How Much to Retire in Japan as an Expat: 2026 Costs, Visas, and Realistic Budgets

Japan is famous for safety, high-quality healthcare, and everyday convenience—but it is also notorious for confusion when it comes to visas, taxes, and what retirement really costs.

For foreigners, retirement in Japan is not just about money. It is about residency, healthcare access, currency risk, and long-term sustainability. That means planning must begin long before you stop working.

This guide provides realistic 2026 cost estimates, explains visa pathways, and shows how different lifestyles translate into very different budgets. Always consult professionals for your specific situation.

This blog covers:

1. First Reality Check: There Is No Retirement Visa

2. Monthly Retirement Budget Overview for a Couple (2026)

3. Typical Monthly Living Costs Breakdown: A Comfortable Lifestyle Explained

4. Taxes and Mandatory Costs Retirees Often Forget

5. Real Expat Pitfalls: What Locals Don’t Have to Worry About

6. Lifetime Retirement Savings: How Much Do You Actually Need?

7. Q&A

8. Wrap Up

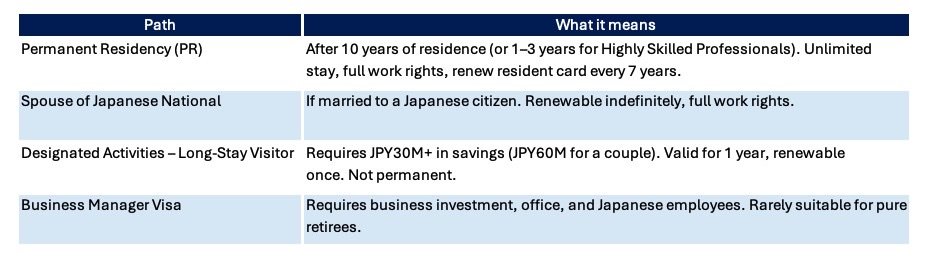

1. First Reality Check: There Is No Retirement Visa

Japan still does not offer a true retirement visa. You must qualify under another legal status.

The main options for retirees

The key rule: Financial self-sufficiency

Japan Immigration does not publish a single “retirement income requirement.” Instead, your application is evaluated under general stay-eligibility standards published by the Immigration Services Agency of Japan.

In practice, the standards differ by visa type:

1) Work-based visas

(e.g., Engineer/Specialist in Humanities, Business Manager, Highly Skilled Professional)

Immigration strongly expects stable annual income of at least JPY 3 million as a practical benchmark. What matters most is continuity — if income drops or fluctuates sharply, renewals become difficult.

2) Status-based visas

(e.g., Spouse of Japanese National, Spouse of Permanent Resident, Long-Term Resident)

There is no fixed income threshold. Immigration reviews the household as a whole, including:

Combined income

Savings and investments

Property ownership

Living expenses

This means even if one spouse earns under JPY 3 million, approval is often possible if the household is financially stable.

Character and compliance matter

In all cases, applicants must satisfy:

No criminal record

Good conduct

Proper tax and social insurance compliance

👉NOTE: Bringing elderly parents to Japan (Designated Activities – Elderly Parent Support)

Japan does not have a general visa category for bringing elderly parents to live with you. In very limited cases, immigration may consider a Designated Activities visa for elderly parent support, but this is treated as an exceptional measure, not a standard option.

In practice, applications are only considered when all of the following conditions are largely met:

The parent is typically 70 years of age or older

There are no close relatives in the home country who can provide care

The parent is living alone in their home country

The parent has health issues or chronic conditions that make independent living difficult

The sponsoring child in Japan has sufficient and stable income to fully support the parent

Because this status is granted on a case-by-case basis, screening is extremely strict, and approvals are rare. Even if an application can be submitted, permission is not guaranteed.

What does NOT work

A tourist visa (90 days) cannot be used for retirement.

“Visa runs” do not work in Japan and can lead to entry refusal.

If you want to retire in Japan, you must secure a long-term legal status — ideally Permanent Residency or a Spouse visa — before or soon after leaving full-time employment.

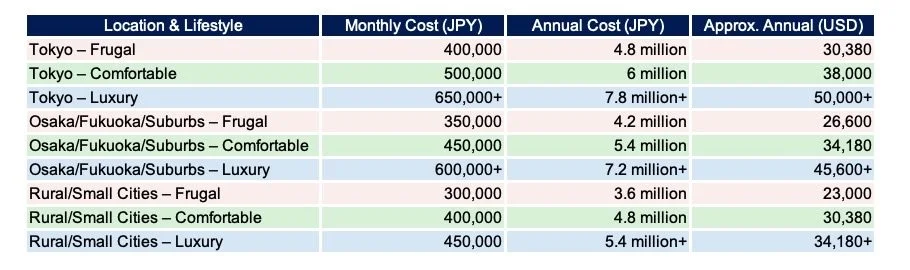

2. Monthly Retirement Budget Overview for a Couple (2026)

We divide retirement lifestyles into three tiers:

Frugal – modest housing, cooking at home, limited travel

Comfortable – normal apartment, eating out, domestic travel

Luxury – premium housing, dining, frequent travel

And three region types:

Tokyo central

Osaka / Fukuoka / Suburbs

Rural & small cities

Retirement Cost Comparison for a Couple in Japan (2026 Estimates)

👉Notes for the Table:

These figures represent planning-level averages; actual monthly spending will fluctuate.

All figures represent gross monthly living costs for a retired couple, including taxes, health insurance, long-term care insurance, utilities, and non-consumption expenses.

For reference, Japan’s Statistics Bureau reports that 65+ couple-only households with no employment spend an average of JPY 286,877 per month (2024 Family Income & Expenditure Survey). Frugal and comfortable tiers are calibrated against this national benchmark.

Rural and small-city households in Japan often benefit from lower overall living costs, including the potential to reduce food expenses through home gardens or local produce exchanges (such as vegetables and fruits). Lower property taxes also make rural Japan structurally more affordable.

If you are single, multiply these numbers by approximately 60-65%.

USD = JPY ÷ 158 (As of January 16, 2026) Disclaimer: Exchange rates fluctuate daily.

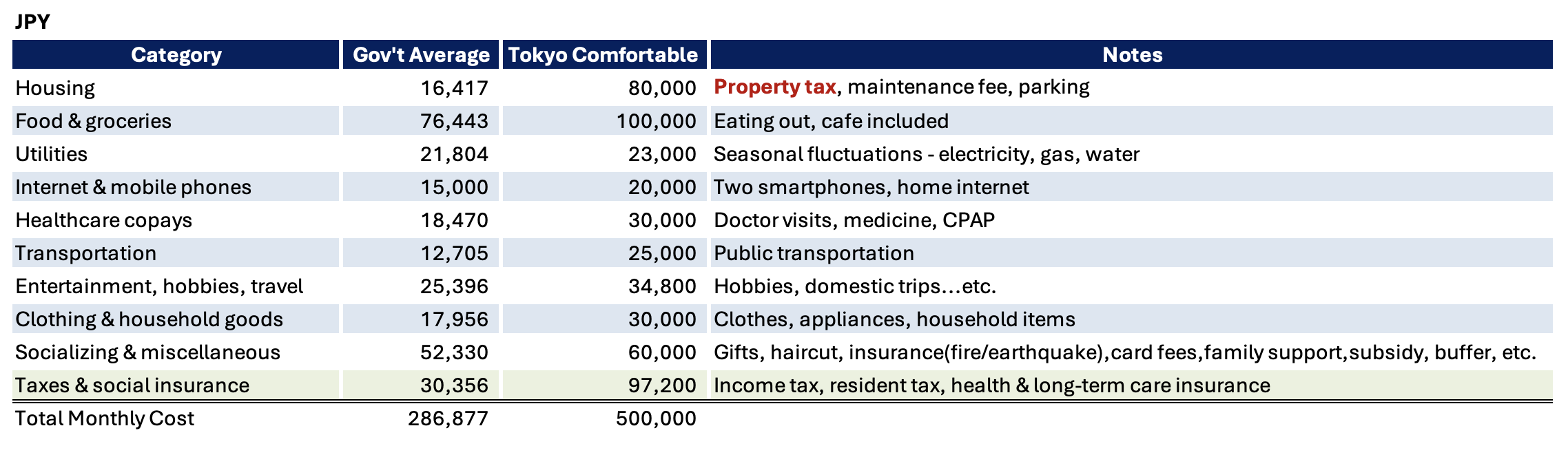

3. Typical Monthly Living Costs Breakdown: A Comfortable Lifestyle Explained

The table below shows what a Tokyo-comfortable lifestyle looks like for a retired couple when their total gross monthly income (pensions + part-time work or rental income) is around JPY 500,000.

After taxes and social insurance, this typically results in about JPY 410,000 - 420,000 in take-home income, which is then used to cover everyday living costs.

This model assumes:

A two-person household (both aged 60-65+)

Home ownership (mortgage fully paid off)

No child-related expenses (no education or dependent support)

Monthly Living Cost Comparison

👉Notes for the Table:

Property tax is not an income-tax deduction. It is billed separately on an invoice basis and is therefore included under Housing in this cost breakdown.

National average based on government survey data (Statistics Bureau, p. 18)

Important context on the government average

The JPY 286,877 figure is a national average, meaning many households live on less than this amount, while others spend more. It reflects a wide range of lifestyles, including very frugal households, people receiving family support, and those benefiting from local subsidies.

The following costs do not occur every month — but they are inevitable over time and must be included in any realistic retirement budget, either through monthly budgeting or dedicated savings and investments:

Major medical expenses (surgery, chemotherapy, advanced treatments, dental work)

Long-term care costs

Replacement of major appliances (air conditioners, refrigerator, washing machine, water heater)

Housing maintenance (aging, natural disasters)

Car ownership costs (automobile tax, insurance, mandatory inspections, parking, fuel)

Real story:

My ex-boss, an American couple, bought an older home in Karuizawa, Nagano — a resort area surrounded by nature and less than an hour from Tokyo by bullet train. They had never lived in the countryside before, but the easy access to Tokyo made the move feel safe.

They love the house, enjoy the fresh air, and even grow their own vegetables. At the same time, because Tokyo is so accessible, they go back frequently — meeting friends, attending events, and shopping. Sometimes almost every week. As a result, their transportation and leisure costs ended up much higher than expected.

They are still happy in Nagano, but they are already considering whether they might return to Tokyo in a few years.

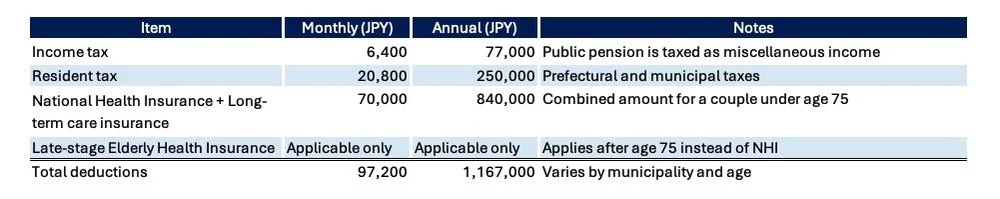

4. Taxes and Mandatory Costs Retirees Often Forget

Japan’s retirement system is predictable — but not free.

While Japan is not a tax haven, it offers a transparent and stable system that allows retirees to plan.

Below is a sample deduction breakdown for a retired couple receiving JPY 500,000 (Tokyo-Comfortable) per month in total pension and other income.

Monthly and Annual Deductions (Couple)

What this means

If your household receives JPY 500,000 per month, your actual take-home amount will usually be around JPY 410,000–420,000 after taxes and social insurance.

That number — not the gross income — is what pays for housing, food, medical care, utilities, travel, and everything else. This is why planning based on gross income alone can be misleading, and why a JPY 500,000 Tokyo-comfortable budget is realistic rather than generous.

Healthcare is Japan’s biggest retirement advantage

One reason this works is Japan’s healthcare system.

Most people pay only 10–30% of medical costs, and seniors usually pay 10–20%.

There are monthly caps on large medical bills through the High-Cost Medical Expense Benefit system.

You can go to any hospital or clinic — there are no insurance networks to worry about.

Because of this, you will never face U.S.-style six-figure medical bills in Japan, even if something serious happens. That said, as Japan’s population continues to age, the healthcare system is periodically reviewed and adjusted.

5. Real Expat Pitfalls — What Locals Don’t Have to Worry About

Foreign retirees face extra costs and risks that Japanese retirees usually do not.

Here are the most important ones.

Currency swings

The yen can move 10–20% (or more) within a year. A weaker yen benefits those receiving income in USD or EUR, while a stronger yen can make everyday life noticeably more expensive in yen terms.

At the time of writing, the exchange rate is around JPY 158 per USD, which is favorable for dollar-based income. For planning purposes, it is wise to stress-test your calculations using a more conservative rate - i.e. JPY130 per USD - to ensure your retirement budget remains resilient even during periods of yen strength.

International travel

Most expats return home for some needs. Flights to overseas typically cost JPY250,000–JPY400,000 per person. Frequency varies. Yet, you may need it.

Global tax compliance

U.S. citizens and many others must file taxes in both Japan and their home country. You may want to budget some cost for specialized accountants.

Visa and/or resident card renewals

Most retirees rely on Permanent Residence, spouse, or special long-stay status. Renewal fees are small, but the paperwork and risk never disappear.

Inheritance tax

Japan has one of the world’s highest inheritance taxes. Without planning, foreign heirs may face tax in two countries.

Related blog: How to Navigate Inheritance, Wills, and Tax in Japan for Foreigners

6.Lifetime Retirement Savings: How Much Do You Actually Need?

This is where the numbers come together.

A practical way to think about retirement planning is to separate it into two roles:

Cost of living → supports day-to-day living

Savings and investments → provide resilience, flexibility, and protection

A JPY 500,000 lifestyle is designed to handle normal, comfortable living.

Savings are what allow you to sleep well at night.

Step 1: Core funding for living expenses (the Japan lens)

A commonly used guideline is the “25–30 times rule.”

How it works:

Take the portion of your annual living costs not covered by pensions, and multiply that gap by 25 (or 30 for extra conservatism).

This estimates the amount of invested assets needed to fund ongoing living expenses over a long retirement.

Why 25?

Assumes a 3–4% withdrawal rate

Assets remain invested and continue to grow

Designed to last 30+ years, even with longevity risk

Step 2: Add a buffer for life events and peace of mind

Regardless of pension coverage, everyone needs a buffer.

Many planners recommend holding a buffer equal to 3–8 years of annual living expenses, depending on risk tolerance and life circumstances:

3 years covers short-term market downturns and timing risk

5 years absorbs most life events, including medical issues and housing repairs

8 years provides extra protection for longevity, long-term care, and cross-border uncertainty

There is no single “correct” number. The right buffer reflects how much risk you want to remove from your retirement plan.

This buffer is used for:

Major medical events or long-term care

Housing repairs or disaster recovery

Inflation, market downturns, or currency swings

Discretionary spending such as travel, hobbies, or family support

Think of this to ensure overall resilience and flexibility. You will sleep well.

Putting it together: Real-world examples

Example 1: Single-earner couple (Tokyo-comfortable)

Living cost: JPY 500,000

Pension (Japan): JPY 220,000

Monthly shortfall: JPY 280,000

Core savings (25× gap):

JPY 280,000 × 12 × 25 ≈ JPY 84 million

Suggested buffer (5 years of living expenses): JPY 500,000 × 12 × 5 = JPY 30 million

Total planning range: Approximately JPY 110–115 million

👉In this scenario, the required amount is meaningful. Some couples may choose to adjust lifestyle or location—for example, moving to suburban or smaller cities—or consider part-time work or semi-retirement to reduce the gap and lower the required savings.

Example 2: Dual-income couple (Tokyo-comfortable)

Living cost: JPY 500,000

Pension (Japan): JPY 324,545 (Combined)

Monthly shortfall: JPY 175,455

Core savings (25× income gap): JPY 175,455 × 12 × 25 ≈ JPY 52 million

Suggested buffer (5 years of living expenses): JPY 500,000 × 12 × 5 = JPY 30 million

Total planning range: Approximately JPY 80–85 million

👉 In this dual-income scenario, public pensions already cover much of everyday living, significantly reducing pressure on savings. In practice, many couples can feel comfortable with a smaller buffer—such as three years of living expenses (around JPY 70 million).

In addition, retirement allowances apply to both spouses. Japanese employers often pay JPY 20–30 million per person at large companies (or JPY 10–14 million at smaller firms), with favorable tax treatment. For expats, 401(k)s and overseas retirement plans further reduce the need for Japan-based savings.

Importantly, the JPY 80–85 million planning range is not required upfront. It is drawn down gradually over 20–30 years, while monthly living costs continue to be supported by pensions.

Example 3: Dual-income couple with U.S. Social Security

Living cost: JPY 500,000

Social Security income: USD 3,200 (combined)

(≈ JPY 505,6000 at current exchange rates)Monthly shortfall: None

Here, pensions may fully cover daily living costs. However, savings are still essential—not to fund monthly expenses, but to absorb life events and provide peace of mind.

Suggested buffer (5 years of living expenses): JPY 500,000 × 12 × 5 = JPY 30 million

More conservative planners—especially those concerned about healthcare, long-term care, or currency risk—may target JPY 20–50 million as a safety buffer.

👉In this case, retirement savings function as protection and optionality: for medical events, long-term care, major repairs, market or currency swings, and discretionary spending such as travel or family support.

Take away:

Start with lifestyle and location. These choices shape everything else.

Use the examples above as planning references, not rigid targets.

Pensions create stability; savings create flexibility.

Review your public pension, savings, employer retirement allowance and investments, and run your own numbers based on how you want to live.

👉Critical Note

If your situation involves multiple income sources, cross-border assets, or long-term care considerations, consulting a qualified financial or tax professional can help you validate assumptions and tailor a plan that fits your circumstances.

7.Q&A

Q1. Can we live in Japan on U.S. Social Security alone?

A1. Sometimes. It depends on both spouses’ benefits, lifestyle, and region. A couple receiving $3,500/month (JPY550,000) can live comfortably. Remember it is taxed in Japan as miscellaneous income.

Q2. Is the weak yen good for retirees?

A2. Yes — for now. USD and CAD holders get more yen, but currency risk cuts both ways long term.

Q3. Do we pay tax on worldwide income?

A3. Yes. Once you become a Japanese tax resident, Japan taxes your worldwide income. Tax treaties help prevent double taxation, but they do not eliminate reporting and filing obligations.

You may be required to:

File disclosures on overseas financial assets with the Japanese tax authorities (if thresholds apply)

Continue reporting foreign accounts and assets to your home country (e.g., U.S. IRS requirements)

Report overseas income on your Japanese tax return (consult a qualified tax advisor or tax service provider)

In addition, when opening a bank account in Japan, U.S. persons are required to complete FATCA-related declarations, which means cross-border financial information is already highly transparent.

Q4. Do we still need to pay Japanese pension after 60?

A4. In general, mandatory contributions end at age 60, and pension payments begin at age 65. However, it is possible to continue making voluntary contributions after age 60 in some cases. For details specific to your situation, consult your local pension office or a qualified advisor.

Q5. What happens if one spouse dies?

A5. Survivor pension benefits may apply, but cross-border estate and inheritance taxes can be significant, so advance planning is important.

If you are living in Japan on a spouse visa, that status does not continue indefinitely after your spouse’s death. In general, you are expected to change your visa status or make arrangements to leave Japan, typically within about six months. The exact options depend on your circumstances, so it is important to consult Immigration Services or a qualified professional as early as possible.

Q6. Can we keep a U.S. brokerage account?

A6. Often yes, but it depends on the brokerage firm. Some U.S. brokers restrict or close accounts for clients who reside in Japan. In many cases, maintaining an account requires a valid U.S. domicile address, not a P.O. box. Policies vary by firm, so confirm directly with your broker before relocating.

Q7. Is private health insurance needed?

A7. Usually no. As long as you are enrolled in Japan’s public health insurance, most medical costs are covered, and out-of-pocket expenses are capped.

That said, some people choose supplemental private insurance for specific reasons, such as:

Cancer insurance

Advanced or experimental treatments not fully covered

Private or semi-private hospital rooms

Dental coverage or English-language support

These policies are optional and meant to add comfort or flexibility, not to replace Japan’s public system.

Q8. Can we own a home on a visa?

A8. Yes. Foreigners can own property in Japan regardless of visa status. Property ownership does not grant residency, but holding a valid visa allows you to buy and own real estate.

In most transactions, you do not need a lawyer. A judicial scrivener (司法書士) typically handles the legal paperwork, registration, and settlement process. Lawyers are only necessary in unusual or complex cases (for example, disputes, inheritance complications, or special corporate structures).

8.Wrap Up

Later in life, your living arrangements may change, including a move to assisted living or a nursing home. As in the United States, many people in Japan fund this transition by selling their home and using the proceeds as upfront capital, combined with monthly payments for ongoing care.

For readers who want to model different scenarios, Japan’s Financial Services Agency offers a Life Plan Simulator (in Japanese) that can be a useful planning tool.

Ultimately, the right number — and the right plan — depends on how you want to live and how much flexibility you want over time. Plan early.

If you have thoughts or questions, please share them in the comments.

And if you found this article helpful, feel free to share it with friends, colleagues, or family members who are considering retirement in Japan.

See also:

Navigating Mandatory Retirement in Japan and Life After 60

Referral:

Immigration / Visa - Immigration Services Agency of Japan

General Requirements for Residence Status

Designated Activities (Parents of Highly Skilled Professionals)

General Guidelines for Stay Eligibility

Cost of Living / Household Statistics

Statistics Bureau of Japan – Family Income and Expenditure Survey (Monthly Report)

Statistics Bureau of Japan – Family Income and Expenditure Survey Overview (2024)

Media / Context

Nikkei: Trends in Household Spending and Living Costs in Japan