed reveals another layer of difference.

🇯🇵 In Japan: “Wealth” (豊かさ, yutakasa) often means safety, harmony, health, community, and culture, not just money. You might share a train with a millionaire without noticing. Space constraints play a role—Japanese homes are smaller, so there’s little room for the oversized items (boats, billiard tables, home gyms, or kids' play equipment) you’d find at a Costco.

In addition, as shown above, 89.7% of households in Japan fall into the "mass" category in terms of wealth. You rarely see ultra-wealthy individuals in everyday life here—super-rich lifestyles are not as visible or common as they are in some other countries.

Even if you pay $10 million for a house in an expensive area of Tokyo, it typically comes with no yard, no pool, and a floor space of just 150–300㎡ (1,600–3,200 sq ft). For security and privacy, many of these high-end homes are surrounded by tall, thick concrete walls, making them feel more enclosed than luxurious.

Source: https://www.kencorp.co.jp/housing/buy/feature/theme/residence/

🇺🇸 In the U.S.: wealth is often a status symbol. Big homes, luxury cars, and designer brands signal success.

Despite decent jobs, the pressure to maintain appearances left them financially stretched. Even billionaires like Warren Buffett, known for frugality, stand out as exceptions in a culture where wealth often invites excess—sometimes leading to challenges like substance abuse, which doesn’t discriminate by income.

Real Story: When we visited Dallas, I saw a high-end community with million-dollar homes that looked like castles compared to Japanese real estate. But a realtor shared that some residents were “house poor”—overextended on mortgages, with empty rooms due to lack of funds for furniture.

5. Where Might You Feel Wealthier?

Having lived in both countries, I’ve found that each has its pros and cons.

🇯🇵 In Japan:

Beyond finances, Japan offers a unique aspect of “wealth” through what’s now called “J-Wellness.” Travelers flock to Japan for hot spring baths (onsen), healthy cuisine/food, Zen meditation, and forest walking. These wellness experiences—often affordable or free—enhance quality of life, making even a modest income feel richer in terms of well-being.

A $1 million net worth might feel tight in New York but buys comfort in Japan.

🇺🇸 In the U.S.:

The U.S. offers greater earning potential and rich cultural diversity—things I still love and miss. Some people thrive in the American culture of ambition, where pay-for-performance, "up or out," and healthy competition are the norm. Talented individuals, bold ideas, and a spirit of innovation—that energy is exciting and inspiring.

Over time—or even from the start—many people realize that you don’t need massive wealth to be happy. Some have shifted their priorities. Despite the social pressure to "keep up appearances," more people are finding joy in experiences—family dinners, hobbies, cultural immersion—rather than chasing material status. A big house with a pool might sound appealing, but the maintenance takes time, money, and effort, especially in times of rising inflation.

And the lifestyle possibilities? Endless. The U.S. is a vast country full of dynamic ways to enjoy life and nature.

Real Stories:

One of my husband’s friends is planning to build a large pond for fishing.

Another friend built a family cabin in the forest—from scratch.

Yet another created a luxury house for his dog, complete with a rooftop deck—bigger than my son’s apartment in Tokyo!

Those ideas are fun, bold, and very “American.” I love that.

Wrap up:

This isn’t financial advice—it’s just my perspective as someone who’s lived both sides.

The meaning of “wealth” depends on what you value.

In Japan, you might find it easier to live a stable, modest, and deeply fulfilling life.

In the U.S., the rewards can be higher—but so are the risks and expectations.

As for me? My mission now is to support people who want to live and work in Japan.

Still, the U.S. is the place where many of my dreams came true—and that will always stay with me.

At NavigatorJapan.com, we’re here to help you explore.

If this helped you, here are a few other things that might help too:

(Related Guides)

Overtime in Japan: What’s Legal, What’s Not, and How to Protect Yourself

Senior Care in Japan: Costs, Choices, and What Foreigners Should Know