How to Read a Japanese Payslip & withholding tax slip - What Foreign Workers Need To Know.

Do you actually study your payslip and withholding tax slip (源泉徴収票 ) when you receive them?

Some people only glance at their net pay, but these documents show much more—your salary details, overtime, taxes, and insurance contributions. And understanding your withholding tax slip also helps you apply the right deductions, which can save you significant money every year.

If you work in Japan and don’t understand these documents, you are effectively operating blindfolded.

This guide will show you how to read them, how to spot problems, and how to use them to protect your income, rights, and long-term security.

This blog covers:

How Japanese payslips work

How to Read a Japanese Payslip

How to Read the Withholding Tax Slip(源泉徴収票)

Q&A

Wrap up

1. How Japanese payslips work

It’s important to understand the basic structure behind how Japanese payroll works. Once you know this framework, much of the confusion disappears.

a. Legal Foundation

Under the Japanese Income Tax Act (所得税法 第231条), companies are legally required to issue a payslip to employees—either in paper form or electronically. If a company fails to issue a payslip, this is not merely “bad practice.” It is a legal violation.

For foreign workers, this is especially important because your payslip later becomes official proof of income for many essential procedures, including:

Income verification for tax filing

Income verification for visa renewals

Mortgage screening

Apartment rental screening (賃貸契約の審査)

Income certification when applying to be a dependent under Japanese health insurance (被扶養者認定)

⚠️ The withholding tax slip (源泉徴収票) is the primary official income document in Japan. However, in many real-life situations, monthly payslips may also be requested to confirm current income status.

b. Types of Salary Structures in Japan

Japanese employment contracts typically follow one of the two structures below. You should know exactly which one applies to you, as it directly affects how your payslip is calculated.

Monthly Salary System (月給制): Your contract specifies a fixed monthly salary. This is the most common salary system in Japan

Annual Salary System (年俸制): Your contract specifies your total annual income. The company divides that amount into 12 monthly payments. If the total does not divide evenly, the difference is typically adjusted in months such as April or December

⚠️ Many disputes occur because employees assume that “annual salary” automatically includes a guaranteed bonus. In Japan, this is not true. Bonuses are usually discretionary unless your contract explicitly guarantees them.

d. Pay Period & Payment Date

Each company sets:

A closing date/payroll cutoff date (締め日) for calculating salary

A payment date (支払日) for actually transferring the money

Common examples include:

Month-end closing, paid on the 15th of the following month

15th closing, paid on the 25th

This often confuses foreign workers at the beginning, especially when:

Overtime appears one month later than expected

Final salary after resignation does not match expectations

Always confirm with HR about the final payment detail when you resign.

e. Working Time Classifications (勤務時間制度)

Your payslip is calculated differently depending on your working time classification. In Japan, the most common types are:

Standard working hours: Typically, 9:00–18:00 with a one-hour break

Flextime system (フレックスタイム制): Start and end times are flexible as long as total hours meet the requirement.

Discretionary labor system (裁量労働制): Work methods and time allocation are left to the employee’s discretion.

Deemed working hours system (みなし労働時間制): Daily working hours are legally assumed regardless of actual time spent.

⚠️ You must confirm which working time system applies to you in both your employment contract and your company’s work rules (就業規則). Overtime pay can arise under any of these systems. To avoid misunderstandings or disputes, always confirm any unclear points with HR in advance.

2. How to Read a Japanese Payslip

Your Japanese payslip is typically divided into four major sections:

a. Attendance / Work Record (勤怠)

b. Payments / Earnings (支給)

c. Deductions (控除)

d. Net Pay / Take-Home Pay (差引支給額)

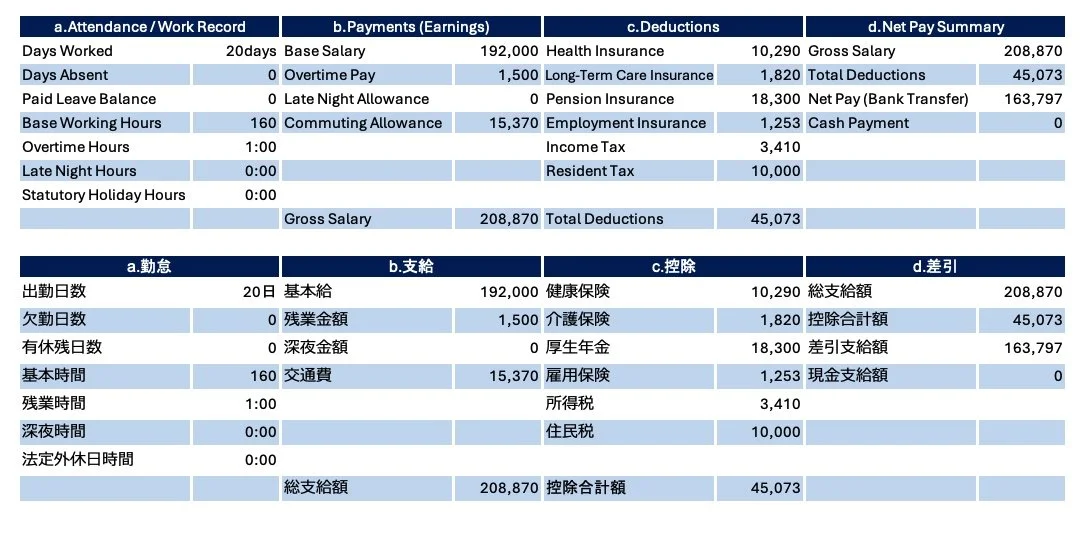

The sample chart below shows a typical payslip layout in both English and Japanese so you can visually match what appears on your own statement.

a. Attendance / Work Record (勤怠)

This section records of days worked and absent, total working hours, overtime hours, and leave taken.

Different categories of overtime such as normal overtime, late night work and weekend/holiday work are paid at different rates. Japanese payslips usually show the breakdown directly affects how your overtime pay is calculated and taxed.

👉 Related guide: Overtime in Japan: What’s Legal, What’s Not, and How to Protect Yourself

b. Payments / Earnings (支給)

This section lists everything your company pays you before deductions.

Base Salary (基本給): Your fixed monthly pay as stated in your employment contract.

Overtime Pay (残業代): In many companies, overtime is paid one month later, not in the same month it was worked. If your contract includes fixed overtime (固定残業代), a preset number of overtime hours and the corresponding amount are already included in your salary. The exact number of hours and amount must be clearly written in your employment contract or offer letter.

Allowances & Special Payments (各種手当): These vary by company but commonly include: Commuting allowance (通勤費), Business expense reimbursements, Housing allowance (住宅手当) or Position allowance (役職手当)

⚠️ Bonuses, incentives, and retirement/severance pay (退職金)

These usually come with a separate bonus or retirement statement, because their tax treatment is very different from regular salary.

c. Deductions (控除)

This is the section that frightens many foreign workers—but it doesn’t have to. Once you understand what each item means, it becomes much less intimidating.

Major Mandatory Deductions

Health Insurance (健康保険): Based on your income. The contribution is split 50/50 between employer and employee.

Long-Term Care Insurance (介護保険): Mandatory for everyone aged 40 and over.

Welfare Pension Insurance (厚生年金): Based on your income. The contribution is split 50/50 between employer and employee.

Employment Insurance (雇用保険): Funds unemployment benefits and job transition support. In principle, to qualify for basic unemployment benefits, you must have been insured for at least 12 months within the two years prior to leaving your job.

Income Tax (所得税): A progressive tax withheld monthly. Any over- or under-payment is adjusted through the year-end tax adjustment (年末調整).

Resident Tax (住民税): Based on last year’s income and paid from June to the following May.

Optional Company Programs (If offered): Company retirement savings (401k-type plans), Group savings programs, corporate savings schemes.

⚠️ Workers’ compensation insurance (労災保険) is paid 100% by the employer. It is never deducted from your salary.

👉 Related guide: Leaving Japan Vol.1: Visa, Exit Taxes, Pension Refunds, and What to Do Before You Go

d. Net Pay / Take-Home Pay (差引支給額)

Total Payments – Total Deductions = Net Pay

This is the amount actually transferred to your bank account.

Japan does not use paper checks. Salary is paid by:

Bank transfer, or

Cash (rare, but still used by some companies)

Some companies allow employees to register two bank accounts, usually to divide salary for savings or other purposes. Ask your HR department if this applies at your company.

Important Notes Every Foreign Worker Should Know

Absence, unpaid leave, suspension, mid-month joining, or mid-month resignation will trigger pro-rated salary reduction.

Many companies issue an annual compensation statement, showing total salary, bonuses, long-term incentives (LTIP), and stock compensation.

What Foreign Workers Should Especially Watch For

Here are Japan-specific traps that many foreigners fall into:

Assuming “no payslip—paper or online—is normal” → ❌ It is illegal

Forgetting to update dependent status after marriage, childbirth, or divorce → ❌ This directly affects your tax and insurance burden

· Noticing resident tax suddenly increase every June → ❌ This is normal, but often misunderstood (See Q&A Q1)

Assuming overtime is always paid → ❌ Verify it on your payslip

3. How to Read the Withholding Tax Slip(源泉徴収票)

Your withholding tax slip (源泉徴収票 / Gensen Choshuhyo) is Japan’s official income and tax statement. Unlike your monthly payslip, this is not a routine document—it is issued only at key moments:

Every January as your official year-end tax statement after year end tax adjustment, or

Whenever you leave a company, even mid-year, summarizing all income and taxes paid up to your final day. If you change jobs, you must give this slip to your new employer so they can perform the correct year-end adjustment for the entire year.

Because this document shows your final, confirmed income and tax amounts for the period you worked/entire tax year, it carries far more legal weight than a payslip.

This document is essential for:

Filing your tax return (if required)

Applying for permanent residency

Mortgage screening

Visa renewals

Proof of income for major financial procedures

Must be submitted to your next employer for year-end tax adjustment

⚠️U.S. Citizens / Green Card Holders

The U.S. taxes your worldwide income.

Your U.S. tax preparer will always want your Withholding Tax Slip, because it instantly shows:

How much you earned in Japan

How much Japanese tax you already paid

These two numbers let them claim the Foreign Tax Credit (and sometimes the Foreign Earned Income Exclusion) so you avoid double taxation under the U.S.–Japan tax treaty. Never lose this slip — scan it and email it to your U.S. accountant every year. You can use the translation below.

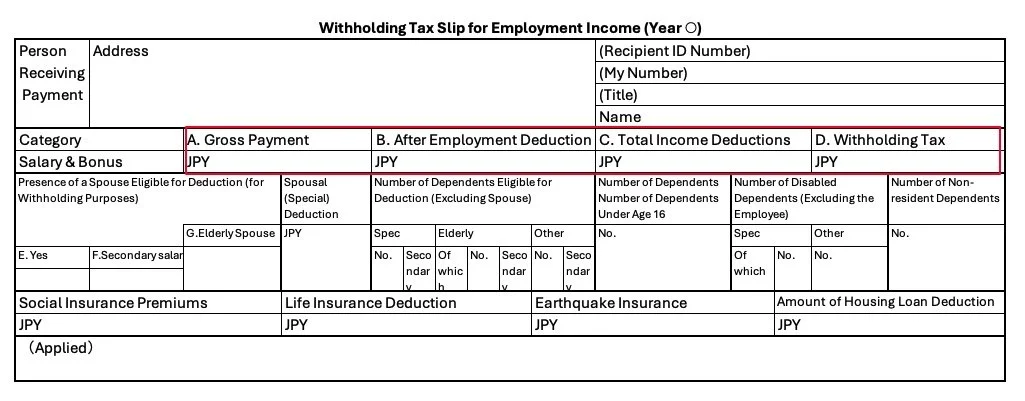

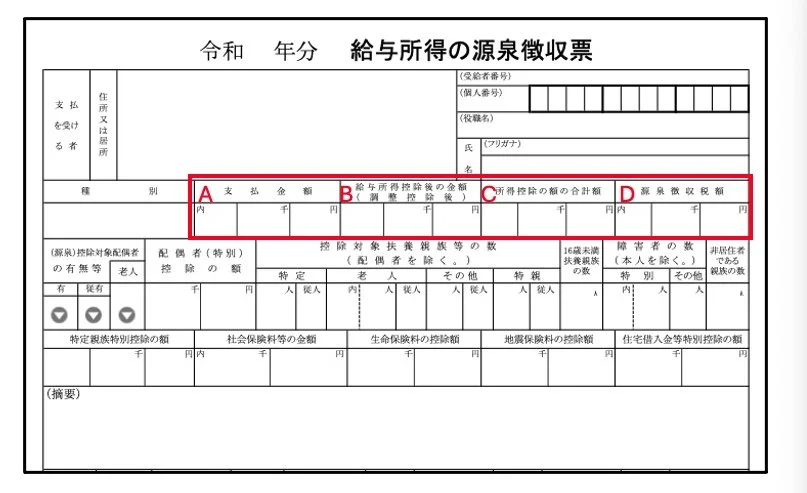

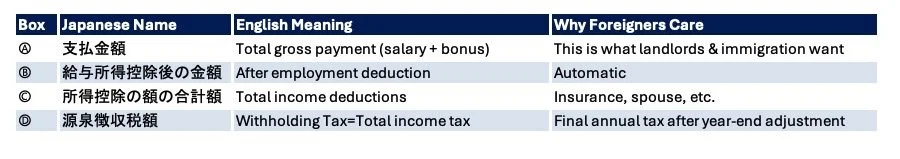

The 4 Most Important Items on the Withholding Tax Slip

Most numbers on the withholding slip connect back to just four core figures.

E: If year-end tax adjustment is performed on your primary salary and you have a spouse eligible for deduction, mark “○”. If year-end adjustment is not performed, mark “○” only if you have a spouse eligible for the withholding-based deduction.

F:Mark “○” if you have a spouse eligible for the withholding-based spouse deduction for your secondary salary.

G:Mark “○” if your deductible spouse (or withholding-deductible spouse, when no year-end adjustment is done) qualifies as an elderly deductible spouse.

A. Payment Amount (支払金額): This is not your take-home pay. It is your pre-tax annual earnings.

B. Amount After Employment Income Deduction (給与所得控除後の金額):This adjusted amount becomes the starting point for real tax calculation.

C. Total Amount of Income Deductions(所得控除の額の合計額):This section shows the total value of all personal deductions applied to your income.Then, during year-end adjustment (年末調整), additional deductions are applied based on the documents you submit to HR.

⚠️ ⚠️ Major Types of Income Deductions: I’ve posted the list of deduction categories on the Freebie Shelf. If you don’t know these deductions exist, you may miss out on tax benefits you are entitled to.

⚠️ To apply these deductions, you must submit the required forms and certificates before year-end adjustment is processed. HR cannot apply them without documentation, even if they provide general guidance.

⚠️ Medical expense deductions, casualty loss deductions, and donation deductions generally cannot be processed through your company’s year-end adjustment. These require filing a personal tax return.

D. Withholding Tax Amount (源泉徴収税額):After year-end adjustment, this number becomes your final income tax amount for the year. If too much tax was withheld, you receive a refund. If too little was withheld, you will need to pay the difference.

What Foreign Workers Should Pay Special Attention To

⚠️If you are classified as a non-resident (日本国内に住所がない非居住者), you can only claim three types of deductions in Japan: casualty loss deduction, donation deduction, and basic deduction. All other deductions generally cannot be applied.

⚠️ Even if your employer completed year-end adjustment (年末調整), you may still need to file a personal tax return if you have:

– Overseas income-> Consult with a cross boarder tax accountant

– Stock or capital gains income

– Rental income

In these cases, a tax return is required because 年末調整 covers only employment income.

Related blog: Japan Tax Returns for Employees in 2026: Filing Rules, Refunds, and Deadlines

4. Q&A

Q1: Why does my net pay suddenly drop every June?

A1: Because resident tax (住民税) begins being withheld in June each year, based on your previous year’s income. This is one of the most common surprises for foreign workers in Japan.

Q2: Why is my new company withholding resident tax based on income I earned at my previous company?

A2: Resident tax (住民税) is always calculated based on your income from the previous calendar year, not your current income.

This often surprises foreign workers because the tax can feel “disconnected” from your new salary. If the amount seems incorrect, check your Resident Tax Notice(住民税決定通知書) issued by your city hall. You can also ask HR, as employers receive resident tax notices for all employees directly from the city hall.

Q3: What should I do if my company never gives me a payslip?

A3: This is a serious red flag. Payslips are legally required.

First contact HR. If nothing changes, escalate the issue to Hello Work or the Labor Standards Inspection Office (労働基準監督署).

Q4: My payslip shows zero overtime, but I clearly worked late. What should I do?

A4: Act immediately.

Save all evidence of your attendance (time stamps, emails, logs) and report the discrepancy to HR, requesting a written explanation or correction.

If the issue is not fixed, escalate it to Hello Work or the Labor Standards Inspection Office.

Q5: What are the “Five Principles of Wage Payment”?

A5: These are the five rules required under Japan’s Labor Standards Act:

Payment in Currency (通貨払い) – Wages must be paid in cash unless the employee agrees to bank transfer.

Payment Directly to the Employee (直接払い) – Employers must pay wages directly to the employee.

Full Payment (全額払い) – Employers must pay the full amount, except for legally allowed deductions (income tax, social insurance, etc.).

Payment at Least Once per Month (毎月1回以上の原則) – Wages must be paid at least once every month.

Payment on a Fixed Payday (一定期日払い) – Employers must set and follow a fixed payday each month.

If any of these principles are violated, it is a legal violation. Contact HR.

5. Wrap Up: Why This Actually Matters

For many foreign workers, reading a payslip or withholding tax slip in Japanese can feel overwhelming—especially when everything is written in complex kanji.

But understanding these documents is essential. They show exactly how much you pay for health insurance, long-term care insurance, and welfare pension—and knowing your deduction options can save you real money every year.

I’ve posted a list of deductions you may be able to claim in the Freebie Shelf, so make sure to check it out.

And remember:

If you change jobs, renew your visa, or file a tax return in Japan, this single document suddenly becomes critical. Save your Withholding Tax Slip(源泉徴収票) and use this page as your reference whenever you need it.

Explore More:

Senior Care in Japan: Costs, Choices, and What Foreigners Should Know