Navigating Mandatory Retirement in Japan and Life After 60

In Japan, the mandatory retirement age 60 (定年/teinen) is a deeply ingrained custom. This practice is not considered age discrimination under Japanese law, but rather a long-established employment custom.

The real challenge arises because full public pension benefits typically begin at age 65, creating a potential five-year income gap for many retirees.

This blog explores the current landscape of retirement in Japan, how the government and employers are responding to this gap, and the practical ways people navigate life after 60.

For foreign residents in particular, retirement planning is not only about income—it also involves employment continuity, visa status, and long-term residency decisions. Understanding these dynamics early is essential for anyone planning to work or retire in Japan long-term.

This blog covers:

1. The Reality of Japan's Mandatory Retirement System

2. Government Response: Encouraging Continued Employment

3. Employment Extension, Reemployment, and “Role Retirement”

4. When Does the Pension Start?

5. Difficulty of Job Hunting in One’s 50s and 60s

6. For Foreign Residents: Navigating Mandatory Retirement in Japan

7. Q&A

8. Wrap Up

1. The Reality of Japan's Mandatory Retirement System

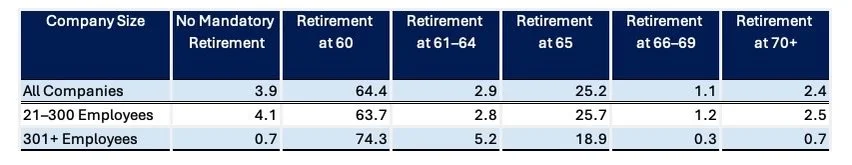

According to the latest government statistics, 96.1% of companies in Japan maintain a mandatory retirement system. Among them, 64.4% set the retirement age at 60, making it by far the most common retirement threshold.

Mandatory Retirement Age in Japan by Company Size (%, 2024 government data)

This structure often gives the impression that work ends at 60. In reality, however, most people continue working well beyond that age.

How Many People Are Still Working After 60?

Government labor statistics (2024) show that continued employment after mandatory retirement is the norm rather than the exception:

Ages 60–64: 72.1% are still working

Ages 65–69: 50.7% are still working

Ages 70–74: 32.1% are still working

In other words, even though many companies formally require retirement at 60, a clear majority of people in their early 60s remain in the workforce, typically through reemployment, contract work, or employment extensions.

Why Do People Keep Working?

When asked why they continue working after retirement age, older workers cite practical and personal reasons rather than necessity alone:

For income: 55.1%

Because working is good for health / helps prevent aging: 20.1%

These responses highlight an important reality: for many people, post-60 work in Japan is not only about money, but also about maintaining routine, purpose, and physical and mental well-being.

What This Means in Practice

Mandatory retirement at 60 in Japan does not usually mark the end of working life. Instead, it marks a transition point—from standard employment to reemployment, contract work, or alternative arrangements.

2.Government Response: Encouraging Continued Employment

To address the gap between mandatory retirement and pension eligibility—and to mitigate labor shortages caused by Japan’s aging population—the government has repeatedly amended the Act on Stabilization of Employment of Elderly Persons.

A. Minimum Mandatory Retirement Age

Under the Act, if a company sets a mandatory retirement age, it must be no lower than 60.

B. Obligation to Secure Employment Until Age 65

Employers whose mandatory retirement age is below 65 are required to implement one of the following measures to secure stable employment opportunities for employees up to age 65:

Raise the mandatory retirement age to 65

Introduce a continued employment system up to age 65 (the most commonly adopted option among employers)

Abolish mandatory retirement altogether

These measures focus on access to continued employment.

C. Effort Obligation to Secure Work Opportunities Until Age 70

Since 2021, employers whose mandatory retirement age is 65 or below 70 are encouraged—but not legally required—to make efforts to provide work opportunities up to age 70. Recognized options include:

Raising the mandatory retirement age to 70

Introducing continued employment systems up to age 70 (such as reemployment or employment extensions)

Abolishing mandatory retirement

Offering ongoing outsourcing or contract-based work up to age 70

Providing opportunities to engage in social contribution activities, either:

Directly operated by the employer, or

Conducted by organizations supported or funded by the employer

D. Employment Support for Workers Aged 45 to Under 70

The Act also addresses situations where older workers are expected to leave due to restructuring or termination:

Employers are required to make efforts to support the reemployment of workers aged 45 to under 70, such as by assisting with job searches.

Upon request, employers must provide a Job Search Support Document, summarizing the employee’s work history and skills to support future applications.

These provisions are intended to ease transitions, but they do not guarantee reemployment.

Applicability to Foreign Workers

All of these protections and obligations apply equally regardless of nationality, if you are legally employed in Japan.

3. Employment Extension, Reemployment, and “Role Retirement”

Many companies address retirement through continued employment system such as employment extension systems(勤務延長制度) or reemployment systems(再雇用制度).

A. Employment Extension (勤務延長)

Under this system, employees continue working past retirement age with relatively minimal changes to their employment status. This is less common and usually offered selectively.

B. Re-Employment (再雇用)

More common is reemployment after retirement. In this case:

Employment technically ends at 60

A new contract is issued.

Salary is often significantly reduced

Job scope and authority may change

Since revisions to the law in 2013, all employees who wish to continue working must be eligible for these systems.

In practice, many companies rehire employees at reduced pay and shorter hours, often at 50–70% of their previous salary, while job responsibilities and authority are frequently scaled back.

⚠️ Critical Reality: Continued Employment Requires Mutual Agreement

While the law requires companies to offer access to continued employment systems, it does not guarantee continued reemployment.

Most companies with a retirement age of 60 offer employment extensions on one-year contracts, renewable annually until age 65.

However, if the employer presents what it considers “reasonable conditions”—such as lower pay, reduced responsibility, or a change in reporting lines—and the employee does not agree to those terms, the employment relationship may not continue.

Crucially, this does not constitute a violation of the Act on Stabilization of Employment of Elderly Persons. From a legal standpoint, the situation is treated as a failure to reach mutual agreement, rather than an employer refusing continued employment.

The Human Impact After Retirement

For many workers, the challenge is not simply financial. After decades in senior roles, some find themselves:

Reporting to former subordinates

Struggling with loss of authority or professional identity

Accepting significant salary reductions

These transitions can be emotionally difficult and are rarely discussed openly—particularly in environments where continued employment is framed as a “benefit” rather than a negotiation.

C.Role-based retirement

Managerial positions/titles are removed before or at retirement age, even if the individual remains employed.

D. High-Age Employment Continuation Benefit (高年齢雇用継続給付)

To ease this transition and encourage continued work, the government provides the High-Age Employment Continuation Benefit through Employment Insurance.

Key points (as of December 2025)

Eligibility: Applies to workers aged 60–64 who remain employed after retirement, have five or more years of Employment Insurance contributions, and whose post-60 wages fall below 75% of their pre-retirement level. (This benefit is not unemployment insurance.)

Benefit amount:

If you reached age 60 before April 1, 2025: Up to 15% of your current monthly wage.

If you reached age 60 on or after April 1, 2025: Reduced to up to 10% (further shrinkage planned in future years).

Important: This is not automatic—you must apply at Hello Work. There is also an upper wage limit (around JPY386.922/month as of December 2025) above which no benefit is paid.

Foreign workers are fully eligible as long as they are enrolled in Employment Insurance (standard for regular employees).

4. When Does the Pension Start?

Japan’s public pension system generally begins at age 65. While early or partial pension options exist, receiving the full old-age pension typically requires waiting until that age. It is also possible to delay the start of benefits—up to age 75—in exchange for higher monthly payments.

Until it starts, individuals typically rely on a combination of the following:

Continued employment (employment extension or reemployment)

Personal savings

Investments

Spousal income

Part-time or contract work

Starting a small business or freelance activity

Pension Amounts in Japan (For Reference Only)

As general context, the average monthly pension benefits in 2023 were:

Men (65+): JPY169,484

Women (65+): JPY111,479

Actual pension amounts vary widely depending on years of contribution and lifetime earnings. The gender gap largely reflects differences in average income levels, contribution periods, and career interruptions.

👉 Related guide:

👉 Lump-sum withdrawal for short-stay expats

Leaving Japan Vol.1: Visa, Exit Taxes, Pension Refunds, and What to Do Before You Go

5. Difficulty of Job Hunting in One’s 50s and 60s

While Japan is often described as facing labor shortages, finding a new job in one’s late 50s or 60s is not easy, especially outside specialized or highly technical fields.

Several structural factors contribute to this difficulty:

Strong preference for age-based workforce balance

Limited lateral hiring culture

Seniority-based wage expectations

Reluctance to hire older workers into long-term roles

For foreign workers, additional challenges include:

Language expectations

Visa constraints tied to employer sponsorship

As a result, many people who leave their employer at retirement find that reentering the job market is far more difficult than expected.

6. For Foreign Residents: Navigating Mandatory Retirement in Japan

The gap between retirement and pension eligibility in Japan can be more complex than for Japanese nationals—but not necessarily more difficult.

Work: Planning Life After 60

Advance planning is essential. Well before retirement approaches, it is important to think about where and how you want to spend the next stage of your life—whether that means remaining in Japan, returning to your home country, or pursuing a more flexible, cross-border lifestyle.

As retirement nears, foreign employees should proactively speak with their HR department.

Inform HR that you wish to continue working after the mandatory retirement age.

Under what conditions (contract length, pay level, role changes)

How employment changes may affect visa renewal

If applicable, ask about the amount and timing of any retirement allowance, as this is often paid out upon mandatory retirement before reemployment under a new contract.

Many foreign residents continue to thrive professionally after 60 by leveraging their skills, experience, and international perspective.

Common paths include consulting in one’s professional field, freelance work, translation or writing, or starting small businesses. Others choose part-time roles in tourism, cultural exchange programs, education, or gig-based work, depending on visa eligibility.

Pension: Coordinating Japan and Home-Country Benefits

Many foreign workers who come to Japan later in life already have pension entitlements in their home country. In such cases, income itself may not be the primary concern.

Japan has social security (totalization) agreements with 24 countries (as of December 2025). These agreements are designed to:

Avoid double social security contributions, and

Allow coverage periods in different countries to be combined for pension eligibility, depending on the partner country and the specific agreement.

Understanding how your home-country pension and Japan’s system interact is an important part of realistic retirement planning.

Why Investment Matters More Than Ever

Japan’s public pensions are modest by design. For expats, fewer contribution years in Japan can mean a smaller Japanese pension, making personal savings and investment planning especially important.

Practical options often include:

Maintain or roll over home-country retirement accounts (e.g., 401(k)/IRA in the U.S., SIPP in the U.K., superannuation in Australia, RRSP in Canada), depending on your home-country rules and tax residence.

Using NISA or iDeCo, where eligible. For U.S. taxpayers, the investments held within these accounts may raise PFIC-related tax issues, so consulting a qualified tax professional is advisable.

Even modest, regular saving and investing over time can help reduce the gap between retirement and pension income. The key is not aggressive strategies, but early awareness, consistency, and alignment with your tax position.

Planning ahead—by understanding pension totalization agreements, the tax implications of investment choices, and your long-term residence status—can turn potential challenges into a stable and sustainable retirement in Japan.

⚠️ This article provides general information only and does not constitute financial or tax advice. Individual circumstances vary, and professional advice may be appropriate.

Visa Status: Often the Bigger Issue

The larger challenge is residence status and employment continuity.

Most work-related statuses of residence are tied to active employment. When a job ends at mandatory retirement (or contract expiry), you may need to:

Secure continued employment or reemployment (often through one-year contracts)

Change to a different status of residence (e.g., spouse or long-term resident, if eligible)

Already hold Permanent Residency (PR), which removes job dependency and provides far more stability during retirement transitions

If you plan to remain in Japan long-term, PR is often a major “de-risking” milestone.

As a general reference, PR typically requires around 10 years of residence, but eligibility may be shortened to 3 years (70+ points) or 1 year (80+ points) under the Highly Skilled Professional points framework, subject to screening factors such as conduct, taxes, and social insurance.

Health Insurance Continuation

Once employment ends at retirement, you generally have the following health insurance options:

a. Continue your employer-provided health insurance for up to two years under the voluntary continuation system. In this case, you pay the full premium yourself, as the employer contribution ends. You must apply on your own, so ask HR about the procedure and application deadlines.

b. Enroll yourself (and your family) in National Health Insurance (NHI) through your local municipality. You must apply on your own.

c. Join your spouse’s health insurance, if you meet the dependency requirements.

d. Enroll in your next employer’s health insurance, if you secure employment with coverage.

Many people ask which option is more cost-effective between (a) and (b). The answer depends on factors such as your previous income, household size, and municipality, as National Health Insurance premiums vary by city. For accurate comparisons, it is best to confirm the details with your local city office.

7. Q&A

Q1: Is mandatory retirement legal in Japan?

A1.Yes. Mandatory retirement is legal and widely practiced. It is not considered age discrimination under Japanese law.

Q2: Can foreigners continue working after 60?

A2. Yes, but usually under different conditions. Salary and role changes are common, and opportunities vary by employer.

Q3: What happens if I leave Japan before retirement?

A3. Your pension eligibility depends on your contribution period and totalization agreements between Japan and your home country.

Q4: Should I rely solely on the Japanese pension?

A4.For most foreigners, relying solely on the public pension is risky. Supplementary savings and investments are strongly recommended.

Q5: How much savings needed for the gap?

A5: In 2019, Japan’s Financial Services Agency (FSA) estimated that a household might need around JPY20 million in additional savings on top of public pension benefits to support retirement living. This estimate was based on assumptions about average household expenses and life expectancy at the time, and it sparked widespread public debate.

However, actual retirement needs vary significantly. With increasing life expectancy—potentially into one’s 90s or even 100s—maintaining a comfortable lifestyle, particularly as a couple, may require substantially more savings, depending on factors such as housing, healthcare costs, location (travel to home country), and personal lifestyle choices.

Rather than relying on a single headline figure, it is more realistic to view retirement savings as a range shaped by individual circumstances. If needed, consulting a qualified financial professional can help clarify what level of savings may be appropriate for your situation.

Q6: Can foreigners get the same re-employment?

A6: Yes, if employed under standard contracts and mutually agreed. Visa renewal may depend on it.

Q7: What if I want to work past 70?

A7: Possible via freelance, part-time, or company efforts. At that age, many people work for their own business.

8. Wrap-Up: Plan Early, Plan Realistically

From your 50s—or even earlier—it is natural to start thinking about how long you want to work and where you would like to live in retirement.

Retirement in Japan is therefore not just a financial transition, but a structural one. The earlier you understand how employment, pensions, and residence status intersect, the more choices you will have when it matters most.

If this ablog was helpful, please consider sharing it with colleagues, friends, or family members who are working in Japan or thinking about their long-term plans here.

We also welcome your comments—particularly if you have personal experience navigating retirement, reemployment, or life after 60 in Japan. Your insights may help others prepare more confidently.

See also:

Senior Care in Japan: Costs, Choices, and What Foreigners Should Know

Japan Tax Returns for Employees in 2026: Filing Rules, Refunds, and Deadlines

References

Ministry of Health, Labor and Welfare (MHLW): Employment Measures for Older Workers and Employment up to Age 70

(High-Age Employment Stabilization Policies)MHLW Report on the Employment Conditions of Older Persons (Latest Edition)

MHLW Overview of the Act on Stabilization of Employment of Elderly Persons

MHLW Public Pension System: Financial Projections and Benefit Structure